The Volatility 75 index is one of the most volatile Deriv indexes and may be quite profitable if you understand how the market works.

Because of the index’s liquidity, many synthetic traders have inquired about how to make daily profit in volatility 75 index.

In reality, it is best to trade volatility 75 when there is a clear market setup, which implies that favorable market setups do not exist daily.

In this article, I will demonstrate the fundamental trading approach that will build your confidence for better market entry and lower risk, as well as provide references to my previous work so you can have all the information you need to profit from trading the volatility 75 index.

- HOW TO MAKE DAILY PROFIT IN VOLATILITY 75 INDEX

- VOLATILITY 75 INDEX CHART

- VOLATILITY 75 INDEX STRATEGY

- VOLATILITY 75 INDEX KILLER STRATEGY USING MT5 INDICATORS

- VOLATILITY 100 INDEX STRATEGY

- VOLATILITY 75 BOOKS

- MAKING MONEY TRADING VOLATILITY INDICES

- VOLATILITY 75 INDEX LOT SIZE CALCULATOR

- HOW DO YOU TRADE VOLATILITY 75 INDEX SUCCESSFULLY?

- WHAT IS THE BEST WAY TO TRADE VOLATILITY INDEX?

- WHAT IS THE BEST TIME TO TRADE VOLATILITY INDICES?

- HOW MUCH DO I NEED TO TRADE VOLATILITY 75?

- CONCLUSION

HOW TO MAKE DAILY PROFIT IN VOLATILITY 75 INDEX

There is no guarantee of daily profit in volatility 75 index because good setups don’t appear daily however you can be consistent in seeing good setup that will continuously grow your account.

You can find this set quickly on lower timeframes of volatility 75 index 5 minutes to 15 minutes.

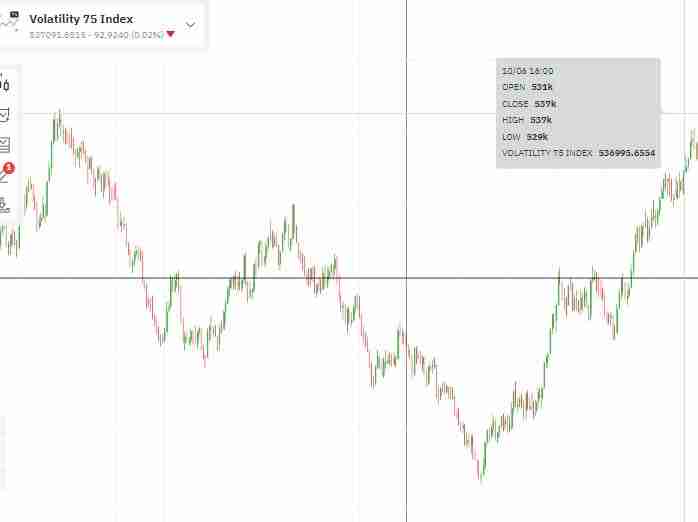

VOLATILITY 75 INDEX CHART

Volatility 75 index chart shows the price movement of V75 indices; in the chart, you will find all the needed tools for your trade analysis.

RELATED: HOW TO TRADE VOLATILITY 75 1S

VOLATILITY 75 INDEX STRATEGY

Every trader desires a profitable trading plan; when it comes to trading, different traders approach the market with different trading strategies.

Whatever trading technique a trader employs, understanding the principles of trading will offer you a superior advantage in developing a plan that works for you.

In my previous articles, I have written extensively on volatility 75 index strategies, , you can go read up.

VOLATILITY 75 INDEX KILLER STRATEGY USING MT5 INDICATORS

There are hundreds of MT5 indicators that you can combine to aid your trading decisions however if you want a volatility 75 index strategy that works then your first choice should be understanding market structure trading.

As I have discussed in my previous articles indicators such as moving averages and oscillators lag, which means their signals are late.

This is why the best volatility 75 index killer strategy will always remain how a trader can combine support and resistance, multiple time frame, trend line, Fibonacci tool and more.

All together identifying the dominant market trend is what you need for a successful volatility 75 strategy.

Below is a visual example of the use of market structure on Volatility 75 index.

VOLATILITY 100 INDEX STRATEGY

Volatility is another volatile index of Deriv and like every other instrument, it follows the market patterns.

Below is a visual example of volatility 100 index strategy using market structure trading.

VOLATILITY 75 BOOKS

In this volatility 75 book, you will find detailed information on how to trade volatility 75 using MT5 default tools such as trend lines, Fibonacci, and more.

MAKING MONEY TRADING VOLATILITY INDICES

To begin with, a lot of traders focus on making money trading volatility indices when their focus should be not losing money trading volatility indices.

Professional traders focus on not losing money and you should too; this will help you take only high-yield setups.

High-yield setups don’t appear every day when you do your analysis correctly using the fundamental principles of trading.

In conclusion, making money trading, volatility indices entails following the dominant trend with high-yield market structure setups.

VOLATILITY 75 INDEX LOT SIZE CALCULATOR

The volatility 75 index lot size calculator assists you in estimating the pip value in your trades so that you may manage your risk more effectively. Below are the most common frequently asked questions on how to make daily profit in Volatility 75 index:

HOW DO YOU TRADE VOLATILITY 75 INDEX SUCCESSFULLY?

To trade Volatility 75 index successfully you need to

1. Identify the dominant trend.

2. Wait for a pullback.

3. Use Fibonacci to retracement zones with support and resistance.

4. Use multiple timeframe analysis for entry.

WHAT IS THE BEST WAY TO TRADE VOLATILITY INDEX?

The best way to trade volatility index will always be market structure trading.

WHAT IS THE BEST TIME TO TRADE VOLATILITY INDICES?

The best time to trade volatility indices is at the break of the market structure pattern (on a lower timeframe) in the direction of the dominant trend.

HOW MUCH DO I NEED TO TRADE VOLATILITY 75?

Every trader has their style when it comes to trading so giving a fixed amount needed is difficult, for the record because of its volatility I will advise starting with about $500 paying attention to proper risk management.

CONCLUSION

To see a consistent profit on volatility 75 a trader must possess the right knowledge and know how to apply the basic principles of trading alongside proper risk management.

Leave a Reply