The difference between successful traders and those who blow their accounts often comes down to one crucial skill: risk management.

In the unforgiving world of forex trading, your ability on how to set stop loss and take profit in MT4 isn’t just important it’s absolutely essential for survival.

Every successful trader knows that managing risk is far more crucial than picking winners.

Whether you’re trading with $10 or $10,000, mastering stop loss and take profit settings in MT4 can make the difference between consistent profits and devastating losses.

Ready to transform your trading approach?

- WHAT ARE STOP LOSS AND TAKE PROFIT ORDERS?

- HOW TO SET STOP LOSS AND TAKE PROFIT IN MT4: STEP-BY-STEP GUIDE

- CALCULATING YOUR STOP LOSS AND TAKE PROFIT LEVELS

- PROFESSIONAL STOP LOSS STRATEGIES

- ADVANCED TIPS FOR MT4 RISK MANAGEMENT

- COMMON MISTAKES TO AVOID

- CAN YOU ADJUST STOP LOSS AND TAKE PROFIT LEVELS?

- RISK MANAGEMENT BEYOND STOP LOSSES

- MAXIMISING YOUR TRADING POTENTIAL

- CONCLUSION

WHAT ARE STOP LOSS AND TAKE PROFIT ORDERS?

Before diving into the mechanics, let’s get our bearings straight. A stop loss is your predetermined exit point when a trade moves against you.

Think of it as your trading insurance policy it automatically closes your position to prevent further losses.

A take profit order, on the other hand, is your victory lap. It automatically closes your trade when you’ve reached your profit target, ensuring you actually bank those gains instead of watching them evaporate.

These tools work together like a well-choreographed dance, protecting your capital whilst maximising your earning potential.

HOW TO SET STOP LOSS AND TAKE PROFIT IN MT4: STEP-BY-STEP GUIDE

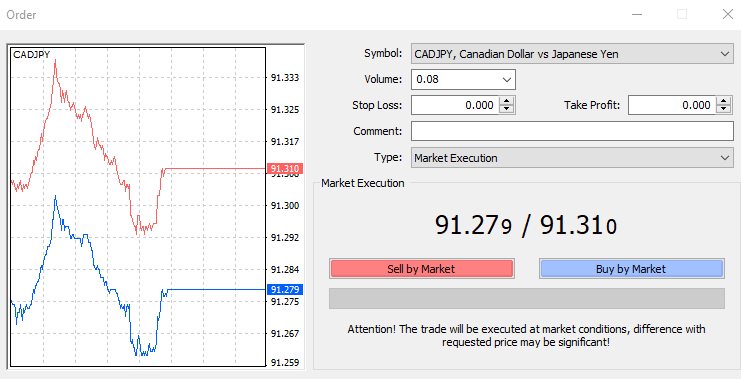

Method 1: Setting Orders When Opening a Trade

Step 1: Right-click on your chosen currency pair in the Market Watch window

Step 2: Select “New Order” from the context menu

Step 3: In the order window, you’ll see “Stop Loss” and “Take Profit” fields

Step 4: Enter your desired levels in pips or price points

Step 5: Click “Sell” or “Buy” to execute your trade with pre-set levels

Method 2: Adding Levels to Existing Trades

Step 1: Locate your open trade in the “Trade” tab at the bottom of your screen

Step 2: Right-click on the trade and select “Modify or Delete Order”

Step 3: Enter your stop loss and take profit levels in the respective fields

Step 4: Click “Modify” to apply the changes

Method 3: The Drag-and-Drop Method (Desktop Only)

This is where MT4 truly shines with its user-friendly interface:

Step 1: After placing your trade, you’ll see a green horizontal line indicating your entry level

Step 2: Move your cursor to this green line until it changes to a four-way arrow

Step 3: Click and hold, then drag upward or downward to create your stop loss and take profit lines

Step 4: Position the red line (stop loss) and blue line (take profit) at your desired levels

Step 5: Release to confirm your settings

Setting Stop Loss and Take Profit on MT4 Mobile

Trading on the go requires a slightly different approach. Here’s how to manage your risk using the MT4 mobile app:

For Android and iOS:

- Open your trade from the “Trade” tab

- Tap “Modify Trade”

- Use the horizontal line tool to mark your desired levels

- Copy the price level displayed

- Manually enter this value in the stop loss or take profit field

- Tap “Modify” to confirm

The mobile version doesn’t support drag-and-drop functionality, but this manual method ensures precision in your risk management.

CALCULATING YOUR STOP LOSS AND TAKE PROFIT LEVELS

Understanding the mathematics behind your risk management is crucial. Here’s how different lot sizes affect your profit and loss calculations:

Standard Calculations:

- 0.01 lots (micro lot): 1000 points = $10 profit/loss

- 0.1 lots (mini lot): 1000 points = $100 profit/loss

- 1 lot (standard lot): 1000 points = $1000 profit/loss

Important considerations:

- Always factor in spread costs

- Account for overnight swap fees on positions held beyond market close

- Consider currency pair volatility when setting distances

For those starting with smaller accounts, learning to trade Forex with as little as $10 requires particularly careful position sizing and risk management.

PROFESSIONAL STOP LOSS STRATEGIES

The 1% Rule

Professional traders swear by the 1% rule never risk more than 1% of your total account balance on a single trade. This approach involves:

- Large volume trades: Using tighter stop losses to maintain 1% risk

- Small volume trades: Allowing wider stop losses whilst keeping total risk at 1%

Support and Resistance Strategy

The most effective stop loss and take profit placements align with key market levels:

For Stop Losses:

- Place below support levels for long positions

- Position above resistance levels for short positions

- Allow for minor market noise and false breakouts

For Take Profits:

- Target the next significant resistance level for long trades

- Aim for the next support level for short trades

- Consider understanding market structure to identify optimal exit points

The Risk-Reward Ratio Approach

Professional traders typically aim for risk-reward ratios of 1:2 or better. This means:

- If you risk 50 pips, target at least 100 pips profit

- Maintain discipline even when trades move in your favour

- Adjust profit targets based on market conditions and volatility

ADVANCED TIPS FOR MT4 RISK MANAGEMENT

Trailing Stop Loss

Once your trade moves into profit, consider implementing a trailing stop:

- Right-click on your profitable trade

- Select “Trailing Stop”

- Choose your preferred trailing distance

- The system will automatically adjust your stop loss as profits increase

Multiple Take Profit Levels

Scale out of winning positions by:

- Closing partial positions at different profit levels

- Reducing risk as trades develop

- Maximising profits from strong trending moves

For traders exploring different platforms, comparing MT4 or MT5 for beginners can help determine which suits your trading style better.

COMMON MISTAKES TO AVOID

Setting Stops Too Close: Tight stops might seem safer, but they often get triggered by normal market fluctuations before your trade has a chance to develop.

Ignoring Market Structure: Placing stops at random levels instead of respecting key support and resistance zones is a recipe for unnecessary losses.

Moving Stops Against You: Never move your stop loss further away from your entry when a trade goes bad. This violates your original risk management plan.

Forgetting About Spreads: Always account for bid-ask spreads when calculating your actual risk and reward levels.

CAN YOU ADJUST STOP LOSS AND TAKE PROFIT LEVELS?

Absolutely! MT4 allows you to modify your levels at any time:

To adjust existing levels:

- Right-click on your open trade

- Select “Modify or Delete Order”

- Enter new stop loss or take profit values

- Click “Modify” to confirm changes

Best practices for adjustments:

- Only move stops in your favour (profit protection)

- Adjust take profits based on changing market conditions

- Use trailing stops to lock in profits automatically

For those implementing systematic approaches, exploring a very easy and profitable trading strategy on MT4 can provide structured methods for setting these levels.

RISK MANAGEMENT BEYOND STOP LOSSES

Position Sizing

Your lot size should reflect your risk tolerance:

- Never risk more than you can afford to lose

- Consider your account size when determining position sizes

- Factor in currency pair volatility and spread costs

Diversification

Don’t put all your eggs in one basket:

- Trade multiple currency pairs

- Avoid over-concentration in correlated pairs

- Spread risk across different trading sessions

Continuous Education

Stay informed about market conditions and how to know when a trade is ending to make better exit decisions.

MAXIMISING YOUR TRADING POTENTIAL

Understanding proper risk management opens doors to consistent profitability.

Many traders wonder how much you can make trading Forex, and the answer largely depends on how well you manage your downside risk.

For those working with established brokers, researching the Metatrader 5 brokers can provide additional platform options with enhanced risk management features.

CONCLUSION

Setting stop loss and take profit levels in MT4 isn’t just about clicking buttons it’s about developing a professional mindset that prioritises capital preservation.

Whether you’re using the desktop platform’s intuitive drag-and-drop functionality or manually entering levels on mobile, these tools are your first line of defence against market volatility.

Remember, successful trading isn’t about being right all the time; it’s about managing your risk when you’re wrong and maximising profits when you’re right.

Master these MT4 risk management techniques, and you’ll join the ranks of traders who consistently navigate the forex markets with confidence.

Ready to implement professional risk management in your trading?

Start by practising these techniques on a demo account, then gradually apply them to your live trading. Your future self will thank you for developing these crucial skills today.

What’s your biggest challenge with setting stop losses? Share your experience in the comments below and let’s discuss strategies that work in today’s markets.