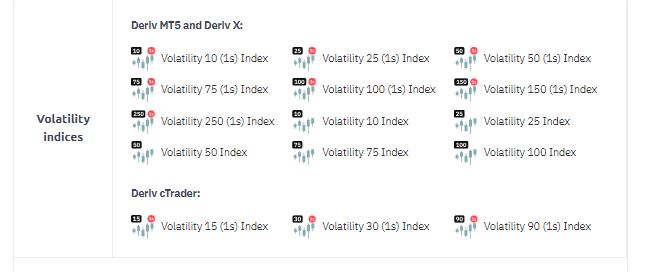

Deriv Broker stands out for its distinctive synthetic index, setting it apart from its counterparts. Amidst the plethora of volatility index assets for trading, our attention is drawn to the Deriv Volatility Index.

Unlike traditional volatility indices, it exhibits a unique movement pattern unaffected by global events. This makes it a compelling choice for traders seeking alternative avenues.

Notably, the volatility index offered by Deriv is exclusive to the platform, distinguishing it from other brokers.

Whether you’re a forex or crypto trader, exploring new trading assets is crucial, as you might discover untapped opportunities akin to stumbling upon a gold mine.

Besides the Deriv Volatility Indices or Index, you might also find the Boom and Crash Index to be lucrative trading options.

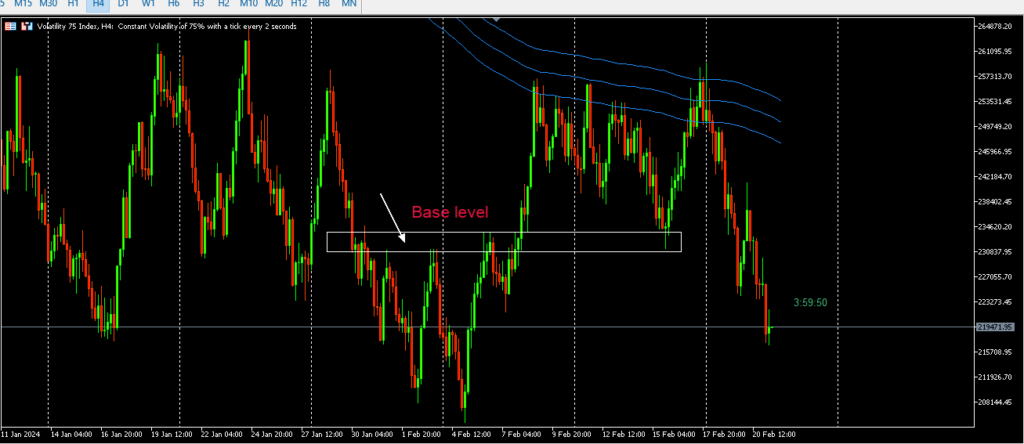

DERIV VOLATILITY INDEX STRATEGY

When you look across the internet, you will find unlimited information regarding trading strategies that talk about Deriv volatility index.

Sometimes these strategies can be similar in their approach even with the change of moving averages, however in all of these strategies, there remains a pivotal factor that cannot be changed, and that factor is the understanding of market psychology and it is a vital part of trading any financial asset, whether it is forex, commodity or Deriv volatility indices.

I am going to show you examples of how market psychology applies to Deriv volatility index.

DERIV VOLATILITY INDEX

Deriv volatility index is a synthetic trading asset unique to Deriv broker; it is not affected by global events and it is traded 24/7 even on Holidays.

You can take advantage of this market by opening a free account on Deriv.

DOES DERIV HAVE VOLATILITY INDEX?

Yes, Deriv has volatility index.

However, Deriv volatility is synthetic and can be traded 24/7 even on holidays and it is not affected by global events.

Deriv volatility index is unique to Deriv broker and can be traded only on MT5 and Deriv trading view.

You can sign up on Deriv to see all available Detiv indices.

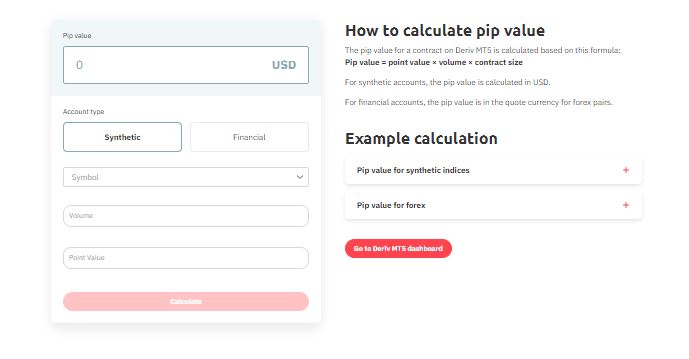

DERIV VOLATILITY INDEX CALCULATOR

The Deriv Volatility Index Calculator provides a valuable tool for traders, enabling them to gauge the pip value within their trades accurately.

By utilizing this tool, traders can enhance their risk management strategies effectively. Understanding the pip value is crucial in assessing potential profits or losses in trading positions.

With the assistance of the Deriv Volatility Index Calculator, traders can make more informed decisions, optimizing their risk exposure and maximizing their trading potential.

This calculator serves as a practical aid in navigating the complexities of the financial markets, offering clarity and precision in trade analysis.

Whether you’re a seasoned trader or just starting, having access to such a tool can significantly improve your trading experience and overall success in the markets.

VOLATILITY 100 (1S) INDEX

The Volatility 100 (1s) index stands out as a distinctive synthetic index offered by Deriv, representing simulated markets characterized by a consistent volatility level of 100%, with price ticks occurring every second.

This index provides traders with a unique trading opportunity in a dynamic and rapidly changing market environment.

By mirroring the volatility of real-world markets, it offers a realistic trading experience, allowing traders to hone their skills and strategies effectively.

With its frequent price updates, the Volatility 100 (1s) index enables traders to react swiftly to market movements and capitalize on potential profit opportunities.

Deriv’s provision of this specialized index underscores its commitment to offering innovative trading instruments tailored to meet the diverse needs of traders in today’s financial landscape.

VOLATILITY 100 (1S) INDEX CHART

The Volatility 100 (1s) index chart is exclusively available through Deriv broker, accessible solely on MT5 and Deriv trading view platforms.

This standalone chart provides traders with unique insights into market dynamics, specifically reflecting the Volatility 100 (1s) index’s movements.

Offering a dedicated visualization of this index underscores Deriv’s commitment to providing comprehensive trading tools and platforms tailored to meet traders’ needs.

By incorporating this chart into their trading analysis, traders can gain a deeper understanding of market trends and make more informed trading decisions in real time.

WHICH VOLATILITY INDEX IS BEST TO TRADE?

You seem to be discussing the Deriv volatility index, and the straightforward answer is none. Here’s why: all Deriv volatility indices exhibit similar movements, making it impractical to deem one superior for trading.

The crucial determinant in trading any Deriv volatility indices lies in grasping market psychology. Understanding concepts like rally base rally, drop base drop, market bias, and base zone (or order block), among others, is pivotal.

With a solid grasp of market psychology, traders can effectively navigate and trade any Deriv volatility indices, leveraging these insights to make informed decisions in various market conditions.

WHAT DOES VOLATILITY 10 INDEX MEAN?

Volatility 10 stands out among Deriv’s distinctive volatility indices, characterized by a consistent 10% volatility rate and a tick every 2 seconds.

Exclusively provided by Deriv broker, it remains unaffected by global events and is accessible for trading on both MT5 and Deriv trading view platforms.

Notably, trading is available 24/7, including holidays, offering traders continuous opportunities to engage with the market.

This index’s unique features make it a valuable asset for traders seeking stability and consistent trading opportunities, regardless of external market influences.

Leave a Reply