In my years of forex trading, I’ve learned that the 1 hour time frame is critical for market top-down analysis.

For any trader who wants to see meaningful development in the forex market, a 1 hour timeframe is essential.

I’ll go into more detail on trading 1 hour time frame forex later in this article but before I do that you have to understand that as a forex trader, you may never need to employ some trading time frames such as the monthly and 1 minute time frames since they are either too lengthy or too short.

However, the 1 hour timeframe combines the benefits of both the longer and shorter durations, making it the most traded timeframe.

BEST TIME FRAME FOR DAY TRADING

Day traders profit from market swings between a resistance and support zone on a higher period (H1 and H4) and place their trades entry on a much smaller timeframe (15 minutes, 30 minutes).

There are no holy grails in forex trading, and all strategies and time frames have drawbacks. Being a day trader requires you to set a tight stop loss and constantly monitor the market for changes.

It’s important to remember that if you perform market analysis incorrectly as a day trader, you risk losing your hard-earned profits.

TRADING 1 HOUR TIME FRAME FOREX

In forex trading, to be effective with the 1 hour time frame, you should not trade in isolation; it should be traded in conjunction with the dominant trend on a high timeframe (D1 and H4). Furthermore, Traders of many types employ the 1 hour time window, including intraday, day, and swing traders.

1 HOUR CHART FOREX TRADING STRATEGY

The 1 hour chart is the most popular time frame for forex trading because it accommodates a wide range of trading techniques.

Traders that don’t have the time to stay on a trade for too long and don’t want to trade on a much smaller time frame like 5 minutes wind up on the H1 timeframes, which, when traded correctly, provides a nice trade setup that can last a few days.

There are hundreds of 1 hour chart forex trading methods available on the internet; nevertheless, all of these strategies adhere to the forex market’s basic concepts of market psychology and market structure.

As a result, I’m going to show you a one-hour chart forex trading strategy that I employ for market entry.

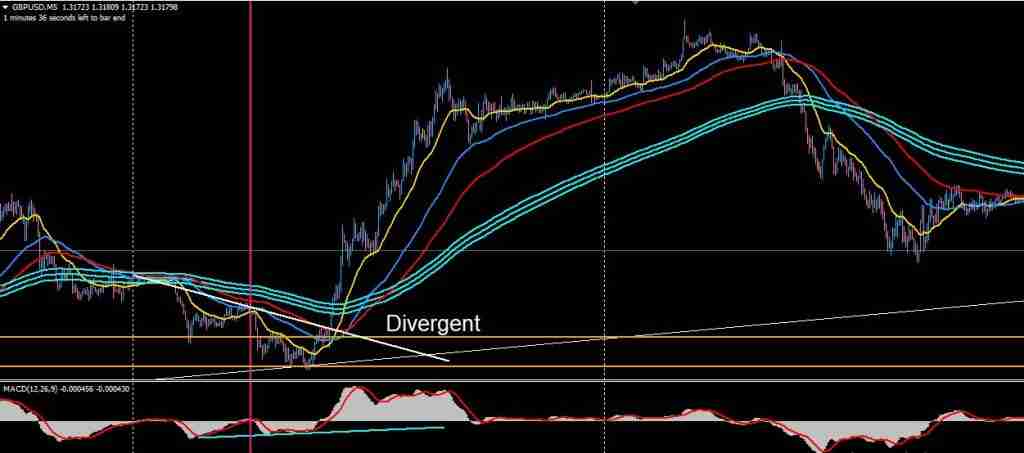

Indicators

- Moving averages Exponential

Period 233 shift 3

Apply: high

- Moving average exponential

Period 233 shift 3

Apply: low

- Moving averages exponential

Period 233 shift 3

Apply: median price

- Moving average exponential

Period 21 shift 1

Apply: close

- Moving average exponential

Period 55 shift 5

Apply: close

- Moving average exponential

Period 89 shift 8

Apply: close

MACD: default.

RULES

Find the dominant trend on a higher timeframe; H4 or H1

After retracement (support and resistance on H1) look for trend continuation on a lower timeframe 5 minutes, 15 minutes

Candle breaks out closes above EMA 55

Look for divergent on MACD on the lower timeframe to confirm your entry.

RELATED: BEST 1 HOUR TRADING STRATEGY

BEST TIME FRAME TO TRADE FOREX FOR BEGINNERS

Understanding the basics of the forex market in terms of market structure, support and resistance, and so on can be intimidating, especially for beginners. Knowing the timeframe that suits you is good, but understanding the basics of the forex market in terms of market structure, support and resistance, and so on is even better.

Forex time frame will not be a concern for you if you have this expertise.

Still, as a beginner, I would advise you to avoid scalping and instead focus on intraday trading, which involves trading on the H1 and H4 timeframes.

RELATED: BEST FOREX TRADING STRATEGY FOR BEGINNERS

DAILY TIME FRAME FOREX TRADING STRATEGY

Many traders avoid trading the daily time frame due to the limited number of setups available; yet, the daily time frame is where you will find better setups with fewer fake-outs.

Lower time frames are beneficial, but they can have drawbacks.

As I often say, it doesn’t matter what method you use when trading daily time frames; what matters is that you understand market structure while trading any time frame.

Understanding market structure will aid in the implementation of your forex trading plan.

An example of a daily time frame forex trading strategy is shown below.