When you go check on the best exotic forex pairs to trade on the internet; you will find a lot of information surrounding this topic, however, there is more to this than just listing a few exotic pairs to trade.

In my experience, I have come to see that any exotic forex pairs can be the best to trade with provided that you understand the basic principles of how the forex market works.

When you constantly make money on a certain forex pair, it certainly becomes your best trading pair.

That being said I will certainly list a few exotic pairs I have traded, with market structure understanding and I will encourage you to put this market analysis into consideration when trading these exotic forex pairs.

WHAT ARE EXOTIC CURRENCY PAIRS?

Exotic currency pairs consist of a major currency pair as the base currency and a strong smaller emerging economy whose currency will be the quote in the pair example is the USD/MXN.

These pairs come with a much larger spread than the major currency pairs because they lack liquidity because they are not traded as often as the major currency pairs.

Exotic pairs are characterized by high volatility and trading with proper market analysis can give you a huge return in profit because of the nature of both economies.

RELATED: CURRENCY PAIRS THAT MOVE TOGETHER

BEST EXOTIC FOREX PAIRS TO TRADE

There are many exotic pairs to trade in the forex market; in my years of trading, this is my choice in the most successful exotic forex pairs to trade.

- USD/ZAR

- USD/MXN

- USD/PLN

- USD/NOK

- USD/TRY

- USD/RUB

RELATED: HOW TO TRADE GBP JPY SUCCESSFULLY

RELATED: BEST TIME TO TRADE NZDUSD

EXOTIC FOREX PAIRS LIST TO TRADE

This is a list of a few exotic forex pairs list and their countries;

| Pairs | Countries |

| USD/ZAR | US Dollar/South African Rand |

| GPB/DKK | British Pounds/Danish Krone |

| USD/SGD | US Dollar/Singapore Dollar |

| USD/DKK | US Dollar/Danish krone |

| USD/SEK | US Dollar/ Swedish krona |

| USD/TRY | US Dollar/ Turkish Lira |

| USD/NOK | US Dollar/Norwegian krone |

| USD/MXN | US Dollar/Mexican Peso |

| USD/HKD | US Dollar/Hong Kong Dollar |

| EUR/TRY | EURO/Turkish Lira |

| USD/PLN | US Dollar/ Polish zloty |

| USD/CNH | US Dollar/Chinese Yuan |

RELATED: BEST PAIRS TO TRADE DURING TOKYO SESSION

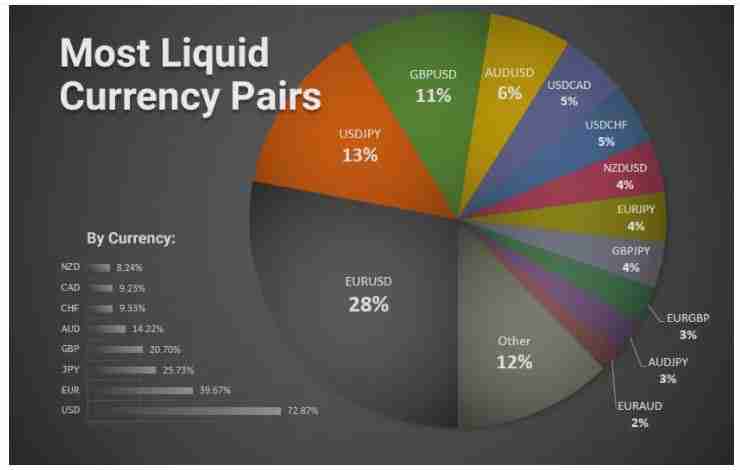

MOST LIQUID CURRENCY PAIRS

I am going to list the most liquid currency pairs in terms of market volume, before I do that let us first define what forex market liquidity is.

Forex market liquidity refers to an asset’s ability to be sold quickly and at the best possible price.

Liquidity in the forex market also means the most traded currency pairs

In terms of market volume, these are the most liquid currency pairs;

- EUR/USD

- GBP/USD

- NZD/USD

- USD/CAD

- USD/JPY

- USD/CHF

- AUD/USD

- AUD/JPY

According to the most traded currencies website, these are the top 25 most traded currencies with their shares of daily turnover.

| Rank | Currency | Share of turnover (%)* |

| 1 | US dollar | 87.62 |

| 2 | European Euro | 31.27 |

| 3 | Japanese yen | 21.56 |

| 4 | Pound sterling | 12.78 |

| 5 | Australian dollar | 6.94 |

| 6 | Canadian dollar | 5.13 |

| 7 | Swiss franc | 4.78 |

| 8 | Chinese Yuan Renminbi | 3.97 |

| 9 | Swedish krona | 2.22 |

| 10 | Mexican peso | 2.20 |

| 11 | New Zealand dollar | 2.06 |

| 12 | Singapore dollar | 1.79 |

| 13 | Hong Kong dollar | 1.73 |

| 14 | Norwegian krone | 1.67 |

| 15 | South Korean won | 1.65 |

| 16 | Turkish lira | 1.40 |

| 17 | Indian rupee | 1.14 |

| 18 | Russian ruble | 1.14 |

| 19 | Brazilian real | 1.00 |

| 20 | South African rand | 1.00 |

| 21 | Danish krone | 0.83 |

| 22 | Polish Zloty | 0.69 |

| 23 | New Taiwan dollar | 0.63 |

| 24 | Thai baht | 0.43 |

| 25 | Malaysian Ringgit | 0.41 |

| Rank | Currency | Average turnover (Billion US$) |

| 1 | US dollar | 4 458 |

| 2 | European Euro | 1 591 |

| 3 | Japanese yen | 1 097 |

| 4 | Pound sterling | 650 |

| 5 | Australian dollar | 353 |

| 6 | Canadian dollar | 261 |

| 7 | Swiss franc | 243 |

| 8 | Chinese Yuan Renminbi | 202 |

| 9 | Swedish krona | 113 |

| 10 | Mexican peso | 112 |

| 11 | New Zealand dollar | 105 |

| 12 | Singapore dollar | 91 |

| 13 | Hong Kong dollar | 88 |

| 14 | Norwegian krone | 85 |

| 15 | South Korean won | 84 |

| 16 | Turkish lira | 71 |

| 17 | Indian rupee | 58 |

| 18 | Russian ruble | 58 |

| 19 | Brazilian real | 51 |

| 20 | South African rand | 51 |

| 21 | Danish krone | 42 |

| 22 | Polish zloty | 35 |

| 23 | New Taiwan dollar | 32 |

| 24 | Thai baht | 22 |

| 25 | Malaysian Ringgit | 20 |

| Rank | Currency | ISO 4217 code |

| 1 | US dollar | USD |

| 2 | European Euro | EUR |

| 3 | Japanese yen | JPY |

| 4 | Pound sterling | GBP |

| 5 | Australian dollar | AUD |

| 6 | Canadian dollar | CAD |

| 7 | Swiss franc | CHF |

| 8 | Chinese Yuan Renminbi | CNY |

| 9 | Swedish krona | SEK |

| 10 | Mexican peso | MXN |

| 11 | New Zealand dollar | NZD |

| 12 | Singapore dollar | SGD |

| 13 | Hong Kong dollar | HKD |

| 14 | Norwegian krone | NOK |

| 15 | South Korean won | KRW |

| 16 | Turkish lira | TRY |

| 17 | Indian rupee | INR |

| 18 | Russian ruble | RUB |

| 19 | Brazilian real | BRL |

| 20 | South African rand | ZAR |

| 21 | Danish krone | DKK |

| 22 | Polish zloty | PLN |

| 23 | New Taiwan dollar | TWD |

| 24 | Thai baht | THB |

| 25 | Malaysian Ringgit | MYR |

| Rank | Currency | Country or territory |

| 1 | US dollar | United States |

| 2 | European Euro | 19 states of the EU |

| 3 | Japanese yen | Japan |

| 4 | Pound sterling | United Kingdom |

| 5 | Australian dollar | Australia |

| 6 | Canadian dollar | Canada |

| 7 | Swiss franc | Switzerland |

| 8 | Chinese Yuan Renminbi | China |

| 9 | Swedish krona | Sweden |

| 10 | Mexican peso | Mexico |

| 11 | New Zealand dollar | New Zealand |

| 12 | Singapore dollar | Singapore |

| 13 | Hong Kong dollar | Hong Kong (China) |

| 14 | Norwegian krone | Norway |

| 15 | South Korean won | South Korea |

| 16 | Turkish lira | Turkey |

| 17 | Indian rupee | India |

| 18 | Russian ruble | Russia |

| 19 | Brazilian real | Brazil |

| 20 | South African rand | South Africa |

| 21 | Danish krone | Denmark |

| 22 | Polish zloty | Poland |

| 23 | New Taiwan dollar | Taiwan |

| 24 | Thai baht | Thailand |

| 25 | Malaysian Ringgit | Malaysia |

The most liquid currency pairs in January 2020 are depicted in an image pie chart below. Understand that the data is constantly changing due to the market situation at any given time.

MAJOR CURRENCY EXOTIC PAIRS TO TRADE

Major currency pairs are called major forex pairs for many reasons; one of these reasons is because they are paired with the US dollar and they are the most traded currency pairs in the forex market.

For example, the EUR/USD records a high trade volume amongst other currency pairs in the forex market.

Below are a few major currency pairs

EUR/USD

GBP/USD

USD/CAD

NZD/USD

USD/JPY

AUD/USD

USD/CHF

MINOR CURRENCY PAIRS

Minor currency pairs are also called cross-currencies. For a clearer definition Cross-currency pairs, or simply “crosses,” are currency pairs that do not include the US dollar. An example of this minor/cross-currency pair is the CAD/JPY.

BEST MINOR CURRENCY PAIRS

In my years of technical analysis trading, I have known that the Japanese Yen pair currency is the best minor currency pair to trade and this is why.

The currencies paired with the JPY mostly operate on a different economic model.

Because of the different countries’ economic models, they make a perfect match when paired together, also in terms of their trading sessions. For example when one country’s session opens, the other is closed.

Examples of these best minor pairs are:

- GBP/JPY

- AUD/JPY

- NZD/JPY

- EUR/JPY

MOST VOLATILE EXOTIC CURRENCY PAIRS

All the exotic currency pairs are volatile, however, the most volatile exotic currency pairs are

- USD/ZAR

- USD/PLN

- USD/MXN

- USD/NOK

- USD/TRY