Every synthetic trader wants a volatility 75 index strategy that works. It is possible that while you are busy looking for a V75 index strategy you can lose focus on the most important part of trading.

In my previous article, I mentioned that for technical analysis trading the market moves in structure and patterns.

That being said whatever strategy you come up with should be from an understanding of the fundamental principles of trading.

In this article, you are going to understand the volatility 75 index strategy that works.

VOLATILITY 75 INDEX STRATEGY

For a successful volatility 75 index strategy, focus on the following:

- Identify the dominant trend.

- Wait for pullback.

- On a lower time frame identify a market pattern breakout.

- Join in the trend continuation from the lower timeframe.

RELATED: VOLATILITY 25 INDEX STRATEGY

VOLATILITY 75 INDEX TRADING STRATEGIES

In my years of trading synthetic indices, I have come to see that volatility 75 index moves in structures, when you zoom out your chart, you will be able to easily see them.

This is what you have to do:

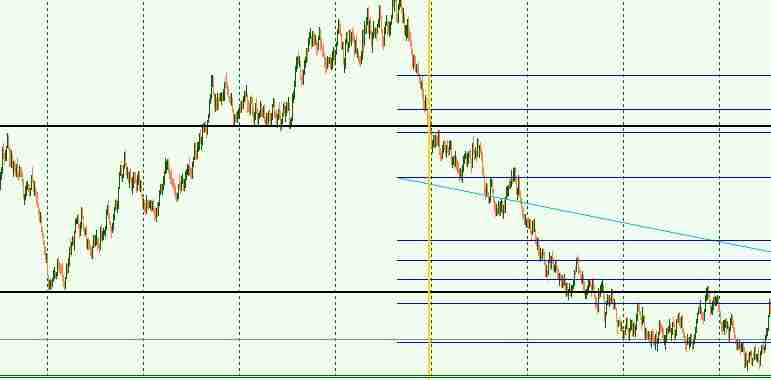

- Use timeframe between 5-30 minutes

- Zoom out your chart to see market structures

- Use trend line and horizontal lines to map out trigger zones

- Enter market on breakout of market structure

See the image below:

VOLATILITY 75 INDEX KILLER STRATEGY USING MT5 INDICATORS

I have seen many synthetic traders talk about a killer trading strategy for volatility 75; the sad news is that most searches are centered on indicators that lag.

The truth is that no lagging indicator will give you that killer strategy you are looking for.

If you want a volatility 75 index killer strategy you should start seeing the market in structures, with that you can easily identify when a breakout happens.

In my previous article, you will find detailed information regarding Volatility 75 index strategy.

VOLATILITY 100 INDEX STRATEGY

There are many volatile Deriv synthetic indices and the volatility 100 index is one of them, as a synthetic trader if you have ever traded volatility 100 index and you are on profit, it is very fulfilling.

You do not want to be on the losing side with Volatility 100 index.

To have volatility 100 index strategy with consistent profit you would need to have the right basic knowledge of how volatility indices work.

To make it simple your strategy is built on the knowledge of market structure.

I am not going to show you a bunch of lagging indicators that don’t work. What I am telling you is for you to focus on naked trading and pure price action so that you can catch trends early.

To fully understand what am saying go read up on the best time to trade Synthetic indices.

V75 SCALPING STRATEGY

I have mentioned in my previous articles that scalping is best when there is no expected global news to disrupt the market price since scalping is done on lower timeframes.

In this case, v75 will do well for scalping since it is not affected by global news.

To properly scalp v75:

- Identify the dominant trend on a higher timeframe like 30 minutes and H1.

- Wait for pull back to a resistance or support zone.

- Look for a breakout of structure in the lower timeframe you want to scalp from.

- Another way is a reversal pattern on the lower timeframe.

See the below image example:

CONCLUSION

As a trader, you must ask the right question. Asking the right questions will lead you on a path toward success.

There is a lot of information on the internet; hence not all will be beneficial to your trading.

If you have been trading for a while, you would agree with me that certain information you discovered and applied made a whole lot of difference in your trading.

Asking the right question is a start to successful trading.