The 5 minute scalping strategy stands as a dynamic approach in the world of forex trading, designed for those seeking rapid trades and quick profits.

This strategy revolves around making numerous short-term trades within a concise time frame of just five minutes.

By leveraging the inherent volatility of the market, traders aim to capitalize on small price movements, accumulating gains over multiple trades.

This introduction delves into the intricacies of the scalping strategy, exploring its principles, techniques, and risk management considerations.

Whether you’re a seasoned trader looking to diversify your approach or a newcomer seeking an intense trading experience, mastering the art of this scalping strategy could potentially provide a valuable addition to your trading arsenal.

BEST SCALPING STRATEGY

Everyone wants to get their hands on the best scalping strategy however there are basic rules to scalping the forex market that many traders miss.

- Don’t scalp against the trend

- Wait for the price to close above your chosen moving average

- Don’t stay too long in the market.

In this article, I am going to show you the best scalping strategy with just two indicators; following the above rules.

Indicators

3 Exponential Moving averages

EMA 9 color – yellow

EMA 55 – color- Blue

EMA 200- color -red

Stochastic Oscillator — Default

RULES OF BEST SCALPING STRATEGY

- The market should be trending in the direction of H1 before entry on 5 mins

- On 5 minutes the EMA 9 should be above EMA 55 and 200

- On 5 minutes EMA 55 should be above EMA 200

- On 5 minutes the stochastic oscillator should be at 20 or close to 20 to place a bullish entry

- Vice versa for a bearish market.

READ ALSO: BEST 1 HOUR TRADING STRATEGY

READ ALSO: TRADING 1 HOUR TIME FRAME FOREX

5 MINUTE SCALPING STRATEGY

For the 5 minutes scalping to be effective we will first:

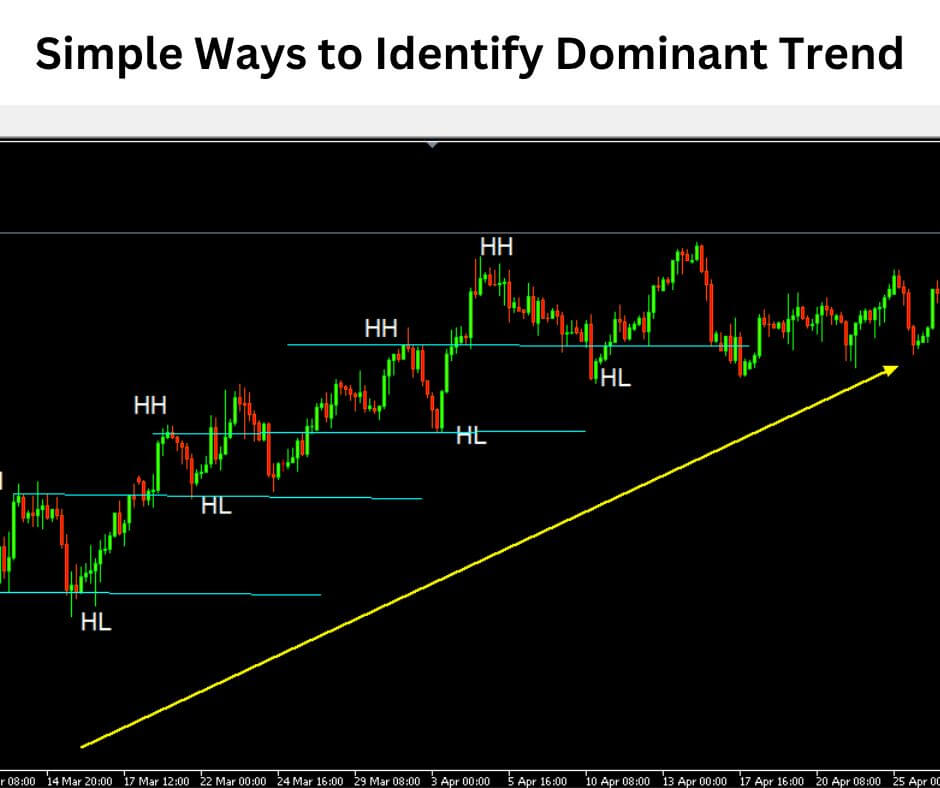

- Know the dominant trend using H4 and H1

- Wait for a resistance or support zone

- Go to your 5 minutes for entry

INDICATORS OF 5 MINUTE SCALPING STRATEGY

- EMA 1: Period = 9

- EMA 2: Period = 55

- EMA 3: Period = 200

- MACD- default

RULES OF 5-MINUTE SCALPING STRATEGY

EMA 9 crosses over EMA 55 and in turn EMA 55 crosses over EMA 200

Price closes below all three lines.

READ ALSO: 8, 3, 21 EMA STRATEGY

1 MINUTE SCALPING STRATEGY

There are very few traders who scalp with the 1-minute timeframe, it is true that the 1-minute timeframe is the noisiest timeframe with plenty of fake-outs however it still has its place in market analysis, especially for scalping.

I am going to talk about a 1 minutes scalping strategy that I have not seen anyone talk about, if you are reading this; consider yourself lucky.

This is how this strategy works:

- Find the most recent trend on H1

- Find support or resistance

- Then on 1M on the support or resistance lookout for a chart pattern

- Wait for a breakout of the 1m chart pattern

- Take profit will be equal to the length of the most recent market impulse on M1 (use trend line to measure the length)

- There is an image below on how to set take profit and stop lose

- You can also use Fibonacci for take profit on the Fibonacci reversal zone.

5-MINUTE SCALPING INDICATOR

There are no best 5 minutes scalping indicators; what really matters is to understand the structural flow of the forex market so that you will know when to apply for your entry in 5 minutes, especially for scalping.

At the very top of this article, you find an explanation with an image description of scalping in both 5-minute and 1-minute timeframes.

READ ALSO: BEST FOREX TRADING STRATEGY FOR BEGINNERS

FOREX 15-MINUTE SCALPING STRATEGY

The forex 15-minute strategy am about to share is more than a decade old, it has been used and tested by many traders; when trading this strategy you will have to consider the present market structure of the currency pair and the dominant trend as well.

SETUP

Open 15-minute chart of G-J; change to candlesticks; enlarge as much as possible

- Add Parabolic SAR, default settings;

- Add 5 LWMA (close price); this is the signal line

- Add 20 LWMA (close price);

- Add RSI (5); add levels 10, 20, 70, 80

Entries (2 conditions!):

- As a general rule, I enter a trade when RSI is between:

- 70 and 80, but preferably above 80 if I go short, and

- 20 and 10 but preferably below 10 when going long.

- I also look at the candle pattern and enter ONLY if I see a trend reversal pattern.

- Be careful; enter if BOTH 1) and 2) are present at the same time.

Targeting (or exits):

There are 3 indicators for a bit more accurate targeting that can be used for short entry/exit: 5 and 20 LWMA, and parabolic SAR.

- After you open a trade, you should look for EITHER 5 OR 20 LWMA lines, whichever is first (usually, 20 MA is your first target, but there are situations when SAR is between these 2 MAs.

- The next target after 5 and 20 MAs cross (be careful, IF they cross!) is parabolic SAR (but sometimes 20 LWMA).

Tips & Tricks:

- The most critical of the indicators are candlesticks and RSI; RSI will be used as an advanced warning system, next to candlesticks. RSI (5) is the fastest signal and will signal reversal way before anything is visible on any other indicator.

As you gain experience reading the RSI you may decide to take certain “risks” and enter earlier while the RSI is not in an optimal position.

- The RSI (5) on the 15-minute timeframe has a range of about 100-125 pips, so depending on when you enter, you will know exactly where you need to exit.

- The range of the RSI (5) in 5-minute timeframe is between 35-40 pips (depending on where you enter, but more like 35). So if an optimal entry of 15 min is missed, then a shorter timeframe can be used for taking a profit of fewer than 100 pips.

- Sometimes you can be ahead of the game even more IF you learn to read candles because you can sometimes enter based on candle patterns even before the RSI signals reversal

- I am also using MTF_RSI (5) and MTF_PSAR for 30 min on my actual 15 min chart.

- If I get the same signal from 2 different TFs, the trade has a better chance to end successfully. Also, it helps me to see what’s next.

- Be careful with RSI divergences.

- Don’t trade the news unless you REALLY know what you’re doing. If it happens, be ready to close your trade at any time if it’s going the other way.

- Avoid going against the trend; for instance, if the trend is up and RSI is between 70 and 80, you will be tempted to enter a short. Well, don’t, UNLESS candlestick configuration really suggests that. You’ll see that in most cases, RSI will drop somewhere around 50 (while the price will stay almost the same!) and then will go up again (but this time, along with the price).

- I am only using this strategy for GBP-JPY, but I think it can be used for any other pair.

SOURCE: forex strategies resources – scalping forex strategies

5-MINUTE SCALPING STRATEGY MACD INDICATOR

The 5-minute scalping strategy comes with a MACD and RSI indicator.

This trading strategy can be used for swing trade for day traders with low-risk management and a low-volume filter to prevent day traders from losing money.

SETUP

- Moving Averages Period: 21, Close (21 periods used for reducing False signals and panic in traders, If you are Good with MA You can use the 13 Period MA line).

- MacD (12, 26, 9) with default settings.

- Relative strength index (RSI 14 period close with level 50).

Timeframe: 1min or 5min (Recommended).

Currency pairs All Major Currency pairs.

Trading sessions (London and New York) do not trade before economic news (Avoid major news hours).

Set up the chart and trade EURUSD, and GBPUSD (High Volume) pairs in any trading session because this approach is more reliable.

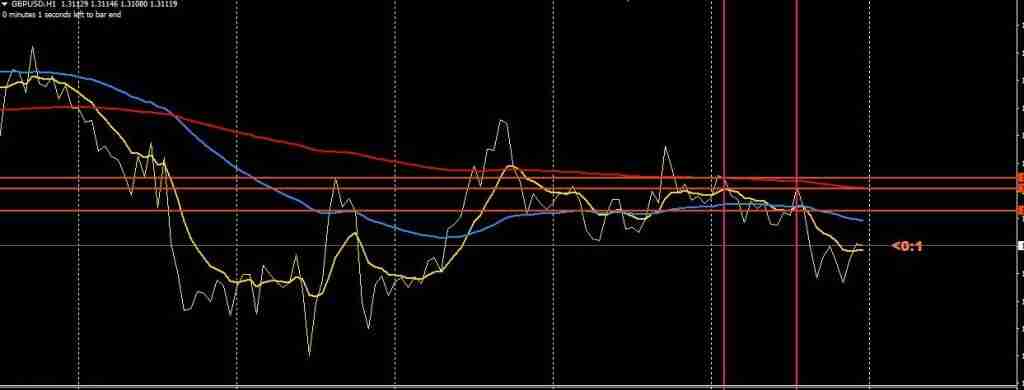

Buy Signal / long Trade conditions:

- Price move above or Crosses up 21 MA line (Represent Buy trend).

- MACD lines Cross > 0 zero line and Green volume bar start.

- RSI is above > 50 levels.

Sell Signal / Short Trade conditions:

- Price moves below or Crosses down the 21 MA line (Represent Buy trend).

- MACD lines Cross < 0 zero line and Red volume bar start.

- RSI is below < 50 levels.

Stop loss: Initial Stop loss 15 pips. Profits target 10 – 15 pips. After 5 pips in gain move stop loss at breakeven.

HOW TO AVOID FALSE SIGNALS AND REDUCE LOSSES

Every method has flaws and weak points, which traders must be aware of in order to prevent false signals, reduce losses, and boost win rates and profits. If you’re using a 5-minute forex scalping method, ignore the measures below if you’re trading in a sideways trend or with little volume.

Low Volume and MacD Lines Below 0

MacD Volume Max High and Max Low Reversals should be avoided.

Price movements in the MA line should be avoided.

5-MINUTE SCALPING STRATEGY HIGHEST WIN RATE

There is a lot of information on forex trading on the internet, but one thing you won’t find is the reality of the market structure.

Before you plunge into the best 5-minute scalping strategy or the most accurate 5-minute Forex scalping strategy, keep in mind that it wouldn’t make much of a difference if you didn’t invest in market structure trading expertise.

That being said, in this post, you will find information on the 5-minute scalping approach.

5 MINUTE GOLD SCALPING STRATEGY

When scalping gold, traders will have to set their stop losses and take profit because of its volatility.

These are the indicators needed for 5 minutes gold scalping strategy

7 Exponential Moving Average

14 Exponential Moving Average

21 Exponential Moving Average

RULES OF 5 MINUTE GOLD SCALPING STRATEGY

When the price is above all three EMA and the 7 and 14 EMA are above the 21 EMA

The next is when the price/candle retraces back to touch any of the EMA

Place your horizontal line at the highest/lowest level at setting your pending order

Take profit at the next resistance or support (You can find your TP on Higher timeframe)

Stop loss will be a few pips below the horizontal line after trade triggers.

Below is an image illustration:]