Volatility, Boom, and Crash indices are all more than one on the Deriv platform, but the Step index is the only standalone synthetic index.

The step index is unique in its design because a price series with a fixed step size of 0.1 has an equal probability of moving up or down.

Before learning how to trade step index, you should understand that it moves differently than other Deriv synthetic indices.

Whatever the movement pattern, it is still consistent with the principles of a trading market structure.

- WHAT IS STEP INDEX TRADING?

- DERIV REAL ACCOUNT SIGN UP

- HOW TO TRADE STEP INDEX

- STEP INDEX BROKERS

- WHAT IS STEP INDEX IN FOREX?

- WHAT MOVES THE STEP INDEX

- STEP INDEX ANALYSIS

- STEP INDEX DERIV

- STEP INDEX SYMBOL

- WHAT IS STEP INDEX BINARY?

- STEP INDEX STRATEGY

- STEP INDEX ONE MINUTE STRATEGY

- STEP INDEX INDICATORS

- STEP INDEX CHART

- STEP INDEX TRADINGVIEW

- STEP INDEX MT4

- WHAT IS THE BEST TIME TO TRADE STEP INDEX?

- HOW DO YOU ANALYZE STEP INDEX?

- HOW DO YOU TRADE FOREX ON DERIV?

- CAN I TRADE INDICES ON MT4?

- HOW DO I MAKE A TRADE CHECKLIST?

WHAT IS STEP INDEX TRADING?

Step index trading is Deriv’s proprietary synthetics indices that simulate real-world market movements.

Backed by a cryptographically secure random number generator, these indices are available to trade 24/7 and are unaffected by regular market hours, global events, or market and liquidity risks.

With these indices, there is an equal probability of up/down movement in a price series with a fixed step size of 0.1.

DERIV REAL ACCOUNT SIGN UP

Deriv real accounts sign-up is where you register as a client to trade any financial instrument of your choice.

HOW TO TRADE STEP INDEX

There are fundamentals of trading that will always be consistent with all trading instruments if you pay attention, you will see it.

Step index is not excluded; with that in mind, this is how to trade step index;

- Identify the dominant trend

- Wait for a retracement on a support or resistance zone (use default tools to mark zones)

- Join the dominant trend on the zone on a lower timeframe with a market structure breakout (chart pattern).

STEP INDEX BROKERS

At the time of writing this article, there is only one broker that offers step index, that broker is Deriv.

Deriv Synthetic step index are designed to mimic real-world market movements.

These indices, which are supported by a cryptographically secure random number generator, are available for trading 24 hours a day, seven days a week, and are unaffected by regular market hours, global events, or market and liquidity risks.

WHAT IS STEP INDEX IN FOREX?

Step index is not in forex, step index in trading is a unique Deriv trading instrument offered only by Deriv broker.

With these indices, a price series with a fixed step size of 0.1 has an equal chance of moving up or down.

Step indices are available for trading around the clock, including on weekends and holidays, and they are unaffected by market hours and world events.

WHAT MOVES THE STEP INDEX

Step index is moved by pure price action and market structure since it is not affected by market hours or global events.

STEP INDEX ANALYSIS

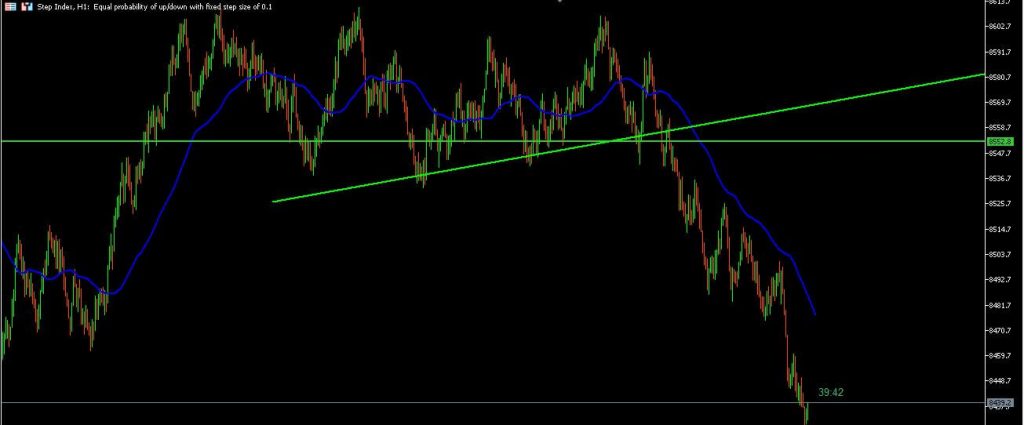

A proper step index analysis involves looking at the market from a higher time frame while applying a price action strategy with top-down analysis to know the underlying dominant trend.

Below is a live image of step index analysis.

STEP INDEX DERIV

Step index Deriv is a proprietary synthetics index that simulates real-world market movements.

Backed by a cryptographically secure random number generator, these indices are available to trade 24/7 and are unaffected by regular market hours, global events, or market and liquidity risks.

STEP INDEX SYMBOL

Step index symbol is step index, it is a standalone indices.

WHAT IS STEP INDEX BINARY?

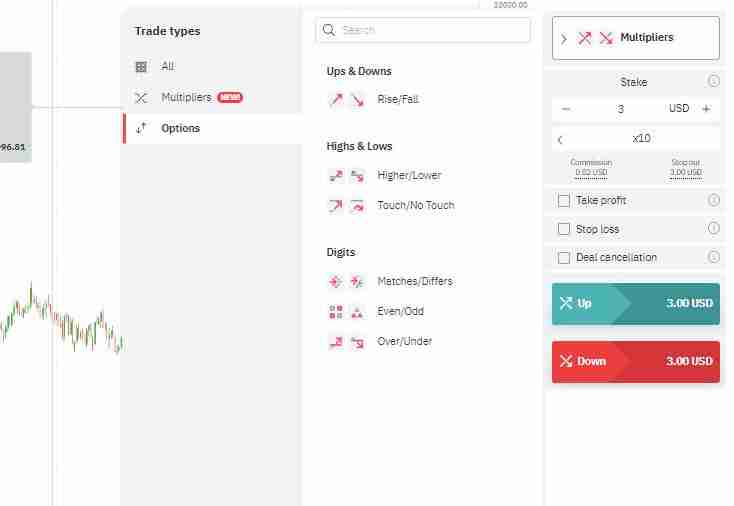

Step index binary is different from regular step index trading. In step index binary you have the option to choose ups & downs, highs & lows.

STEP INDEX STRATEGY

There is a proverb that says ‘“If you give a man a fish, you feed him for a day. If you teach a man to fish, you feed him for a lifetime”

Many traders have missed the point of trading, they spend countless hours searching for the ultimate trading strategy, in the case of step index strategy what they should be focused on it’s the system that births all trading strategies.

Yes, the strategy above all is market structure trading, if you want to be a master at trading step index, then learning market structure is inevitable.

The market structure covers both long and short-term trading strategies.

With market structure, you can identify order block, support and resistance, dominant trend, retracements, chart patterns, and more.

In conclusion, a good step index strategy is beyond indicators; it is of pure price action in real-time.

STEP INDEX SCALPING STRATEGY

There are three important factors and one Exponential moving average you need for a step index scalping strategy:

A trending market on a higher timeframe

Wait for consolidation and retracement

Market entry on a lower time frame.

Exponential moving average 55.

A TRENDING MARKET ON A HIGHER TIMEFRAME

Scalping is more stable in Deriv synthetic indices than conventional currency trading because these indices like step index are not affected by global events.

That being said to have a successful step index scalping strategy, first, you must be patient for a trending market on a higher timeframe. (H4, H1, 30M).

WAIT FOR CONSOLIDATION AND RETRACEMENT

After a market trend, the next move will be to wait for a market consolidation and retracement for a trend continuation.

MARKET ENTRY ON LOWER TIMEFRAME

This is where you place trades, on lower timeframes.

You will identify a market structure here that supports the dominant trend.

This process repeats itself until the market reaches a reversal zone.

Below are images identifying the H1 dominant trend and 15-minute scalping market entry.

STEP INDEX ONE MINUTE STRATEGY

This successful one-minute step index strategy is going to reveal to you requires only one exponential moving average and the use of market structure.

Exponential moving average 55

Find the dominant trend on a higher timeframe (30M and H1)

Identify chart pattern market structure on 1M that supports the dominant trend.

STEP INDEX INDICATORS

Just like trading forex, step index indicators can be seen on MT5 platforms and any other trading platform step index is traded.

BEST INDICATOR FOR STEP INDEX

When trading, there are hundreds of indicators to choose from. However, saying that there is one best indicator for step index trading is not ideal because every trader approaches the market differently.

One thing is certain: whatever indicator you use in your trading will always be subject to market structure.

Furthermore, indicators lag and do not provide real-time market prices, which is why they should be used in conjunction with multiple timeframe analysis, market structure, and other standard trading tools such as Fibonacci.

Ultimately, there is no best indicator for step index trading, for the record I use EMA 50 for my entries after market analysis.

STEP INDEX CHART

The step index chart shows the history and real-time prices of step index on the Deriv platform. On the step index chart, you will find all the default tools needed for trading.

The step chart like all trading chart has a lower time to a higher timeframe and all the default indicators that a trader needs for market analysis.

Step index is available only on MT5.

STEP INDEX TRADINGVIEW

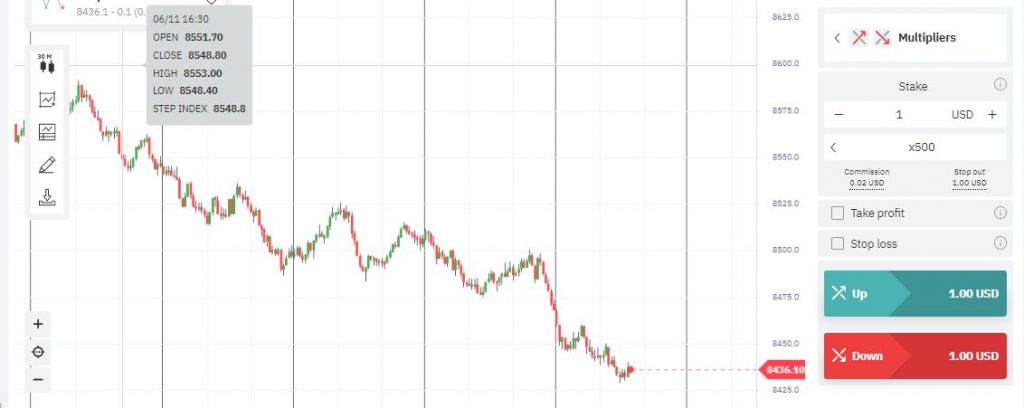

Step index can also be traded on trading view using the web Deriv platform.

The step index trading view on Deriv platform shows a clear market price staking up or down with multipliers.

All these can be seen on the web version. See image below :

STEP INDEX MT4

Step index is not available on MT4, you can trade step index on MT5 and the Web view version only in Deriv broker.

~ forexbrainbox

WHAT IS THE BEST TIME TO TRADE STEP INDEX?

Step index can be traded at any time as long as it provides a good entry setup because step index has constant liquidity, it can be traded at any time.

There will always be a market setup across all timeframes; this setup is consistent because there is no sudden global event that disrupts the organic market trend.

In conclusion, the best time to trade step index is when you identify a clear market setup. This is the best way to trade step index.

To know more about market setup read up market structure.

HOW DO YOU ANALYZE STEP INDEX?

To analyze step index you have to start from the higher timeframe to the lower timeframe (top-down analysis) this will enable identify the dominant trend to make a trade decision.

HOW DO YOU TRADE FOREX ON DERIV?

Trading on Deriv is easy, all you have to do is open an account and you can start trading Demo or Live (after funding).

CAN I TRADE INDICES ON MT4?

Yes, you can trade indices on MT4 with brokers that offer Indices on MT4.

HOW DO I MAKE A TRADE CHECKLIST?

To create a trade checklist, list a series of principles and trade confirmations to look for before entering a trade.

Example of trade checklist;

1) Identify the dominant trend on a higher timeframe.

2) Wait for a retracement to a previous resistant or support zone.

3) Join the dominant trend from a lower time frame with a trade confirmation structure pattern when the price reaches support or resistance zone.