Are you eager to know the best pairs to trade during Tokyo session? I know you do, so stick with me closely.

Forex trading session is an essential part of succeeding in trading the forex market as during each forex trading session some pairs get to see more volatility than others.

The Tokyo session is also known as the Asian forex session.

Generally, the Tokyo or Asian forex session has low liquidity and volatility compared to other forex trading sessions.

For example, most forex traders know that the Asian session/Tokyo market starts at 11 p.m. and at 8 a.m. GMT apart from this, you are here to learn about the Tokyo session best pairs. Let’s go!

- BEST PAIRS TO TRADE DURING TOKYO SESSION

- ASIAN SESSION FOREX PAIRS

- ASIAN SESSION FOREX TRADING STRATEGY

- BEST FOREX PAIRS TO TRADE DURING LONDON SESSION

- BEST PAIRS TO TRADE DURING SYDNEY SESSION

- THE BEST PAIRS TO TRADE DURING THE LONDON AND NEW YORK SESSIONS OVERLAP

- MOST VOLATILE PAIRS DURING THE NEW YORK SESSION

- BEST CURRENCY PAIRS TO TRADE AT NIGHT

BEST PAIRS TO TRADE DURING TOKYO SESSION

According to babypips.com, more forex trading volume comes out of Singapore and Hong Kong than in Tokyo.

These are the best pairs to look out for during Tokyo session.

AUD/JPY

USD/JPY

NZD/USD

NZD/JPY

EUR/JPY

RELATED: CURRENCY PAIRS THAT MOVE TOGETHER

RELATED: RECOMMENDED LOT SIZE FOREX

ASIAN SESSION FOREX PAIRS

The Asian session covers the Tokyo and Sydney trading zones. Compared to other sessions the Asian session has the lowest liquidity.

You can find good liquidity in these pairs below during the Asian session

USDJPY

GBPJPY

EURJPY

GPBUSD

USDCAD

USDCHF

AUDJPY

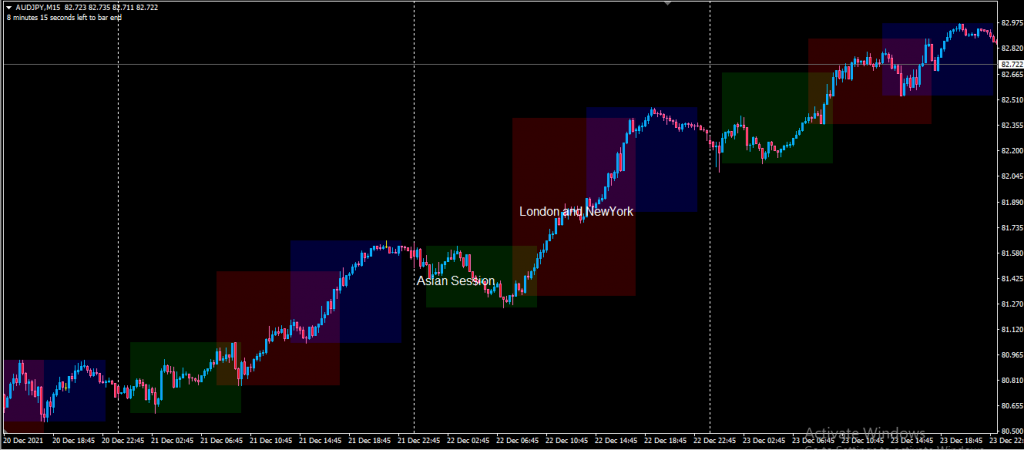

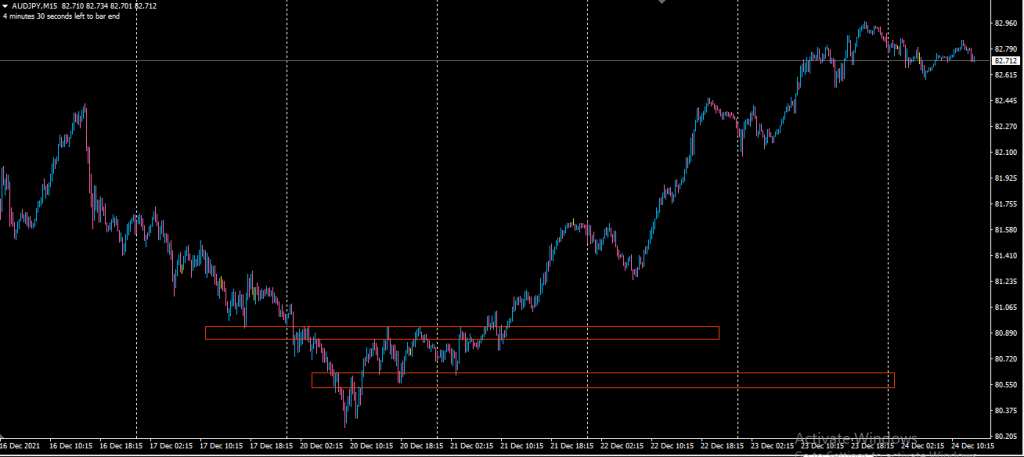

ASIAN SESSION FOREX TRADING STRATEGY

Many traders tend to avoid the Asian session due to its low liquidity, with a good market analysis you can catch the trend early enough.

One good forex trading strategy in the Asian session is to identify the dominant trend and wait for a breakout of the zone.

After identifying the trend on a higher timeframe, use a lower timeframe where the market is ranging and wait for a breakout of the ranging zone for entry.

BEST FOREX PAIRS TO TRADE DURING LONDON SESSION

The London session is one of the most active sessions as it accounts for about 35% of the total volume traded. When the London session overlaps with the New York session, there are high trading activities.

The London session runs from 7 a.m to 4 p.m GMT.

Below are some best forex pairs to trade during the London session

GBPUSD

EURUSD

USDJPY

AUDUSD

NZDUSD

USDCAD

EURGPB

During the London trading session, many traders use a breakout trading strategy to confirm their entry. Note that during this session there could be an increase in spread; this is why you may want to focus on major pairs for tighter spread.

BEST PAIRS TO TRADE DURING SYDNEY SESSION

The Sydney session comes at the end of the New York session and starts two hours before the Tokyo session.

The session is not as active compared to the London and New York sessions; however, trades are still able to catch some pips out of it.

The Sydney session opens at 10 p.m. GMT and closes at 7 A.M GMT

Below are some of the best pairs to trade during the Sydney session

AUDNZD

JPY PAIRS

AUDJPY

AUDCAD

AUDCHF

NZDJPY

THE BEST PAIRS TO TRADE DURING THE LONDON AND NEW YORK SESSIONS OVERLAP

The London New York overlap session has the highest trading activity. It is anticipated by many traders as it has the most liquid period of the day.

The majority of the economic reports are released at the opening of the New York session and the US dollar accounts for about 85% of all trades; that being said the London and New York session overlaps has a wide range of trading pairs.

USDJPY

AUDUSD

GBPUSD

NZDUSD

EURUSD

USDCAD

USDCHF

MOST VOLATILE PAIRS DURING THE NEW YORK SESSION

The most volatile pairs during the New York session are pairs that have USD paired together, especially if the paired currency is weaker than the dollar.

These listed pairs will be volatile during the New York session.

USDZAR

USDSEK

USDMXN

In my opinion, it is much safer to stay with the major pairs in the US session like

GPBUSD

USDJPY

EURUSD

USDCHF

BEST CURRENCY PAIRS TO TRADE AT NIGHT

The best currency pairs to trade at Night are simply based on the trading session the Night falls on in your country.

For example, if the Night-time in your country falls on the Asian session then you will be looking out for trading certain pairs that go with the trading session.

In this article, I have listed different pairs that go with their different trading sessions.