Fibonacci day trading is the combination of the Fibonacci tool and the day trading method. Before you can apply this method efficiently, you must first understand how to draw Fibonacci correctly and when applied to day trading you will be able to find a discount zone on market entry with low risk and high reward.

Derived from the ancient Fibonacci sequence, this strategy delves into the realm of mathematical ratios to identify potential entry and exit points for traders.

By mapping out retracement levels and extensions, Fibonacci Trading seeks to unlock insights into price movements, guiding traders toward informed decisions.

This introduction delves into the fundamental principles of Fibonacci trading, illuminating its application, benefits, and nuances in the dynamic landscape of modern trading.

All this is achieved within a 24-hour market period. For clarity, you can read more on day trading.

- FIBONACCI RETRACEMENT

- FIBONACCI DAY TRADING

- FIBONACCI EXTENSION LEVELS

- FIBONACCI RETRACEMENT STRATEGY

- BEST FIBONACCI INDICATOR

- BEST TIME FRAME FOR FIBONACCI RETRACEMENT

- BEST FIBONACCI LEVELS

- HOW TO DRAW FIBONACCI RETRACEMENT IN UPTREND

- DOES FIBONACCI WORK FOR DAY TRADING?

- HOW ACCURATE IS FIBONACCI IN TRADING?

- HOW IS FIBONACCI USED IN TRADING?

- CAN I TRADE WITH FIBONACCI?

- CONCLUSION

FIBONACCI RETRACEMENT

Fibonacci retracement is a trading tool used by forex technical analysts to identify potential market pullback levels in a trending market.

Fibonacci retracement works best in a trending market to determine a clear zone of support and resistance.

The most commonly used Fibonacci retracement levels are 38.2, 50, and 61.8. Forex technical analysis traders pay attention to the above levels for market entry.

You will start to see confluence and strong zones for market continuance when the Fibonacci retracement is paired with other technical forex trading tools like trend line, support and resistance, chart pattern, and more.

See the image of Fibonacci retracement below. See further information on Fibonacci retracement.

FIBONACCI DAY TRADING

Fibonacci day trading is the practice of entering and exiting a trade within 24 hours while employing the Fibonacci tool to make trade entry and exit decisions.

FIBONACCI EXTENSION LEVELS

When the price is moving into a region where other techniques for determining support or resistance are not applicable or obvious, Fibonacci extension levels are a means to set price objectives or locate anticipated locations of support or resistance.

Fibonacci extension levels, also known as reversal zones, are best applied to markets that are trending since they indicate potential places where the market might reverse.

You can also see chart reversal patterns suggesting a change in momentum on the market’s main trend.

You can read up on my previous article to know the most used Fibonacci extension levels by technical analysis forex traders.

FIBONACCI RETRACEMENT STRATEGY

It’s common practice to incorporate Fibonacci retracements into trend-trading strategies. Traders attempt to create low-risk entries in the direction of the initial trend utilizing Fibonacci levels in this scenario as they see a retracement occurring within a trend.

The three most common Fibonacci retracement levels are those that traders watch for.

These levels typically coincide with points of support and resistance.

To determine the pullback levels on a trending market, the Fibonacci retracement level is drawn from swing low to swing high.

In my last post, I wrote more about Fibonacci retracement and its levels.

BEST FIBONACCI INDICATOR

Numerous custom-made Fibonacci indicators that claim to be the finest Fibonacci indicators for trading have come into my possession during the years that I have been trading.

But even if I did not invest the time or money to test them all out as a trader, one thing has remained constant: a trader should be able to utilize the Fibonacci tool manually so that they are not dependent on algorithms and indicators.

All of this is to argue that the manually built-in Fibonacci tool is the best Fibonacci indicator there is.

It’s quite simple to understand how to utilize the Fibonacci tool; feel free to read about it.

BEST TIME FRAME FOR FIBONACCI RETRACEMENT

Because traders will always have preferences when it comes to forex trading, I want to examine this topic from a wider angle.

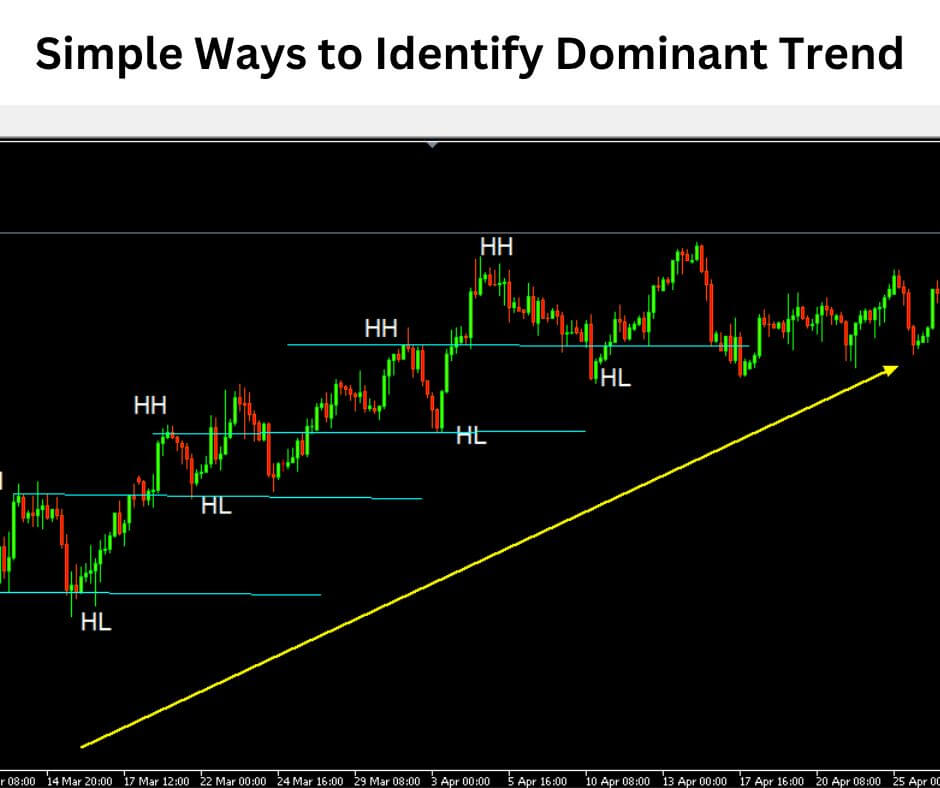

Before anyone decides the best time frame for Fibonacci retracement, it is important to consider what timeframe you can find a clearly defined dominant market trend in the forex market.

You will be able to determine the ideal time frame for a Fibonacci retracement if you can respond to this question.

My experience trading over the years has taught me that the forex market is dynamic, making it possible to see the dominant trends in many timeframes.

Having said that, the best time frame for Fibonacci retracement is between the 15-minute and daily timeframes since, with the above timeframes, the main trend is visible especially when you zoom out your chart.

I also want you to be aware of support and resistance levels while determining the best time frame for Fibonacci retracement. When the Fibonacci retracement level coincides with support and resistance zones, it will provide a stronger confirmation.

As a result, I locate good support and resistance levels using Fibonacci retracements from H1 and above.

BEST FIBONACCI LEVELS

To begin with, there are no best Fibonacci levels, the Fibonacci tool has several levels for both retracement and extension, but some levels are more significant than others since forex traders pay greater attention there.

Given that, it is more crucial to concentrate on the Fibonacci levels that are most frequently employed, which is what I will discuss in this article.

The most frequently used Fibonacci retracement levels are 38.2, 50, and 61.8.

The most frequently used Fibonacci extension levels are 127.2, 141.4, and 161.8.

HOW TO DRAW FIBONACCI RETRACEMENT IN UPTREND

To draw Fibonacci retracement in an uptrend, this is what you need to do:

- Identify the most recent swing low of a bullish market impulse (A)

- Identify the most recent high on the bullish move (B)

- Draw your Fib from point A to Point B

- Point C will align with a support level of around 38.2, 50, or 61.8.

Below are the frequently asked questions about Fibonacci day trading:

DOES FIBONACCI WORK FOR DAY TRADING?

Yes, Fibonacci trading works very well for day trading provided that it’s a trending market.

HOW ACCURATE IS FIBONACCI IN TRADING?

Fibonacci trading has proven to be very useful as many professional traders apply it to effective market entry.

HOW IS FIBONACCI USED IN TRADING?

Fibonacci is used to pinpoint possible pullback zones for market continuation after a rally and a possible market reversal. In other words, Fibonacci is for market retracements and extensions.

CAN I TRADE WITH FIBONACCI?

Yes, every forex trader can trade with the Fibonacci tool.

CONCLUSION

As far as trading using technical analysis is concerned, Fibonacci trading will always be a huge matter.

Your trading strategy as a technical analyst trader won’t be fully realized until you incorporate Fibonacci into it.