The pin bar trading strategy is one of the easiest to apply because of its unique candlestick pattern with a tail and a real body.

The forex market is full of opportunities, however, these opportunities are only visible to experienced traders who possess the right knowledge to identify them, when they appear.

As a forex technical analysis trader, to maximize your profit using a pin bar trading strategy or any trading strategy you must first understand price action and market structure.

IS PIN BAR A GOOD STRATEGY?

In my years of trading, I’ve learned that there are no good or poor trading strategies since traders approach the market differently.

What matters most is that you want to see consistent profit and growth in your account at the end of the day.

Having said that, here is why Pin Bar is a good strategy.

- The pin bar is easy to identify

- mostly formed on supply and demand zones

- forms on a single candlestick

- occurrences are medium

- give high-yield setup

PIN BAR TRADING STRATEGY

Pin bars trading strategy entails looking for trading opportunities in demand and supply zones, with the beginning of a pin bar candle pattern signifying a market reversal.

When paired with market structure knowledge, they are particularly reliable for predicting the near-term, and occasionally long-term, direction of price.

HOW DO YOU USE THE PIN BAR STRATEGY?

If you are reading this, I guess you have heard about Pin bars and you are not sure how to properly use them. Well, read on as I will show you what you need most to use Pin bar strategy.

The only thing you need to learn about pin bar strategy is that it works along with price action and market structure.

MARKET STRUCTURE

Let me explain: Forex technical analysis is defined by market structure and since the pin bar is a candlestick pattern and aligns with supply and demand zones, then the best way to use the pin bar strategy will be to understand market structure.

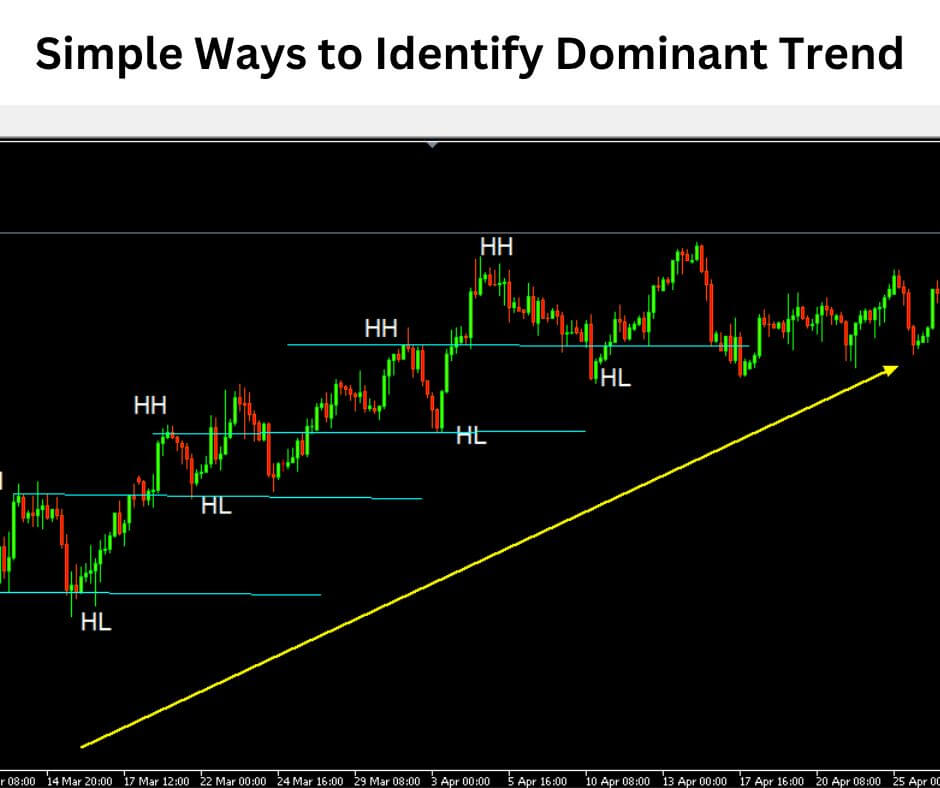

Market structure is everything with pin bar strategy, in it, you will find, supply and demand, support and resistance, order blocks, and higher highs and lows. Etc.

This is why market structure is essential to have a successful pin bar strategy.

That being said, before you perfect any pin bar trading strategy, learn about market structure.

HOW DO YOU TRADE WITH PIN BAR?

Without wasting your time, let me go straight to the point, pin bars are best traded in supply and demand zones, where they are possible reversals as big banks and institutions are interested in those supply and demand areas.

Pin bars are also best taken on higher timeframes.

PIN BAR CANDLE MEANING

The pin bar candle is a reversal pattern that signals that the market has rejected the price at a specific price level. It is one of the most easily identified candlestick patterns on Forex charts.

It is produced on a single candle.

When a pin bar appears on a Forex chart, it indicates a possible change in the dominant trend.

The best pin bars can be found in supply and demand zones on higher timeframes.

DO PIN BARS IN FOREX FAIL

If you’ve read any of my previous articles, you’ll know that no forex trading strategy should be used in isolation.

All market dynamics should be used in conjunction to provide a strong and certain direction for the domination trend.

Market structure and technical analysis can summarize all of these market forces.

For example, if you combine supply and demand with the pin bars strategy, you will identify numerous high-yield setups.

To answer your question, pin bars in forex only fail when utilized independently.

CONCLUSION

Whatever trading technique you choose as a forex trader, keep in mind that basic principles such as market structure and price movement are unavoidable because they constitute the cornerstone of a successful trader.

In all my years of trading, I have yet to come across a successful forex trader who does not comprehend the forex market structure.

It’s time to ditch the sophisticated lagging indicators and focus on real-time market prices.

Say goodbye to trailing indicators and yes to naked trading, the Fibonacci tool, trend lines, and chart patterns, among other things.

Leave a Reply