Any financial trader would have to decide which trading platform to use as there is more than one trading option available to the trader.

That being said, this post will compare “MT4 vs Ninjatrader” side by side. We will emphasize their differences and similarities to assist traders—especially newcomers—in making an informed choice.

At the end of the post, you will have all the knowledge you need to make the best decision if you are new to the forex market and unsure of which platform to use for trading.

Read more below, to know which trading platform is good for you.

IS NINJATRADER A BROKER?

No NinjaTrader is not a broker; NinjaTrader is a well-known trading platform that traders use for a variety of financial assets, such as stocks, futures, and FX, all over the world.

It was established in 2003 by Raymond Deux and has since developed into a sophisticated platform that serves both novice and seasoned traders.

Although it may not match the sheer quantity of brokers serviced by MT4, NinjaTrader does support a sizable number of brokers.

Additionally, NinjaTrader has a respectable-sized community. Even while it might not compare to the enormous community of MT4, it nevertheless provides an important support system.

Users can interact with one another, access learning materials, and share knowledge, building a cooperative environment that supports traders on their path.

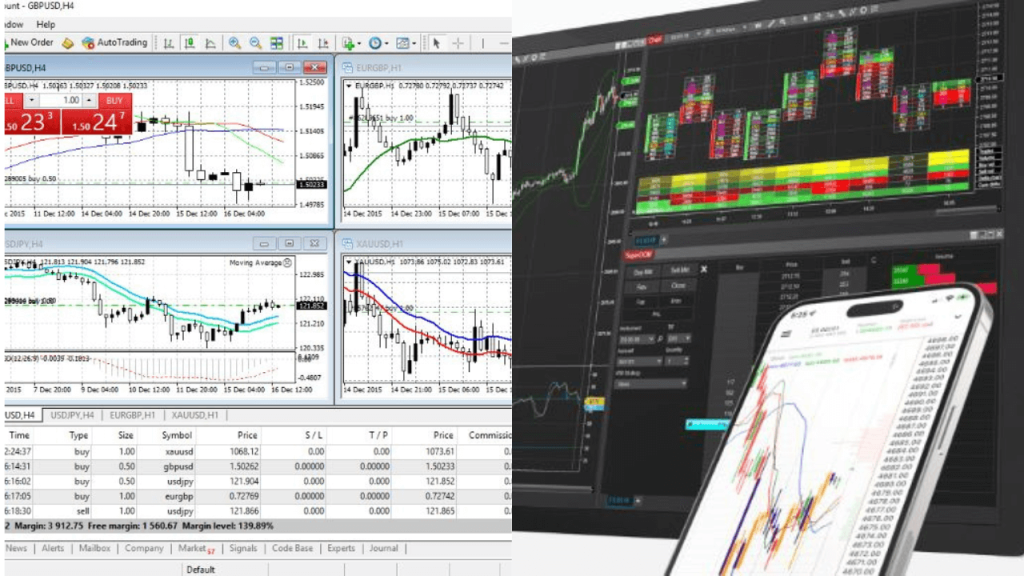

MT4 VS NINJATRADER

Below is a tabular comparison or difference between MT4 and NinjaTrader:

| Aspect | MT4 | NinjaTrader |

| The platform type | Forex and CFDs | Multi-Asset Trading |

| Easy to use | User-Friendly, Popular | User-Friendly |

| Customization | Limited customization | Highly customizable |

| Charting tools | Extensive indicators | Advanced charting tools |

| Automated trading | Support EAs (expert Advisor) | Strong support for automation |

| Order types | Standard order types | Advance order types |

| Community | Vast community support | Smaller community |

| Cost | Often free to use | Licensing fee may apply |

| Data feeds | Support various data providers | Multiple data feed option |

| Broker Compatibility | Compactable with many brokers | Works with various brokers |

| Limited backtesting | Robust backtesting | Licensing fees may apply |

| Platform support | Windows, mobile, and web version | Windows-based and Mobile app |

RELATED: MetaTrader 4 WITHDRAWAL FEES

RELATED: MetaTrader 4 NOT UPDATING

MT4 VS NINJATRADER PRICE

The accessibility of MetaTrader 4 (MT4), along with its extensive library of trading tools and indicators, has contributed to its widespread popularity in the retail trading community.

MT4’s accessibility, combined with its wide range of trading tools and indicators, has made it an appealing choice for beginners and those on a budget.

NinjaTrader, on the other hand, has possible expenses. Although NinjaTrader has a free version, the site also provides a premium subscription option for more sophisticated capabilities.

A $99 monthly subscription cost gives users access to services including sophisticated charting and order flow tools in NinjaTrader’s pricing structure.

For $1,499, traders can purchase a lifetime license for NinjaTrader, providing them with a better long-term option.

IS NINJATRADER GOOD?

Generally, Ninja Trader is a good trading platform and this is why the numerous benefits NinjaTrader provides make it an appealing option for many traders.

With its enhanced chart modification features, traders can more thoroughly alter their charts to suit their unique preferences and methods.

Furthermore, the ability to link various charts together is unquestionably advantageous, enabling a more thorough view of various assets or timeframes concurrently.

The opportunity to code in C# gives traders a wide range of chances to develop and use personalized indicators and automated trading systems, giving them a competitive edge.

Moreover, Windows is seamlessly integrated with NinjaTrader.Internet features, such as Cortana’s voice commands, improve user accessibility and convenience.

Additionally, NinjaTrader provides the OCO (One Cancels Other) order option, which makes managing orders and risks easier.

This platform’s dedication to user support is demonstrated by the free daily webinars it offers, which are especially helpful for beginning traders.

These webinars provide useful tips and advice on how to use the NinjaTrader trading platform efficiently, allowing traders to increase their competence and confidence in their trading endeavors.

CAN YOU TRADE FOREX ON NINJATRADER?

Certainly, trading Forex with NinjaTrader is a viable option because the platform encompasses all the necessary features essential for conducting thorough market analysis, and empowering traders to make well-informed decisions.

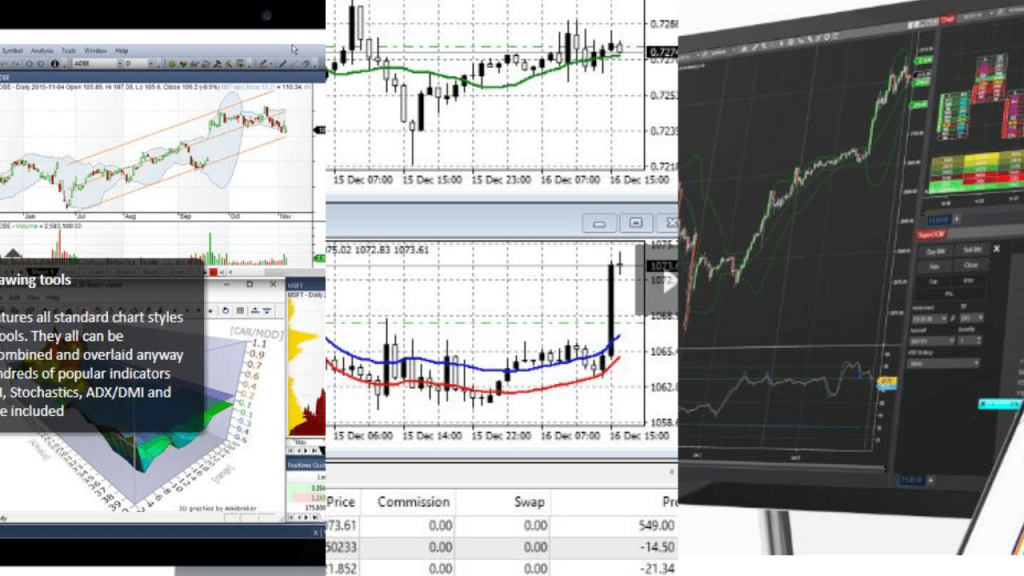

AMIBROKER VS NINJATRADER VS METATRADER

The well-known trading systems Amibroker, NinjaTrader, and MetaTrader each have unique features that address different trading requirements.

Amibroker excels in its powerful backtesting tools and sophisticated technical analysis capabilities. With its own AmiBroker Formula Language (AFL), it gives traders the ability to create and improve trading strategies.

Technical analysts and systematic traders favor the platform because of its adaptability in developing unique indicators and trading plans.

Amibroker excels at analytics but lacks native capability for live trading; as a result, order execution requires integration with third-party technologies.

The extensive toolkit offered by NinjaTrader, which includes sophisticated charting, technical analysis, and seamless live trading integration, makes it stand out.

Traders value its user-friendly design because it makes developing and executing strategies possible.

Both day traders and swing traders can benefit from the market depth and order flow capabilities offered by NinjaTrader.

Furthering its attractiveness is its ecosystem of third-party add-ons and instructional resources.

Contrarily, forex traders like MetaTrader for its user-friendly interface and automated trading features, especially MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

These platforms are preferred options for algorithmic trading in the forex market since they offer a large selection of trading robots and unique indicators.

By supporting more asset classes, including equities and commodities, MT5 is more useful to a wider spectrum of traders.

In conclusion, Amibroker excels in technical analysis, NinjaTrader provides an extensive toolkit with add-ons, and MetaTrader, particularly MT4 and MT5, is praised for its user-friendliness and automation features.

As a result, each platform is perfect for different types of traders depending on their unique preferences and needs.

WHY DO TRADERS PREFER MT4?

MetaTrader 4 (MT4) is popular among traders for several obvious reasons. First of all, newbies will love how easy it is to use.

This ease of use lessens trading errors. Additionally, a lot of traders use it, making it simple to communicate thoughts and seek assistance.

MT4 also provides FIX API access, which functions as a kind of insider’s pass for sophisticated trading. You can tailor your tactics using its programming language, even if you’re not a tech expert.

MT4 is ideal for traders since the majority of them concentrate on forex. Additionally cross-platform, it supports numerous languages and functions on a variety of devices.

Numerous charts and indicators can be used to perform analysis.

You can employ Expert Advisors on MT4, similar to trade assistants. The best thing is that getting started doesn’t cost much, and it functions well with VPS servers, which keep your trade going smoothly.

In a word, MT4 is a top pick for many forex traders because it is straightforward to use, strong, and well-liked.

WHAT SHOULD I USE INSTEAD OF MT4?

If simplicity and cost are important considerations for you when choosing a Meta Trader 4 (MT4) substitute, you might want to check into trading platforms like CTrader and Ninja Trader.

CTrader is a great option for traders who value simplicity because of its user-friendly interface. It provides sophisticated charting and order execution features, making trading easy.

Furthermore, CTrader is well known for its Level II pricing, which is advantageous for investors seeking more open market data.

However, Ninja Trader offers a wide range of features and tools that can accommodate more experienced traders, even though it might be charged.

It offers sophisticated charting, thorough order flow analysis, and assistance with algorithmic trading.

Ninja Trader is a solid option for traders who need more specialized tools and are prepared to invest in their trading platform because of its reputation for flexibility and customization options.

At the end of the day, your choice will depend on your trading style, needs, and budget.

To learn more about the Ctrader trading platform, kindly read the difference between MT4, MT5, and Ctrader.

WHY DO BROKERS USE MT4?

The preference for offering MT4 by most brokers over other trading platforms can be explained quite simply.

Consider it like being a brand offering a product or service – you’d naturally choose something that customers are already familiar with and interested in.

In this case, the primary reason for the widespread use of MT4 among brokers is its global recognition among financial traders, making it a household name.

Additionally, MT4 excels in various aspects crucial for brokers, such as efficient account management, trade processing, and quote transmission.

Moreover, the MetaTrader 4 platform comes with a complete package that includes trade servers, access points, manager terminals, gateways, and data feeds, all readily available within the MT4 back office.

This comprehensive infrastructure simplifies the setup and operations of brokerage businesses, further contributing to its popularity.

In essence, MT4 has made it remarkably convenient for brokers to provide a seamless trading experience to their clients.

Leave a Reply