SYNTHETIC TRADING

The financial market is becoming increasingly conscious of synthetic trading; previous financial crashes suffered by traders and investors over the years have led to an increase in other forex trading alternatives and financial assets.

Because of the world we live in, global events will always have an impact on the financial market; this is why a growing community of traders and investors is incorporating synthetic trading into their portfolios.

The goal of this article is to provide you with a fair perspective on the subject so that you can make an informed judgment about whether or not the synthetic market is for you.

SYNTHETIC TRADING

Synthetic trading is intended to mirror real-world market action, but with one exception: it is unaffected by real-world occurrences and market hours. Synthetic trading is intended to provide consistent volatility while eliminating liquidity risk.

A few brokers provide synthetic trading to their clients; one such broker is Deriv.

SYNTHETIC OPTIONS

According to the corporate finance institute, Synthetic options are portfolios or trading positions holding a number of securities that when taken together, emulate another position.

In theory, the payout of the imitated, synthetic position and the actual position should be similar.

Synthetic choices are unquestionably superior to conventional options. However, there are certain drawbacks to synthetic options.

If the market moves against a cash or futures position, it is literally losing money in real time.

It is expected to appreciate in value at the same rate with a protection option in place. One can cover their losses in this manner.

The main synthetic positions are synthetic long stocks, synthetic short stocks, synthetic long calls, synthetic short calls, synthetic long puts, and synthetic short puts.

Synthetic positions can be used to modify an existing position, reduce the number of transactions required to update a position, and identify market option mispricing.

SYNTHETIC ASSETS

A tokenized derivative that mimics the value of another asset is what a synthetic asset is.

Derivatives are classic financial representations of stocks or bonds that a trader does not own but wishes to buy or sell.

In essence, a derivative allows you to profit from the price changes of a stock that you do not own.

SYNTHETIC TRADING STRATEGY

A synthetic trading strategy is a trading style a trader employs when trading synthetic indices, this strategy is used after traders’ setup and all trading conditions have been confirmed after market analysis on the indices to be traded.

There are numerous synthetic trading strategies a trader can use to place a trade example: chart pattern, support, and resistance, demand, and supply, Fibonacci tool, etc.

This is possible because synthetic trading is designed to mimic convectional trading while eliminating the disadvantage that comes with conventional trading.

You can visit Deriv to try synthetic trading on a demo account.

SYNTHETIC TRADING BROKERS

There are reputable and licensed brokers who provide synthetic trading to their clients; I will list these firms in this post.

Among the brokers I’ll be listing, Deriv sticks out to me the most because of the unique synthetic indices it provides to traders that other brokers do not.

| BROKER | Quick SUMMARY |

| DERIV | The unique synthetic indices developed by Deriv imitate real-world market fluctuations. These indices, which are supported by a cryptographically secure random number generator, are available for trading 24 hours a day, seven days a week, and are unaffected by conventional market hours, global events, or market and liquidity issues. |

| IG | IG provides spread betting, CFD, and Forex trading in a variety of markets. They are FCA-regulated, offer an excellent trading app, and have a 40-year track record of success. |

| IC MARKETS | IC Markets is a well-known and well-established online trading brokerage situated in Sydney, Australia (Regulated by ASIC). International Capital Markets PTY owns and operates the company, which was created in 2007. Its offices are located at Level 6 309 Kent Street Sydney, NSW 2000. |

| PEPPERSTONE | Pepperstone allows both regular and professional traders to trade CFDs. On the MT4, MT5, and cTrader platforms, clients can trade FX, indices, commodities, and stocks. |

| CAPITAL.COM | Capital.com provides CFDs and Forex on a wide range of assets, with attractive spreads and one-of-a-kind platforms, including a fully functional mobile app. |

| AVATRADE | A prominent FX and CFD broker with licenses in Ireland, Australia, Canada, and South Africa Avatrade is found to be successful at integration. |

MT5 SYNTHETIC INDICES

Mt5 synthetic indices provide you with the ability to trade synthetic indices on a single platform.

Exclusive access to unique trade types, for synthetic indices Deriv elevates the MT5 experience for both new and seasoned traders.

QUICK SUMMARY OF MT5 SYNTHETIC INDICES

- Practice with a demo account preloaded with unlimited virtual funds.

- Trade all Deriv indices on a single platform all in one place.

- Trade synthetic indices 24 hours a day, seven days a week.

- Trade with a regulated industry pioneer who has been trusted by traders for over 20 years.

SYNTHETIC INDICES MT4

MT4 is a great trading software and it is still used by many traders, however, synthetic indices are designed for MT5 only.

SYNTHETIC INDICES TRADING

Synthetic indices trading is an alternative to regular trading, and it is gaining popularity quickly, especially among retail traders.

It is a cryptographically secure random number generator that is audited by a third party to ensure that it cannot be manipulated or tampered with.

The volatility of synthetic indices is constant, and they are free of market and liquidity issues.

Synthetic indices trading still respects the laws of support and resistance, supply and demand; general market structure and it cannot be affected by global events.

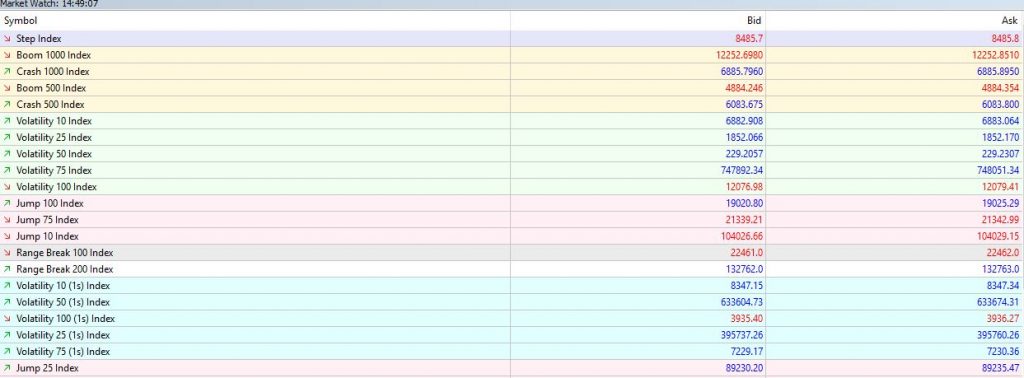

Below are some popular synthetic indices traded with Deriv broker:

- Volatility 75

- Boom and crash

- Jump 75

- Step index

SYNTHETIC INDICES VS FOREX

Synthetic indices are purposefully designed to eliminate the disadvantages of forex trading because no system is perfect, and synthetic indices are not without problems.

But it is still preferred by many retail traders over forex trading.

Below is a table on the difference between synthetic indices and forex trading:

| SYNTHETIC INDICES | FOREX |

| Tight spread | Higher spread |

| Purely a technical analysis and not affected by global events | Affected by global events (fundamental analysis) |

| Constant volatility and are free of market and liquidity risks. | Volatility and liquidity vary based on market condition |

| You can trade 24/7 holidays and weekends included | Trade 5 days a week only |

| Web and MT5 only | Available on MT4 and Mt5 and web |

| Little capital to be significantly successful | Hugh capital to be successful |

| Best for scalping | Scalping only on specific market conditions avoids fundamental news. |

BEST SYNTHETIC INDICES TO TRADE?

On Deriv, traders can choose from a variety of synthetic indexes, each of which is distinctive in its appearance and movement.

That being said, claiming that one, in particular, is the best synthetic indices to trade is not optimal because traders’ experiences and preferences differ.

For the record, if you have a small amount of money (under $250 in my opinion), you should avoid volatility 75 indices because you can lose all of your money even with the smallest lot size (0.001).

You should also stay away from V50 (1s), and jump 75.

Keep in mind that the preceding statement is based on the traders’ experience.

As a synthetic trader, I believe that the best synthetic indices to trade are boom and crash indices since they are quite predictable; however, keep in mind that this is just my perspective; individual traders will have different preferences.

To summarize, rather than focusing on the best synthetic indices to trade, you should instead concentrate on understanding market structure, as this is what synthetic trading is all about.

SYNTHETIC INDICES EXAMPLES

Synthetic indices examples are as follows:

- Boom 1000

- Boom 500

- Boom 300

- Crash 1000

- Crash 500

- Crash 300

- Volatility 75

- Jump 75

- Step index

- Range break 100 index e.t.c

WHERE CAN I TRADE SYNTHETICS?

You can trade synthetic indices on Deriv

IS SYNTHETIC TRADING PROFITABLE?

Yes, because it is designed to eliminate the disadvantages of forex trading and comes with nearly zero spread, allowing for faster gains than traditional trading with a huge spread.

WHAT IS THE BEST TIME TO TRADE SYNTHETIC INDICES?

There is no best time of day to trade synthetic indices; the ideal time to trade synthetic indices is always after identifying a market setup; this is where market structure comes into play again.

ARE SYNTHETIC INDICES MANIPULATED?

I can’t say whether or not synthetic indices are manipulated.

According to Deriv, the indices are based on a cryptographically secure random number generator that is validated by an independent third party to verify that they cannot be manipulated or tampered with.

The truth is that the world’s monetary system is unbalanced and does not benefit the majority, but people continue to profit from it.

These systems still have principles, and you can earn from them if you pay attention to proper trading techniques (market structure) and money management.

DERIV SYNTHETIC INDICES

Deriv synthetic indices are exclusively designed and owned by Deriv broker, they mimic real-world market movement but with a twist — they are not affected by real-world events.

They are built on a cryptographically secure random number generator that has been audited by an independent third party to ensure that they cannot be manipulated or tampered with.

The volatility of synthetic indices is constant, and they are free of market and liquidity issues.