What are synthetic indices? These indices represent a fascinating innovation in the financial world, offering a unique glimpse into the realm of simulated markets.

They are meticulously designed to replicate the price movements and dynamics of real-world financial assets, without necessitating actual ownership.

Through a complex interplay of algorithms and mathematical models, synthetic indices recreate market conditions, allowing traders and investors to engage in speculative activities based on these simulated fluctuations.

This concept is particularly valuable for those seeking exposure to markets that might otherwise be challenging to access.

While synthetic indices hold the allure of accessibility and versatility, they also present an array of intricacies that demand a comprehensive understanding.

By delving into the mechanics of synthetic indices, one can navigate this intriguing facet of modern finance and potentially capitalize on the insights they provide.

- SYNTHETIC INDICES VS FOREX

- WHAT ARE SYNTHETIC INDICES

- LIST OF SYNTHETIC INDICES

- SYNTHETIC INDICES ALGORITHM

- EXAMPLES OF SYNTHETIC INDICES

- WHAT IS TRADED IN SYNTHETIC

- WHICH BROKER HAS SYNTHETIC INDICES?

- HOW MANY SYNTHETIC INDICES ARE THERE?

- DERIV MULTIPLIERS

- WHY TRADE MULTIPLIERS ON DERIV

- HOW MULTIPLIERS CONTRACTS WORK

- WHAT ARE OPTIONS

- OPTION AVAILABLE ON DERIV

- WHY TRADE OPTIONS ON DERIV

SYNTHETIC INDICES VS FOREX

It will not be proper to discuss synthetic trading without mentioning Forex trading. I have been asked this question a lot, Are synthetic trading the same as forex?

Let’s see the table below that clearly shows the difference between synthetic indices vs forex;

| Synthetic Indices | Forex |

| Constant Volatility | Best volatility at trading sessions |

| Not affected by global events | Affected by global events |

| Can be traded 24/7 weekends and Holidays included | Can be traded Mondays-Fridays |

| Technical analysis only | Fundamental and technical analysis |

WHAT ARE SYNTHETIC INDICES

So, what are synthetic indices? Synthetic indices are one-of-a-kind indexes that imitate real-world market movement with one exception: they are unaffected by real-world occurrences.

These indexes are based on a cryptographically secure random number generator, have constant volatility, and are not subject to market or liquidity issues.

LIST OF SYNTHETIC INDICES

| Volatility Indices | volatility 10(1s) index, volatility 25 (1s) index, volatility 50 (1s) index, volatility 75 (1s) index, volatility 100 (1s) index, volatility 200 (1s) index, volatility 300 (1s) index, volatility 10 index, volatility 25 index, volatility 50 index, volatility 75 index, volatility 100 index. |

| Boom/Crash | Boom 1000 index, Boom 500 index, Boom 300 index, Crash 1000 index, Crash 500 index, Crash 300 index |

| Jump indices | Jump 10 index, Jump 25 index, Jump 50 index, Jump 75 index, Jump 100 index. |

| Step index | Step index |

| Range Break Indices | Range break 100 index, Range break 200 index |

The above are the types of synthetic indices that Deriv offers.

SYNTHETIC INDICES ALGORITHM

Synthetic indices are artificial markets whose price movement is determined by computer programs and whose behavior is produced by using randomly generated numbers.

These indices exhibit behavior similar to actual financial markets; they can be traded on MT5 and options.

According to Deriv brokers, an impartial third party continuously audits the algorithm that controls the synthetic trading charts for fairness to maintain.

EXAMPLES OF SYNTHETIC INDICES

Find examples below:

- Boom 1000

- Crash 300

- Step index

- Volatility 75

- Jump 75

WHAT IS TRADED IN SYNTHETIC

Indexes like Boom and Crash, and step index Volatility 75 are traded.

WHICH BROKER HAS SYNTHETIC INDICES?

Deriv broker has Synthetic indices.

HOW MANY SYNTHETIC INDICES ARE THERE?

At the time of writing this article, there are twenty-six synthetic indices on Deriv.

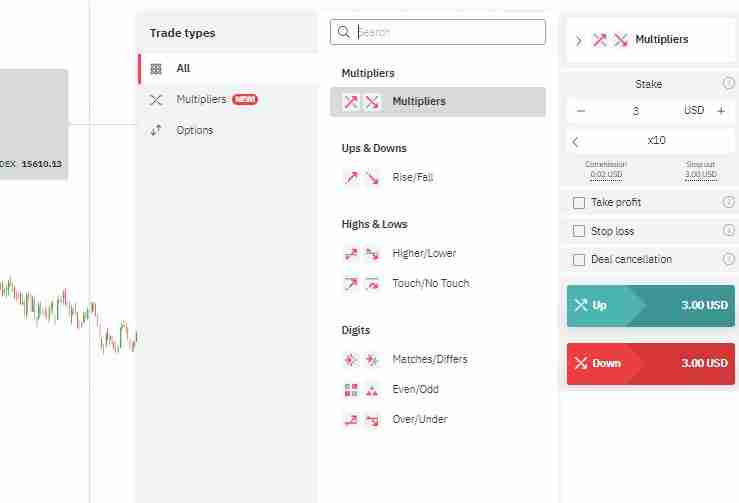

DERIV MULTIPLIERS

Deriv multipliers combine the gains from trading with leverage with the low risk of options.

This translates to the fact that your prospective profits will increase when the market moves in your favor.

Your losses are strictly capped at your initial investment if the market swings against your prediction.

WHY TRADE MULTIPLIERS ON DERIV

- Better risk management

Utilize cutting-edge features like stop loss, take profit, and deal cancellation to tailor your contracts to your preferences and level of risk tolerance.

- Increase market exposure

Increase your market exposure while keeping risk to a minimum.

- Secure responsive platform

Trade safely and easily on Deriv platforms designed for both novice and experienced traders.

HOW MULTIPLIERS CONTRACTS WORK

- Define your position

In addition to choosing the market you wish to trade on, you should also specify the transaction type, stake size, and multiplier value.

- Set optional parameter

Define optional parameters, such as stop loss, take profit, and deal cancellation, to give you additional control over your trading.

- Purchase your contract

If you are confident with the position you have defined, buy the contract.

WHAT ARE OPTIONS

Options are financial instruments that enable market prediction payments without requiring the purchase of the underlying asset.

You only need to open a position if you can forecast the asset’s movement throughout some time.

People can now take part in the financial markets with little to no cash outlay thanks to this.

OPTION AVAILABLE ON DERIV

On Deriv, you can trade the following options:

Digital options let you choose between two probable outcomes and make a prediction; if it is correct, you will receive a fixed payoff.

Lookbacks that let you get paid based on whether the market reached its best high or lowest low during a contract.

Depending on where the exit spot is about the two defined barriers, call/put spreads allow you to profit up to the stipulated payout.

WHY TRADE OPTIONS ON DERIV

- Fixed predictable payout

Before you even buy a contract, be aware of your prospective profit or loss.

- All favorite markets and more

Trade on all well-known markets and our 24/7 accessible, customized synthetic indices.

- Instant Access

Create an account and begin trading right away.

- User-friendly platforms with powerful chart widgets

Trade on systems with robust chart technologies that are secure, simple to use, and intuitive.

- Flexible trade types with minimal capital requirements

You can start trading with as little as a $5 deposit and tailor your transactions to fit your strategy.