You’re sipping your morning coffee, glancing at your phone, and watching your forex account grow whilst you haven’t even properly started your day.

Sounds like a pipe dream? Not quite. The very easy and profitable trading strategy MT4 isn’t just another marketing gimmick it’s a systematic approach that thousands of traders use to generate consistent returns without gluing themselves to their screens 12 hours a day.

Here’s the thing about forex trading: everyone’s searching for that holy grail strategy, but most overlook the beauty of simplicity.

The most successful traders aren’t the ones with the most complex setups; they’re the ones who’ve mastered the fundamentals and stick to proven, straightforward methods.

But here’s where it gets interesting what if I told you that the strategy we’re about to explore has helped traders turn modest $100 accounts into substantial portfolios?

Stick around, because we’re about to unpack exactly how this works.

- WHAT DOES IT MEAN TO HAVE A TRADING STRATEGY IN FOREX TRADING?

- THE FOUNDATION: UNDERSTANDING MARKET STRUCTURE

- THE VERY EASY AND PROFITABLE TRADING STRATEGY MT4: STEP-BY-STEP BREAKDOWN

- Step 3: Use Fibonacci Retracements

- RISK MANAGEMENT: THE UNSUNG HERO

- CHOOSING THE RIGHT BROKER

- STARTING SMALL: THE SMART APPROACH

- REALISTIC PROFIT EXPECTATIONS

- ADVANCED TIPS FOR CONSISTENT PROFITS

- BUILDING YOUR TRADING ROUTINE

- THE PSYCHOLOGY OF PROFITABLE TRADING

- TECHNOLOGY AND TOOLS

- CASE STUDY: REAL TRADE EXAMPLE

- STAYING UPDATED AND EDUCATED

- CONCLUSION

WHAT DOES IT MEAN TO HAVE A TRADING STRATEGY IN FOREX TRADING?

Before diving into the nitty-gritty, let’s address the elephant in the room: what exactly constitutes a trading strategy? Think of it as your roadmap in the chaotic world of currency markets.

A forex trading strategy is essentially your game plan a systematic approach that defines when to enter trades, when to exit, and how to manage risk. It’s like having a GPS for trading; without it, you’re just wandering aimlessly through market volatility, hoping for the best.

The most effective strategies combine three crucial elements:

Psychology (maintaining discipline and emotional control)

Technical analysis (reading charts and patterns)

Risk management (protecting your capital).

THE FOUNDATION: UNDERSTANDING MARKET STRUCTURE

Before we delve into our easy trading strategy, you need to grasp the fundamental concept of understanding of the market structure.

Market structure is like reading the DNA of price movement it tells you where the market has been, where it’s heading, and most importantly, where the smart money is positioning itself.

Markets don’t move randomly; they follow patterns of impulse and correction.

Think of it like ocean waves there’s a dominant direction (the trend), but within that movement, you’ll see smaller waves (corrections) moving against the main flow.

Successful traders learn to ride the big waves whilst avoiding getting caught in the smaller, choppy movements.

Key Components of Market Structure:

- Higher Highs/Lower Lows: These patterns show trend direction and help determine your overall market bias

- Support & Resistance: Key price levels that act as barriers, providing perfect entry and exit points for your trades

- Market Phases: Understanding whether the market is trending or ranging helps you select the right strategy approach

- Volume Analysis: Market participation levels that confirm price movements and validate your trading decisions.

THE VERY EASY AND PROFITABLE TRADING STRATEGY MT4: STEP-BY-STEP BREAKDOWN

Now, let’s get to the meat and potatoes. This strategy works because it aligns with how professional traders approach the markets by following the path of least resistance and joining the momentum rather than fighting it.

Step 1: Identify the Dominant Trend

This is where many traders stumble. They’re so eager to jump into trades that they skip the most crucial step: determining the market’s primary direction.

How to Spot the Dominant Trend:

- Open your MT4 platform and switch to the H4 (4-hour) or Daily timeframe

- Look for a series of higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend)

- Use the 50 and 200 exponential moving averages as trend filters

- When price is above both EMAs and they’re pointing upward, you’ve got a bullish trend

For beginners wondering about platform choice, MT4 or MT5 for beginners offers comprehensive guidance on selecting the right trading platform for your needs.

Step 2: Wait for the Perfect Setup

Patience is your best mate in trading. Once you’ve identified the trend, you’re not looking to chase it—you’re waiting for it to come to you.

The Golden Setup:

- Price makes a strong move in the trend direction (impulse wave)

- Price retraces 38.2% to 61.8% of that move (correction wave)

- You prepare to enter when price shows signs of resuming the trend

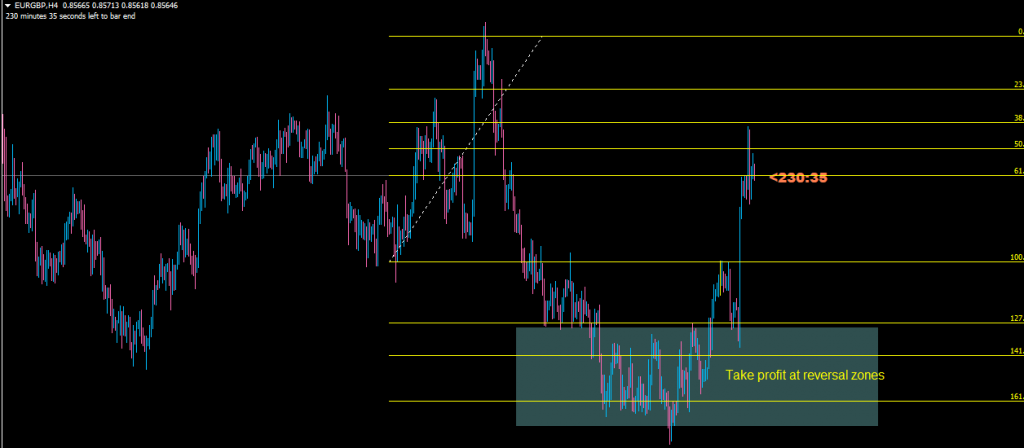

Step 3: Use Fibonacci Retracements

The Fibonacci tool isn’t just mathematical mumbo-jumbo it’s based on natural patterns that appear throughout financial markets.

Think of it as the market’s way of breathing; after a strong move, it needs to pause and gather momentum.

Fibonacci Application:

- Draw from the swing low to swing high (in an uptrend)

- Watch for price reactions at the 38.2%, 50%, and 61.8% levels

- These become potential entry zones for trend continuation trades

Step 4: Confirm with Chart Patterns

Chart patterns are like the market’s body language—they tell you what’s really happening beneath the surface. The most reliable patterns for this strategy include:

- Flag patterns (brief consolidation after strong moves)

- Pennants (triangular consolidation patterns)

- Pullback patterns (healthy corrections in trending markets)

Step 5: Execute with Precision

This is where the rubber meets the road. Your entry should be based on confirmation, not hope.

Entry Criteria:

- Wait for a candlestick pattern confirmation (hammer, engulfing, etc.)

- Ensure the setup aligns with higher timeframe analysis

- Check that your risk-reward ratio is at least 1:2

For proper trade management, understanding how to set stop loss and take profit in MT4 is absolutely crucial for protecting your capital and maximising profits.

RISK MANAGEMENT: THE UNSUNG HERO

Here’s a sobering truth: most traders fail not because they can’t pick winning trades, but because they don’t know how to manage losing ones.

Risk management isn’t sexy, but it’s what separates professionals from gamblers.

The 2% Rule

Never risk more than 2% of your account on any single trade. If you’ve got a $1,000 account, your maximum risk per trade should be $20.

This might seem conservative, but it allows you to survive the inevitable losing streak that every trader faces.

Position Sizing Examples

Here’s how the 2% rule works across different account sizes when using a 20-pip stop loss:

- $1,000 Account: Risk $20 per trade, allowing for 10,000 units position size

- $5,000 Account: Risk $100 per trade, allowing for 50,000 units position size

- $10,000 Account: Risk $200 per trade, allowing for 100,000 units position size

CHOOSING THE RIGHT BROKER

Your broker can make or break your trading success. For those exploring options, our Metatrader 5 brokers list provides comprehensive reviews of the most reliable platforms in the industry.

Key factors to consider:

- Regulation (FCA, CySEC, ASIC)

- Spreads (the lower, the better)

- Execution speed (crucial for scalping strategies)

- Customer support (you’ll need it eventually)

STARTING SMALL: THE SMART APPROACH

Wondering how to trade forex with $10? While it’s possible to start with minimal capital, success requires realistic expectations and proper scaling techniques.

Benefits of Starting Small:

- Lower emotional pressure

- Real market experience without significant risk

- Time to refine your strategy

- Builds confidence gradually

REALISTIC PROFIT EXPECTATIONS

Let’s address the burning question: how much can I make trading forex? The answer depends on several factors, but here’s a realistic breakdown:

Conservative Approach:

- Monthly return target: 5-10%

- Annual return: 60-120%

- Focus on consistency over home runs

Aggressive Approach:

- Monthly return target: 15-25%

- Higher risk, higher reward

- Requires exceptional skill and risk management

Monthly Profit Projections

Here’s what you could realistically expect based on different trading approaches:

- $1,000 Account: Conservative approach (7.5% monthly) yields $75, moderate approach (15% monthly) yields $150, whilst aggressive trading (25% monthly) could generate $250

- $5,000 Account: Conservative returns of $375 monthly, moderate returns of $750, or aggressive returns of $1,250

- $10,000 Account: Conservative monthly profits of $750, moderate profits of $1,500, or aggressive profits of $2,500

Common Pitfalls to Avoid

Even with a solid strategy, traders often sabotage themselves. Here are the most common mistakes:

Overtrading

More trades don’t equal more profits. Quality trumps quantity every time. Stick to your setup and wait for the right opportunities.

Ignoring the Trend

Fighting the trend is like swimming against a riptide—exhausting and usually futile. The trend is your friend until it ends.

Poor Risk Management

This cannot be overstated: preserve your capital at all costs. You can’t trade if you’re broke.

Emotional Trading

Fear and greed are account killers. Stick to your plan, regardless of how you feel about a particular trade.

ADVANCED TIPS FOR CONSISTENT PROFITS

Once you’ve mastered the basics, these advanced concepts can elevate your trading:

Multiple Timeframe Analysis

- Use higher timeframes for direction

- Use lower timeframes for precise entries

- Ensure all timeframes align before entering

News Awareness

Major economic announcements can invalidate technical setups. Keep an economic calendar handy and avoid trading during high-impact news releases.

Seasonal Patterns

Currency pairs often exhibit seasonal tendencies. For example, USD tends to strengthen in December due to repatriation flows.

BUILDING YOUR TRADING ROUTINE

Consistency in trading extends beyond strategy—it’s about developing professional habits:

Daily Routine:

- Market Analysis (15 minutes): Check major pairs for setups

- Trade Management (10 minutes): Adjust stops, take profits

- Journal Review (5 minutes): Record trades and lessons learned

Weekly Routine:

- Comprehensive market review

- Strategy performance analysis

- Goal setting for the upcoming week

THE PSYCHOLOGY OF PROFITABLE TRADING

Technical skills only get you halfway there. The mental game is equally important:

Developing Patience

Great opportunities don’t come every day. Learn to wait for high-probability setups rather than forcing trades.

Managing Expectations

Trading isn’t a get-rich-quick scheme. It’s a skill that requires time, practice, and continuous learning.

Handling Drawdowns

Every trader faces losing streaks. The key is maintaining discipline and not abandoning your strategy during temporary setbacks.

TECHNOLOGY AND TOOLS

Modern forex trading relies heavily on technology. Here are essential tools for implementing our strategy:

Essential MT4 Indicators

- Moving Averages (trend identification)

- Fibonacci Retracements (entry levels)

- RSI (momentum confirmation)

- MACD (trend changes)

Useful Trading Apps

- Economic calendars

- Position size calculators

- Trading journals

- Market sentiment indicators

CASE STUDY: REAL TRADE EXAMPLE

Let’s walk through a real example of this strategy in action:

Setup: GBP/USD Daily Uptrend Date: March 2024 Analysis: Price broke above key resistance, creating new higher high Entry: Waited for 50% Fibonacci retracement Risk: 2% of account (40 pips stop loss) Reward: 80 pips target (1:2 risk-reward) Outcome: Successful trade, +$160 profit on $4,000 account

This single trade demonstrates the power of patience and proper setup selection.

Scaling Your Success

As your account grows and your skills improve, consider these scaling strategies:

Gradual Position Increase

Increase position sizes slowly as your account grows. Don’t jump from micro lots to standard lots overnight.

Strategy Diversification

Once you’ve mastered one strategy, consider adding complementary approaches to your arsenal.

Multiple Currency Pairs

Expand to different currency pairs, but ensure you understand their unique characteristics and correlations.

STAYING UPDATED AND EDUCATED

The forex market constantly evolves. Successful traders never stop learning:

Recommended Resources:

- Central bank communications

- Economic research reports

- Trading psychology books

- Professional trading courses

Community Engagement:

- Join reputable trading forums

- Follow experienced traders on social media

- Attend trading webinars and seminars

CONCLUSION

The very easy and profitable trading strategy MT4 we’ve explored isn’t revolutionary it’s evolutionary. It takes time-tested principles and presents them in a clear, actionable framework that any dedicated trader can master.

Remember, successful trading isn’t about finding the perfect strategy; it’s about finding a good strategy and executing it consistently.

The approach we’ve outlined focuses on high-probability setups, proper risk management, and psychological discipline the three pillars of profitable trading.

The beauty of this strategy lies in its simplicity. You don’t need dozens of indicators or complex algorithms. You need patience, discipline, and a thorough understanding of market structure.

Most importantly, you need to start.

Your Next Steps:

- Open a demo account and practice this strategy for at least 100 trades

- Keep a detailed trading journal

- Gradually transition to live trading with small position sizes

- Continuously refine your approach based on results

The forex market will be here tomorrow, next month, and next year. There’s no rush to get rich overnight, but there’s every reason to start building your trading skills today.

Your future self will thank you for taking the first step towards financial independence through disciplined, profitable trading.

Ready to transform your trading journey? Start implementing this strategy today, and remember every expert was once a beginner who refused to give up.

Your consistency and dedication will determine your success far more than any single trade ever could.

The path to profitable trading begins with a single step. Take that step today.