The array of financial instruments available to traders continues to expand, with one notable addition being the Deriv Volatility 75 index.

Many financial traders, seeking alternatives to forex, are eagerly exploring the opportunities presented by this V75 index.

The growing awareness of Deriv volatility indices has sparked a surge in inquiries within the financial trading community, with individuals keen to understand how to trade Volatility 75 Index.

This article will delve into the Deriv Volatility 75 index, focusing on strategies to achieve consistent profitability.

It emphasizes the importance of patience, highlighting that a crucial element in any successful trading strategy involves waiting for opportune high-yield market setups before confirming a trade entry.

IS VOLATILITY GOOD FOR DAY TRADING?

Whether volatility is good for day trading depends on the trader’s experience, capital, and risk management skills.

In my experience as a forex and synthetic trader, you find that combining swing and day trading is more effective in a volatile market.

This combination provides a clearer market picture and peace of mind. This suggests that the flexibility to adapt strategies to market conditions is crucial, and having a broader toolkit that includes both day and swing trading approaches can be advantageous in navigating the challenges posed by volatility.

In summary, while volatility can offer profit opportunities, day traders need to have experience, sufficient capital, and effective risk management strategies.

The combination of swing and day trading appears to be a strategy that harmonizes with volatile market conditions, providing traders with a more comprehensive and adaptable approach.

HOW TO TRADE VOLATILITY 75 INDEX

As a Deriv synthetic trader who wants to be consistently profitable, this is how to trade volatility 75 index;

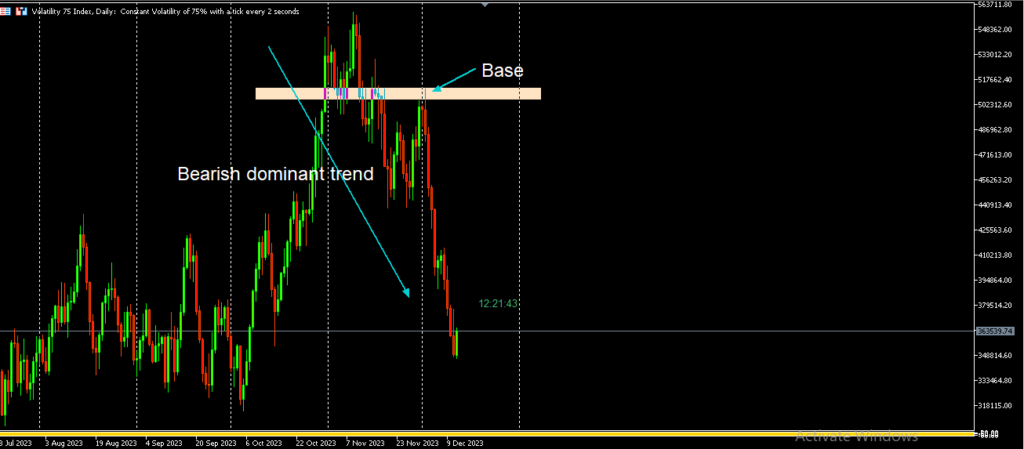

- Identify the dominant trend (market bias on higher time frame)

- Look out for market structure (rally base rally, drop base drop) on a lower timeframe

- Look out for entry on reverse on base

See the live image example below

HOW TO TRADE VOLATILITY 75 INDEX FOR BEGINNERS

The reality of trading Volatility 75 is that there aren’t distinct trading strategies for beginners and experienced traders.

Instead, there’s a fundamental principle that encompasses all strategies, and that is market psychology. This involves comprehending market movements from higher time frames to lower time frames.

In essence, for beginners embarking on the journey of trading the Volatility 75 index, here are key aspects to focus on:

- Understanding market structure ( market psychology)

- Rally base rally, drop base drop

- Support and resistance

- Market top-down analysis (multiple timeframes)

See an Image live example below.

WHICH BROKER IS BEST FOR VOLATILITY 75 INDEX?

There are two variants of the V75 index: one is exclusive to Deriv synthetic indices, and the other is Vix 75, provided by numerous brokers.

However, XM stands out as the premier broker for the Volatility 75 index (Vix 75), and here’s why:

XM has a rigorous no-requotes and no-rejections policy, an impressive 99.53% of trades conducted on the MT4 and MT5 platforms are executed in under a second.

XM offers a comprehensive educational suite designed for traders at every skill level. This includes daily Q&A sessions, live weekday instruction from 05:00 to 15:00 GMT, detailed platform tutorials, instructional videos, and Forex webinars conducted by 67 distinguished professionals in 19 languages.

Traders gain access to premium market analysis tools and exclusive Forex seminars, empowering them to navigate the trading environment with confidence.

Xm has a minimum deposit of $5 and it’s regulated by CySEC, ASIC, DFSA, FSCA, and a max leverage of 1000:1.

WHAT IS THE BEST DAY TO TRADE VOLATILITY?

If there were an optimal day for trading volatility, most traders would likely achieve profitability. However, the reality is that there is no single best day for trading volatility.

What is certain is that to be successful in trading volatility, a trader must comprehend market psychology and all essential components of navigating the financial markets.

For more insights on this topic, refer to my previous post on understanding market structure.

HOW TO AVOID LOSSES IN VOLATILITY 75 INDEX

Losses are an unavoidable part of the journey for every financial trader. This inevitability underscores the significance of employing risk money management strategies.

Grasping the principles of risk money management in your trading endeavors is instrumental in curtailing losses while allowing profitable trades to thrive.

It’s crucial to understand that risk money management doesn’t operate in isolation. Your familiarity with market psychology is equally vital; it aids in recognizing trades with high win rates, effectively minimizing losses.

To delve deeper into the nuances of market psychology, you can explore complementary resources in the form of previous posts on my website.

I trust this provides a satisfactory response to your inquiry on how to mitigate losses in the Volatility 75 index.

Leave a Reply