At the heart of technical analysis lies a potent tool known as the Pin Bar Reversal pattern.

This distinctive candlestick formation, with its unmistakable appearance, holds the potential to illuminate critical market shifts and impending price reversals.

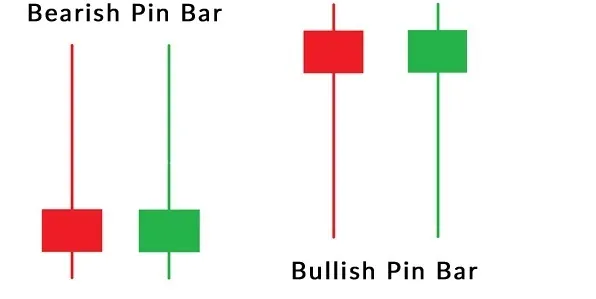

Characterized by a slender body and a prolonged wick on one side, this Pin Reversal signifies a tug-of-war between buyers and sellers.

Its strategic positioning at key support or resistance levels offers traders invaluable insights into potential trend changes.

As a result, mastering the art of identifying and interpreting Pin Reversals empowers traders with the ability to make well-informed decisions, optimizing entry and exit points.

With its ability to capture market sentiment and foreshadow reversals, the Pin Reversal stands as an indispensable asset in the trader’s toolkit.

HOW DO YOU TRADE PIN BAR REVERSAL?

In the forex market, a pin bar formation does not ultimately mean a market reversal as there are many failed pin bar setups.

To maximize pin bar reversal trading, they should not be traded in isolation. There are markers to look out for that support the pin bar reversal.

- Support and Resistance

Support and resistance are essential parts of forex trading, It is important in making trading decisions especially when it is combined with pin bars and multiple timeframe analysis.

Because there is a time pin bar setup fails, it is best to trade pin bars formed at major support and resistance levels.

- Dominant trend

There is a forex saying that says to follow the trend, the trend is your friend. When you decide to trend against the trend, it becomes your enemy. Any pin bar formed in the forex market will be much more effective if it supports the dominant trend.

- Higher timeframe

The higher timeframe, dominant trend, support, and resistance, all work together for a valid pin bar entry. The higher timeframe gives a better pin bar formation as they are not formed every time like in the lower timeframes.

PIN BAR REVERSAL

Pin Bar Reversal is a sharp rejection of price at a lower or higher level, typically at support and resistance zones, It also stands out for having a long tail and a little actual body.

RELATED: BULLISH ORDER BLOCK INDICATOR

RELATED: WHAT IS A BULLISH ORDER BLOCK

IS A PIN BAR BULLISH OR BEARISH?

A pin bar can be seen both in a bullish or bearish market. A pin bar formation is an indication that the price was rejected at a higher or lower level.

On a bearish market, the pin bar can be identified with a long tail at the top and a real body at the bottom.

While in a bullish market, it can be identified with a long tail at the bottom and a real body at the top.

WHAT DOES A BEARISH PIN BAR MEAN?

A bearish pin bar signal has a lengthy upper tail, indicating rejection of higher prices and implying that price will decline in the short term. It also means that sellers are stronger than buyers in the market.

PIN BAR VS HAMMER

A pin bar and a hammer are the same, as they both have a long tail and a small real body; however, a hammer is a bullish candlestick pattern.

In general, it is much easier to use a generic name “PIN BAR” than to use their candlestick names like Hammer and Shooting Star.

PIN BAR PATTERN

A pin bar pattern is made up of one price bar, generally, a candlestick price bar that signifies a sharp price reversal and rejection.

These pin bar candlestick patterns are easy to identify in a market because of their unique pattern.

PIN BAR WITH NOSE

A pin bar has two important parts, the real body, and the tail. Sometimes the tail is called the nose.

See the image below.

PIN BAR CANDLE MEANING

A pin bar candle means that the price was rejected at a lower or higher level.

A price rejection at a lower level shows that buys have entered the market and a price rejection at a higher level shows that sellers have entered the market.

Note that the pin bar is formed in just one candle.

CONCLUSION

A pin bar is a strong indication of the market activity; they should be taken seriously when they are formed as they are pointers to the next dominant trend of the market.

Just because pin bars are formed in a market does not mean is a perfect entry. Pin bars should not be traded in isolation, pin bars must align with the trending market for a high probability entry.

Lastly, from my experience I have come to see that pin bars are best traded on higher timeframes; this will enable fewer entries with high-yield setups.

Great! Keep it ip

Thanks for dropping in.