It is known by FX traders, that navigating the financial markets can be quite difficult.

This is mostly true especially when there isn’t much capital accessible to traders to maximize profit, With this lack of money, traders—especially those who engage in Deriv synthetic trading—ask themselves, “Can I trade Boom and Crash with $10?”

The consequences of participating in the financial markets with limited funds are well-known to experienced traders.

There’s no denying the frustration that these kinds of circumstances bring.

These difficulties, meanwhile, also teach important lessons about discipline and the dangers of making rash decisions without doing adequate research before entering a market, which can lead to financial loss.

I’d like to welcome you to relax and read this piece of writing as I give you a worthy response that offers insights from over seven years of Boom and Crash trading knowledge.

- WHAT IS THE RIGHT WAY TO TRADE BOOM AND CRASH?

- CAN I TRADE BOOM AND CRASH WITH $10

- CAN I TRADE BOOM AND CRASH WITH $5?

- BOOM AND CRASH SNIPER ENTRY

- BOOM AND CRASH 1 MINUTE STRATEGY

- HOW MUCH DO YOU NEED TO TRADE A STANDARD LOT

- WHAT IS THE MINIMUM AMOUNT TO TRADE BOOM AND CRASH?

- CAN I START FOREX TRADING WITH $10

WHAT IS THE RIGHT WAY TO TRADE BOOM AND CRASH?

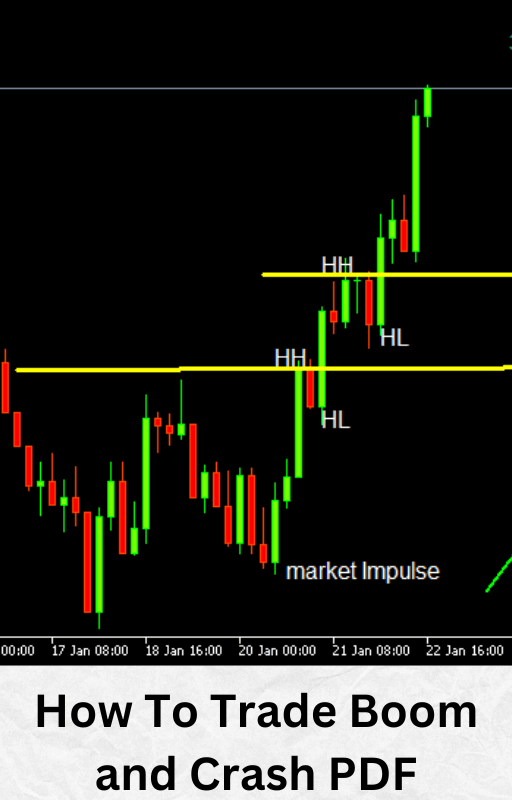

A practical understanding of market structure formations is necessary for Boom and Crash trading, with a focus on the following crucial steps.

First, use higher timeframes such as D1 to identify the dominating trend or market bias.

After that, be patient for a small pullback back to a base level, which is usually a zone of multiple resistance and support.

Finally, carefully examine structural formations over a lower timeframe and keep an eye out for possible breakouts.

To ensure a thorough awareness of market dynamics, this strategy demands the use of multiple timeframes, from the higher to the lower timeframe (top-down analysis).

The following steps above will help traders make better decisions by helping them recognize the best times to enter and exit the market and maximize profit.

See the live examples below.

CAN I TRADE BOOM AND CRASH WITH $10

Yes, you can trade Boom and Crash with $10 and be profitable, however, there are certain conditions to adhere to so that for this to work.

- Identify the Dominant trend or market Bias on a higher Timeframe say D1

- Identify a base(multiple support and resistance zones) on market retracement

- On the base look out for structural formation and breakout on lower timeframes

- See the Live Image below

NOTE: When trading Boom and Crash with $10, for risk management purposes ensure that you use a lot side not more than 0.04, this is how you do it.

Since the minimum lot size on Boom and Crash is 0.20, you can enter with a lot size of 0.23 or 0.24 on market execution then click on the existing trade, reduce to 0.2, and close, 0.04 will be left.

The over conclusion is that you should have a substantial amount of capital to effectively trade any financial instrument. (At least $100).

KINDLY FOLLOW THIS LINK TO TRADE BOOM AND CRASH WITH $10

CAN I TRADE BOOM AND CRASH WITH $5?

While it’s conceivable, directing your attention towards other Deriv synthetic indices, such as Volatility 75 and Jump Index, would be more advisable if you plan to trade with just $5.

BOOM AND CRASH SNIPER ENTRY

When trading any financial instrument, you must lower your expectations to avoid disappointment as there are no perfect trading strategies; however, there are patterns that are consistent and have a high probability of success rate.

These patterns are repeated constantly throughout the market.

Below are points in which the market patterns play out.

- The dominant trend on higher timeframe

- Base Formation (identify a base on a higher or lower timeframe)

- On the base, look out for a breakout of new formations for market entry

See Live Image examples below.

BOOM AND CRASH 1 MINUTE STRATEGY

As a boom and Crash trader with years of experience, do not trade Boom and crash using 1 minute.

Do not trade any financial instrument in 1 minute. It is not a smart way to trade.

When you search through the internet, you will never find a successful trader who uses 1 minute as a trading strategy, if you want consistency, then you have to follow the rules and apply them as professionals do.

In a nutshell, this means looking at the market from a larger perspective to make proper trading decisions.

That being said you can look see my previous article on top secret on how to trade Boom and crash.

HOW MUCH DO YOU NEED TO TRADE A STANDARD LOT

Considering risk management before initiating a trade, it is recommended to have at least $2,500 to trade a standard lot, although this is not the optimal suggestion.

For a more secure and peace-of-mind trading experience, it is advisable to have a minimum of $10,000.

In trading, lot size is intricately linked to leverage, with a standard lot representing 100,000 units of currency.

This translates to a value of approximately $10 per pip. Consequently, depending on the currency pair being traded, a standard lot is valued at around $10 per pip.

If the market moves favorably by one pip, you stand to gain $10; conversely, if the trade goes against you, you will incur a loss of $10 per pip.

To illustrate, if the market shifts adversely by 10 pips after you initiate a trade, your loss would amount to $100.

WHAT IS THE MINIMUM AMOUNT TO TRADE BOOM AND CRASH?

The minimum amount to trade boom and crash will depend on the Boom and cash index you are trading as at the time of writing this article there are six of them.

Boom 1000

Boom 500

Boom 300

Crash 1000

Crash 500

Crash 300

Each index requires its minimum amount to execute a trade.

| BOOM AND CRASH INDEX | DEFAULT MINIMUM LOT SIZE | POSSIBLE MINIMUM AMOUNT RANGE |

| BOOM 1000 | 0.2 | $15-$20 |

| BOOM 500 | 0.2 | $10-$15 |

| BOOM 300 | 1.0 | $20-$30 |

| CRASH 1000 | 0.2 | $10-$15 |

| CRASH 500 | 0.2 | $10-$15 |

| CRASH 300 | 0.5 | $20-$30 |

The possible minimum amount range is fair enough to give room for stop losses.

CAN I START FOREX TRADING WITH $10

It is technically possible to begin Forex trading with $10, but there are considerable challenges and limitations.

Forex trading entails buying and selling of currencies and the amount of funds you begin with might affect your capacity to manage risk, cover trading fees, and survive market volatility.

Your trading possibilities will be significantly limited if you only have $10. Leverage is commonly used in forex trading, allowing you to handle a greater position with a smaller amount of funds.

Using large leverage with a small account, on the other hand, can compound both wins and losses, making it riskier.

Regardless of your trading expertise or method, as a Forex trader, after knowing the basic Forex concepts and how to apply them in real-time, another key factor for a positive trading experience is to have significant capital.

It’s important to consider transaction costs, as they can quickly erode a small account.

Additionally, a $10 account may not provide sufficient margin to maintain open positions, leading to forced liquidations if the market moves against you.

For a more sustainable and less risky start, many traders recommend starting with a larger capital base, such as a few hundred dollars.

This allows for better risk management and a more realistic trading experience.

Leave a Reply