Deriv, a broker catering to both forex and synthetic trading, often encounters a common query from traders: “Does Deriv have Volatility 75 index?”

This article aims to address this question and provide insights into why it arises. Beyond its diverse forex and synthetic offerings, Deriv extends its platform to include commodities and other assets for its clients.

Traders seeking clarification on the availability of Volatility 75 index on MT4 and MT5 through Deriv will find answers here.

Understanding the breadth of Deriv’s offerings, including its unique synthetic indices and additional asset classes, can greatly inform traders’ decisions and enhance their trading experiences on the platform.

- WHAT IS ANOTHER NAME FOR THE VOLATILITY 75 INDEX?

- DOES DERIV HAVE VOLATILITY 75 INDEX

- DOES MT5 HAVE VOLATILITY 75 INDEX?

- WHICH INDICATOR IS BEST FOR VOLATILITY 75 INDEX?

- CAN I TRADE VOLATILITY 75 ON TRADINGVIEW?

- DOES EXNESS HAVE VOLATILITY INDEX?

- VOLATILITY 75 INDEX TRADINGVIEW

- VOLATILITY 75 (1S) INDEX LIVE CHART

- DERIV SYNTHETIC INDICES

- VOLATILITY 75 INDEX CHART

- SYNTHETIC INDICES LOT SIZES

- MOST VOLATILE SYNTHETIC INDICES

WHAT IS ANOTHER NAME FOR THE VOLATILITY 75 INDEX?

Another name for volatility 75 index is V75.

DOES DERIV HAVE VOLATILITY 75 INDEX

No, Deriv does not offer volatility 75 index on MT4, Deriv only has volatility 75 index on MT5.

DOES MT5 HAVE VOLATILITY 75 INDEX?

Yes, MT5 has volatility 75 index.

WHICH INDICATOR IS BEST FOR VOLATILITY 75 INDEX?

Selecting a specific indicator for trading Volatility 75 index hinges on your trading expertise and strategy.

However, there isn’t a one-size-fits-all “best” indicator. To excel in trading Volatility 75 index, mastering trading psychology and understanding market structure are paramount.

These foundational elements empower traders to navigate market dynamics effectively, irrespective of specific indicators used.

By honing your psychological resilience and grasping market intricacies, you cultivate the ability to make informed decisions and adapt strategies accordingly, thus enhancing your proficiency in trading Volatility 75 index.

CAN I TRADE VOLATILITY 75 ON TRADINGVIEW?

Certainly! While it’s possible to trade Volatility 75 on TradingView, it’s important to understand that this feature isn’t readily available by default.

Instead, you’ll need to manually add the Volatility 75 index to your TradingView chart to access it.

DOES EXNESS HAVE VOLATILITY INDEX?

No, Exness does not offer volatility index (VIX) to traders.

VOLATILITY 75 INDEX TRADINGVIEW

Volatility 75 index tradingview can be accessed on the Deriv website.

There you will find all Deriv synthetic and forex assets, (Boom and crash included).

See the tradingview Link here: DERIV CHART tradingview

VOLATILITY 75 (1S) INDEX LIVE CHART

The live chart for Volatility 75 (1s) index is accessible on both MT5 and Deriv trading view platforms.

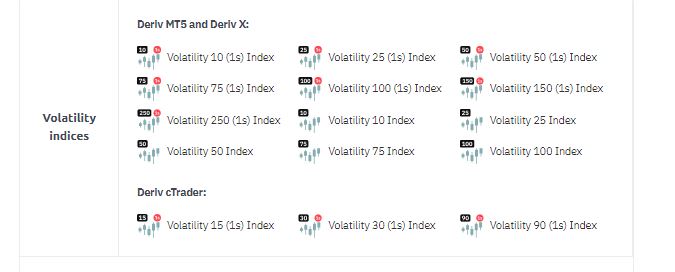

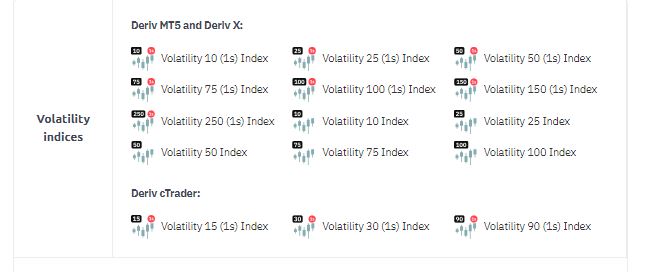

DERIV SYNTHETIC INDICES

Alright, let’s dive into Deriv’s synthetic indices! Imagine you’re exploring a whole new world of trading opportunities that don’t quite follow the traditional markets you may be used to.

Here’s why Deriv’s synthetic indices are so fascinating:

Firstly, trading with Deriv means you’re not bound by time constraints – you can trade 24/7, even during weekends and holidays, providing unmatched flexibility.

What’s more, these synthetic indices are like their own little universe, separate from the global events or market fluctuations that can cause havoc elsewhere.

This means your trades aren’t influenced by outside forces, giving you a unique level of control and stability.

Deriv also offers competitive conditions for trading, with tight spreads, high-leverage options, and deep liquidity.

It’s like having all the tools you need right at your fingertips to make informed decisions and maximize your trading potential.

And lastly, Deriv caters to traders of all risk appetites by offering multiple volatility levels. Whether you prefer a steady ride or thrive on the excitement of higher volatility, there’s something for everyone.

In a nutshell, Deriv’s synthetic indices offer a whole new world of trading possibilities, where time, global events, and market fluctuations take a backseat, and you’re in the driver’s seat of your trading journey.

VOLATILITY 75 INDEX CHART

Deriv Volatility 75 index chart is conveniently accessible on both MT5 and Deriv trading view platforms.

What makes the Deriv Volatility 75 index chart stand out is that it provides all the essential trading tools necessary for conducting a thorough market analysis, similar to what you’d find in forex market analysis.

From trend lines to technical indicators, everything you need to make informed trading decisions is right there on the chart.

Moreover, the Deriv Volatility 75 index chart offers a range of timeframe options, allowing for a comprehensive top-down analysis of the market.

Whether you’re a short-term trader looking at minute-by-minute fluctuations or a long-term investor analyzing trends over weeks or months, you’ll find the timeframe that suits your trading style.

In essence, the Deriv Volatility 75 index chart is your go-to resource for analyzing and trading this dynamic index, equipped with all the tools and timeframe options you need for a successful trading adventure.

SYNTHETIC INDICES LOT SIZES

The lot sizes for Deriv synthetic indices vary depending on the specific index. For instance, the minimum lot size for Boom 500 might be 0.2, whereas for the Volatility 75 index, it could be as low as 0.001.

As brokers can adjust their policies regarding lot sizes, it’s advisable to stay informed about the latest updates.

Opening a demo account with Deriv would be a prudent step, allowing traders to stay up-to-date with any changes in lot size requirements for synthetic indices.

This ensures traders have accurate information and can adjust their trading strategies accordingly, promoting more effective risk management and informed decision-making when trading Deriv synthetic indices.

MOST VOLATILE SYNTHETIC INDICES

As a seasoned trader specializing in Deriv synthetic indices, I’ll highlight the most volatile ones and explain why they stand out. Among them, Volatility 300 (1s) takes the lead.

Its exceptional volatility is evident as it maintains a constant 300% volatility rate, with price ticks occurring every 1 second.

his starkly contrasts with indices like Volatility 75 and Volatility 100, which operate at lower, albeit still notable, volatility levels of 75% and 100% respectively.

The heightened volatility of Volatility 300 (1s) presents both increased risk and potential reward, making it an intriguing option for traders seeking dynamic trading opportunities in the synthetic indices market.