In this article, I will be sharing a simple strategy on how to trade pin bars in forex.

When you think Pin bar, you think of price rejection, the pin bar is a popular candle stick pattern among forex traders and it is easily identified; to some traders, it is considered the best candle stick pattern for a trade setup.

However, if you carefully look through your chart history you will see that there is no such thing as the holy grail (perfect trading strategy) this is why even with the pin bar trading strategy there are other markets set up to look out for to confirm market entry after the pin bar appears.

WHAT IS PIN BAR FOREX?

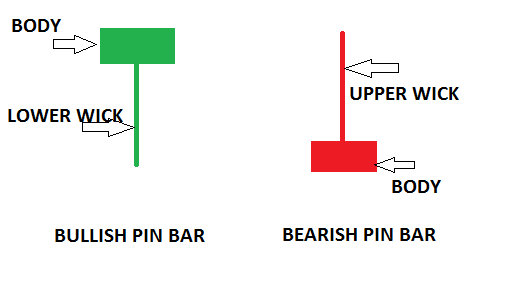

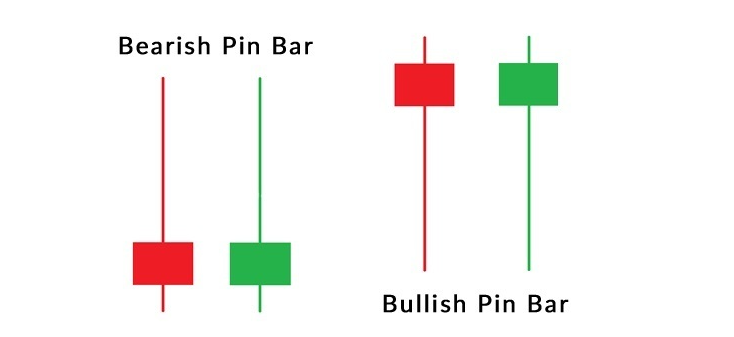

A pin bar in forex is a candlestick pattern that indicates a sharp move in price rejection in areas of support and resistance.

This sharp move in price can be seen on a single candlestick. It can be easily identified by its long wicks formed at the rejection zone. Pin bars are price rejections.

HOW TO TRADE PIN BARS IN FOREX

The fastest and easiest way to trade pin bars in forex is to first find the market trend, then wait for price rejection (which may happen not as a pin bar) in support and resistance level with the trend.

HOW DO YOU TRADE A BULLISH PIN BAR IN FOREX?

Bullish Pin bars are best traded at the end of a trend, in the area of support and resistance, daily high and low.

READ ALSO: RECOMMENDED LOT SIZE FOREX

READ ALSO: HOW TO SET STOP LOSS AND TAKE PROFIT IN MT4

WHAT DOES A PIN BAR INDICATE?

When all the market conditions are met a pin bar indicates a change in trend (from bullish to bearish and vice versa) also trend continuation.

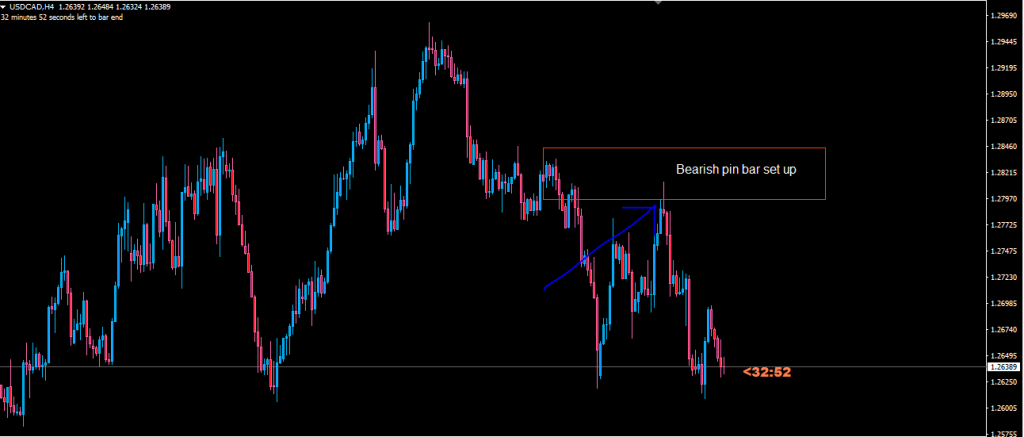

BEARISH PIN BAR SET UP

A bearish pin bar can be seen in two ways

- A trending bearish market

- Reversal market

- A trending bearish market

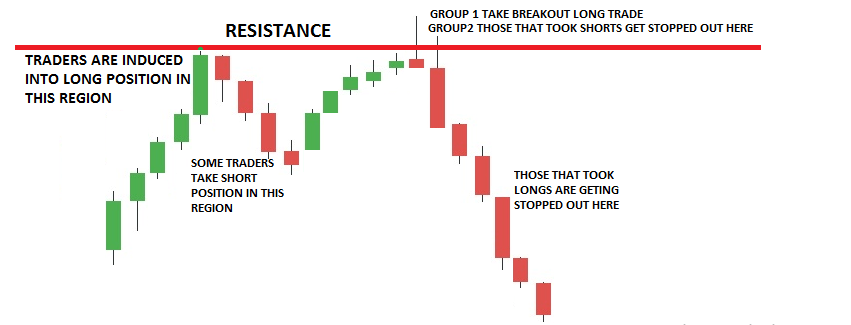

This is when the market is on a bearish move retraces to a resistance zone and forms a bearish pin bar on the resistance zone to indicate a trend continuation.

- Reversal market

This is when the market has been bullish for a while and it gets to a reversal zone (you can find a reversal zone using the Fibonacci tool)

On the reversal zone, the market ranges form resistance, and then a bearish pin bar is formed to indicate a market reversal.

PIN BAR CANDLE MEANING

A pin bar candle means price rejection on that level; when a pin bar is formed in the forex market, it indicates that the market will go in the direction of the pin bar formed provided that it meets all the market requirements that confirm the marker structure.

Having a good knowledge of the market structure will help make good decisions on pin bars and filter out false pin bars in forex trading.

PIN BAR TRADING STRATEGY

Pin bar trading strategy is a good way to trade the forex market however just like every other forex trading strategy, it is not to be traded in Isolation.

When using a pin bar trading strategy, does this mean that anywhere a pin bar appears in the chart, it should be traded, certainly not.

Let us look at the best place pin par strategy can be applied.

- Support and resistance (especially on higher timeframe).

- Consolidation zones (previous highs and lows).

- Daily high and daily low.

- At the end of the day.

BULLISH PIN BAR PATTERN

A bullish pin bar pattern can be on a reversal trend or a trend continuation, on a reversal trend a pin bar is formed at a major support level indicating that buyers have taken over the market while for a bullish pin bar trend continuation.

The market will be on an uptrend on a higher time frame then retraces to create a consolidation zone, (support and resistance in a lower timeframe) the uptrend then continues with a bullish pin bar in a lower timeframe after it fails to break the support. This is also true for a bearish pin bar pattern.

PIN BAR VS HAMMER

Pin bar and hammer are almost the same things because they are formed as a result of price rejection on places of support, for resistance it’s called a hanging man.

Pin bar is a general modern name used. Note that all hammer or hanging man are pin bars but not all pin bars are hammers.

HAMMER PIN BAR

A hammer pin bar is a candlestick bullish pattern that is formed indicating the end of a bearish trend and the beginning of a bullish trend.

A hammer pin bar is one of the easiest candle stick patterns to identify on the chart. When you think of a T, you think hammer pin bar.