Crash 500 index trading requires a minimum lot size of 0.2, and it is designed to tick in a bullish trend and drop in a bearish trend.

Just like traditional trading instruments, crash 500 has multiple timeframes ranging from 1 minute to monthly.

Since the launch of the synthetic index on Deriv, many retail traders have shifted away from currency trading because it is immune to global events, unlike stocks and other trading instruments.

- CRASH 500 BROKER

- CRASH 500 INDEX

- CRASH 500 INDEX STRATEGY

- WHAT IS THE BEST TIME FRAME TO TRADE CRASH 500?

- CRASH 500 CHART

- CRASH 500 STRATEGY

- CRASH 500 TRADINGVIEW

- CRASH 500 MT4

- CRASH 500 MT5

- 1 HOUR CRASH 500 TRADING STRATEGY

- WHAT IS THE DIFFERENCE BETWEEN CRASH 1000 AND CRASH 500?

- WHAT IS BOOM AND CRASH INDEX?

- HOW DO YOU SUCCESSFULLY TRADE THE CRASH 500 INDEX?

CRASH 500 BROKER

If you find yourself here, you will have more than a beginner’s understanding of how to trade the Crash 500 index by the end of this article.

Deriv is the only broker that offers Crash 500 trading platforms to clients. it is one of the largest online brokers in the world. They offer CFDs and other derivatives on forex, indices, cryptocurrencies, commodities, and synthetics that are available to millions of registered users worldwide.

For over 22 years Deriv has grown its clients to over 2.5 million and they have a very reliable customer support team.

READ ALSO: CRASH 1000 INDEX BROKER

READ ALSO: SYNTHETIC INDICES BROKERS

READ ALSO: WHAT IS THE BEST TIME TO TRADE SYNTHETIC INDICES

CRASH 500 INDEX

Crash 500 index is an exclusive synthetic trading instrument on the Deriv platform that moves on an average of one price drop over a 500 tick period.

It is supported by a cryptographically secure random number generator; it is available for trading 24 hours a day, seven days a week, and is unaffected by regular market hours, global events, or market and liquidity risks.

CRASH 500 INDEX STRATEGY

I am going to break down a crash 500 index strategy for you to understand. This strategy will take into consideration all of the forex basics I have been talking about which are:

- Identify the dominant trend (market bias)

- Wait for a minor retracement to supply or demand zone

- Use Fibonacci to identify the reversal zone

- Go to a lower timeframe (look for a market structure that supports the dominant trend, drop base drop)

- Market entry on break out.

See the Live Image example on the crash 500 index strategy below.

READ ALSO: TRADING BOOM AND CRASH

WHAT IS THE BEST TIME FRAME TO TRADE CRASH 500?

One common mistake most Boom and Crash traders make is to think that knowing the best time frame to trade Boom and crash would solve their trading problems, come to think of it, if there was a best time frame to trade crash 500 or any Deriv synthetic index then most traders would be profitable.

To answer your question, the best time frame to trade Crash 500 is all time frames. It is called multiple time frame analysis.

You need all the time frames to make a good trading decision. Because the market structure of Boom and crash will always change, the breakout for entry can happen in any timeframe that is why you need all time frames.

I have already explained this in my previous article, do well to read this article from the beginning or read top secrets on how to trade boom and crash index.

CRASH 500 CHART

Crash 500 charts can be seen on Metatrader 5 and the web version, crash 500 chart has a display of all the default tools a trader needs for market analysis.

On the chart, you will find the market watch, Navigator, and all default indicators as well.

CRASH 500 STRATEGY

To develop a good crash 500 strategy, you must first master the skill of distinguishing between a trending and a retracement market.

As you develop your trading strategy, this skill will assist you in making sound trading decisions.

Any trading strategy developed today is based on a thorough understanding of how the market operates.

That being said here is a crash 500 trading strategy with an exponential moving average of 55

With a bearish flag (continuation pattern)

Note that moving average indicators should be secondary options to market structure.

CRASH 500 TRADINGVIEW

Crash 500 trading view is a display of crash 500 indices on the web version; it is an alternative to MetaTrader 5.

A synthetic trader can choose to use the web trader on Deriv; on the trading view of Crash 500 index, you will find all the necessary tools needed for this analysis.

Crash 500 index trading view on Deriv is known as Dtrader.

CRASH 500 MT4

This can only be traded on MT5 and the web version. It is not available on MT4 and it is exclusive to Deriv broker.

CRASH 500 MT5

It is available to trade on MT5 Deriv broker.

It can be traded across all timeframes and respond to technical market analysis. You can visit Deriv broker and start trading on a demo account right away.

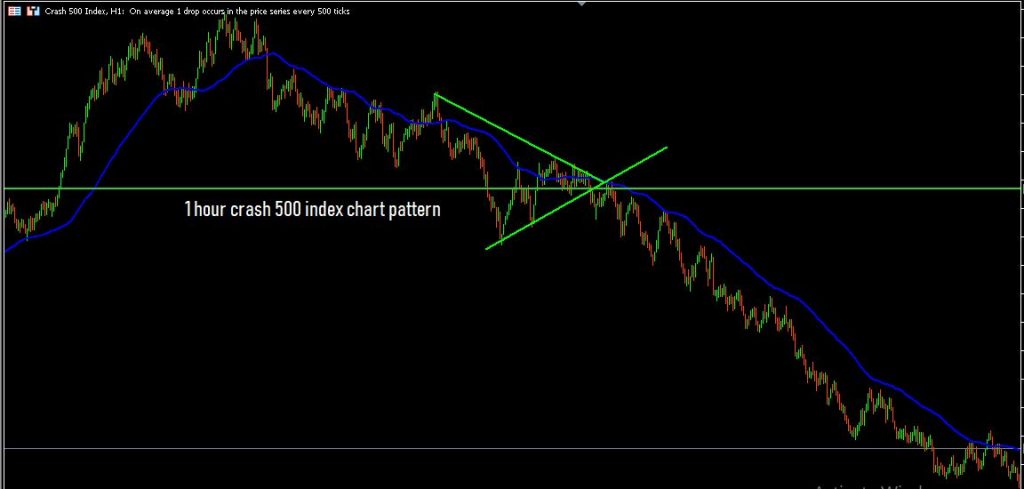

1 HOUR CRASH 500 TRADING STRATEGY

The 1-hour timeframe is one of the most traded timeframes, especially with retail traders as it fits into many trading strategies.

For a trader to effectively trade Crash 500 index in the 1-hour timeframe, the trader must first identify the dominant trend on a higher timeframe (H4, D1)

After that, you can proceed to look out for trade setups that support the higher timeframe dominant trend.

This trade setup can be a continuous chart pattern.

WHAT IS THE DIFFERENCE BETWEEN CRASH 1000 AND CRASH 500?

In Crash 1000, an average of one drop in prices occurs in a series of 1000 ticks while in Crash 500, an average of one drop in prices occurs in a series of 500 ticks.

WHAT IS BOOM AND CRASH INDEX?

Boom and crash index are synthetic indices exclusively designed by Deriv broker; Backed by a cryptographically secure random number generator, these indices are available to trade 24/7 and are unaffected by regular market hours, global events, or market and liquidity risks.

HOW DO YOU SUCCESSFULLY TRADE THE CRASH 500 INDEX?

To successfully trade Crash 500 index you must:

· Understand market structure

· Identify the dominant trend

· Know multiple timeframe analysis

· Know how to identify high trade setups on a lower timeframe that supports the dominant trend.