You’re watching the forex market, and suddenly, a currency pair shoots up dramatically after seemingly consolidating for hours.

What just happened? You’ve likely witnessed an order block in action the footprint of institutional money moving the market.

Order blocks represent the holy grail of forex trading psychology. They’re essentially the breadcrumbs left behind by banks and financial institutions when they place massive trades.

Think of them as invisible magnets that pull price back to specific levels, creating predictable patterns that smart traders can exploit.

But here’s the thing most retail traders don’t even know these exist, let alone how to spot them.

By the end of this guide, you’ll understand exactly what order blocks are, how they work, and most importantly, how to use them to transform your trading approach.

Ready to trade like the big players?

- WHAT EXACTLY ARE ORDER BLOCKS IN FOREX?

- HOW ORDER BLOCKS ACTUALLY WORK

- TYPES OF ORDER BLOCKS YOU NEED TO KNOW

- HOW TO IDENTIFY ORDER BLOCKS: STEP-BY-STEP PROCESS

- PRACTICAL ORDER BLOCK TRADING STRATEGIES

- DOES ORDER BLOCK WORK IN FOREX?

- ORDER BLOCK INDICATORS VS. MANUAL IDENTIFICATION

- ADVANCED ORDER BLOCK CONCEPTS

- COMMON ORDER BLOCK TRADING MISTAKES

- BEST PRACTICES FOR ORDER BLOCK TRADING

- CONCLUSION: MASTERING ORDER BLOCK TRADING

WHAT EXACTLY ARE ORDER BLOCKS IN FOREX?

Order blocks are specific price levels where large financial institutions have placed significant orders.

These aren’t your typical $100 retail trades we’re talking about multi-million pound positions that create lasting imprints on the market.

When banks and hedge funds execute massive trades, they don’t just click “buy” or “sell” like you and me.

They break their orders into smaller chunks to avoid moving the market too dramatically.

However, these accumulated orders create zones of concentrated buying or selling pressure that remain influential long after the initial trades are completed.

Key Characteristics of Order Blocks

Higher timeframe significance: Most effective on 4-hour, daily, and weekly charts

Institutional footprints: Created by banks, hedge funds, and large financial institutions

Supply and demand zones: Act as areas where price is likely to react

Time-sensitive: Remain valid until the market structure changes.

HOW ORDER BLOCKS ACTUALLY WORK

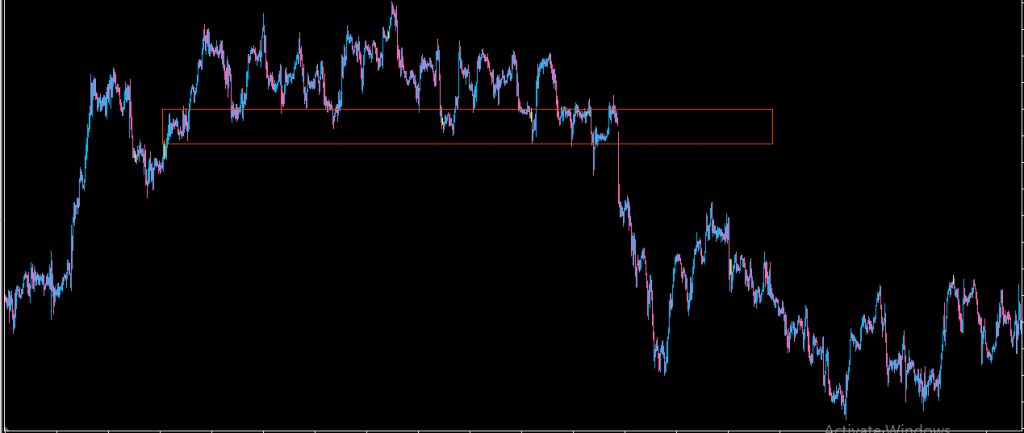

Understanding order blocks requires grasping basic market mechanics. When institutions place large orders, they create imbalances between buyers and sellers at specific price levels.

Here’s what happens:

- Accumulation Phase: Institutions quietly build positions over time

- Consolidation: Price moves sideways as orders are filled

- Breakout: A large institutional candle breaks the consolidation

- Future Reaction: Price often returns to these levels for continuation

The magic happens when price revisits these zones. The unfilled orders act like magnets, drawing price back to complete the institutional agenda.

TYPES OF ORDER BLOCKS YOU NEED TO KNOW

Bullish Order Blocks

A bullish order block forms when:

- Price consolidates in a range

- A strong bullish candle breaks above the consolidation

- The last bearish candle before the breakout becomes the order block

This represents where institutions accumulated long positions, creating a demand zone that supports future price increases.

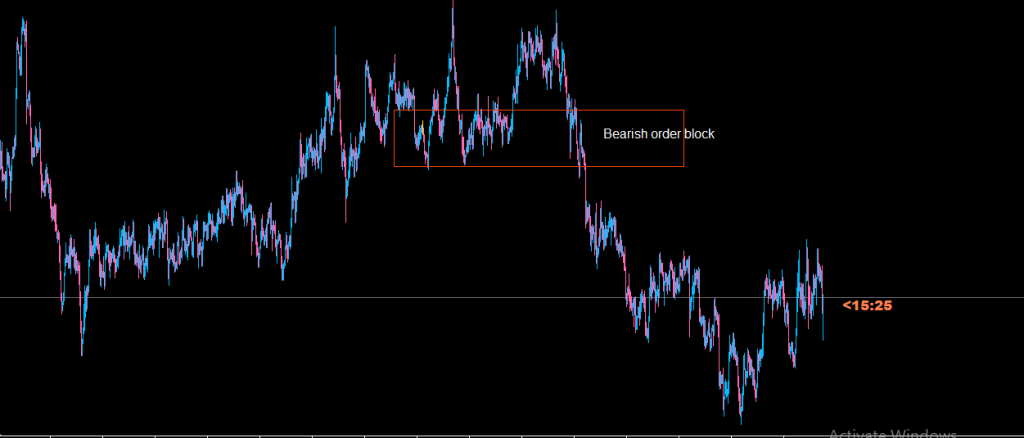

Bearish Order Blocks

Bearish order blocks work in reverse:

- Price consolidates in a range

- A strong bearish candle breaks below the consolidation

- The last bullish candle before the breakout becomes the order block

This indicates where institutions distributed short positions, creating a supply zone that caps future price rises.

HOW TO IDENTIFY ORDER BLOCKS: STEP-BY-STEP PROCESS

Step 1: Choose the Right Timeframe

The best timeframe for order blocks depends on your trading style:

- Daily/Weekly: For swing trading and long-term positions

- 4-Hour: For medium-term trades lasting several days

- 1-Hour: For day trading (though less reliable)

Pro Tip: Always identify order blocks on higher timeframes first, then zoom in for precise entries.

Step 2: Look for Consolidation Zones

Search for areas where price has been ranging for an extended period. These consolidations typically last:

- Several days on daily charts

- Several hours on 4-hour charts

- Multiple weeks on weekly charts

Step 3: Identify the Breakout Candle

Look for a significant candle that breaks out of the consolidation with:

- Large body: Shows strong institutional involvement

- Minimal wicks: Indicates decisive price action

- High volume: Confirms institutional participation (if available)

Step 4: Mark the Order Block Zone

The order block is typically:

- For bullish breakouts: The last bearish candle before the breakout

- For bearish breakouts: The last bullish candle before the breakout

Mark the high and low of this candle as your order block zone.

PRACTICAL ORDER BLOCK TRADING STRATEGIES

Strategy 1: The Retest Setup

This is the most common order block strategy:

Entry Rules:

- Identify a valid order block on higher timeframes

- Wait for price to return to the order block zone

- Look for rejection signals (pin bars, engulfing candles)

- Enter in the direction of the original breakout

Risk Management:

- Stop loss: Beyond the order block zone

- Take profit: Previous swing high/low or use a recommended lot size forex calculations

Strategy 2: The Mitigation Play

Sometimes order blocks fail, creating mitigation opportunities:

When Order Blocks Fail:

- Price breaks through the order block zone

- Previous support becomes resistance (or vice versa)

- The failed level becomes a mitigation block

Trading Approach:

Use tight stops as these moves can be swift

Wait for price to retest the failed order block

Enter trades in the direction of the break

DOES ORDER BLOCK WORK IN FOREX?

Absolutely, but with important caveats:

Success Factors:

- Market structure alignment: Order blocks work best when aligned with overall trend

- Multiple timeframe confluence: Higher success when multiple timeframes agree

- Proper risk management: Even good setups can fail

- Patience: Order blocks require waiting for the right setup

Limitations:

- Not every consolidation creates a valid order block

- Market conditions affect success rates

- Requires experience to identify high-probability setups

- Forex beginners often struggle with timing.

ORDER BLOCK INDICATORS VS. MANUAL IDENTIFICATION

Manual Identification Benefits:

- Better understanding of market psychology

- Flexibility in interpretation

- No indicator lag

- Develops trading intuition

Order Block Indicators Pros and Cons:

Advantages:

- Automated identification

- Consistent marking

- Time-saving

- Good for beginners learning patterns

Disadvantages:

- May miss context

- Can generate false signals

- Reduces understanding of market mechanics

- Potential over-reliance on technology

Recommendation: Learn manual identification first, then use indicators as confirmation tools.

ADVANCED ORDER BLOCK CONCEPTS

Market Structure and Order Blocks

Understanding market structure is crucial for order block success:

- Uptrends: Focus on bullish order blocks at swing lows

- Downtrends: Look for bearish order blocks at swing highs

- Ranging markets: Both types can be traded, but with more caution

Knowing When Trends End

Order blocks can help identify when trends are ending:

- Failed order blocks signal potential reversals

- Multiple order block failures indicate weakening momentum

- New order blocks forming against the trend suggest institutional repositioning

COMMON ORDER BLOCK TRADING MISTAKES

Mistake 1: Trading Every Order Block

Not all order blocks are created equal. Focus on:

- Higher timeframe blocks

- Blocks aligned with market structure

- Fresh, untested zones

Mistake 2: Ignoring Market Context

Order blocks work best when:

- Aligned with overall trend direction

- Supported by fundamental analysis

- Confirmed by multiple timeframe analysis

Mistake 3: Poor Risk Management

Even the best order blocks can fail:

- Always use stop losses

- Position size appropriately

- Don’t risk more than 1-2% per trade.

BEST PRACTICES FOR ORDER BLOCK TRADING

Pre-Trade Checklist:

- [1 ] Identified valid consolidation on higher timeframe

- [ 2] Clear institutional breakout candle present

- [ 3] Order block zone clearly marked

- [ 4] Market structure supports the trade direction

- [5 ] Risk management plan in place

- [6 ] Entry and exit levels defined

Trade Management:

Take partial profits at key levels

Monitor price action at the order block zone

Look for rejection signals before entering

Move stops to breakeven when possible.

CONCLUSION: MASTERING ORDER BLOCK TRADING

Order blocks represent one of the most powerful concepts in forex trading, offering a window into institutional behaviour and market psychology.

They’re not just another technical indicator they’re a fundamental aspect of how the forex market operates.

The key to success lies in understanding that order blocks are probability-based setups, not guaranteed winners.

Focus on identifying high-quality setups, managing risk appropriately, and staying patient for the right opportunities.

Remember, institutions don’t trade every day, and neither should you. Wait for clear order block setups that align with your analysis, and you’ll find yourself trading alongside the smart money rather than against it.

Ready to put this knowledge into practice? Start by identifying order blocks on your favourite currency pairs using daily charts.

Mark the zones, wait for retests, and observe how price reacts. With time and practice, you’ll develop the skill to spot these institutional footprints and trade them profitably.