Boom and Crash are distinctive indices exclusive to Deriv, available for trading only to registered traders.

The dynamic movements of these indices have prompted questions and discussions among traders, particularly regarding strategies on how to trade spikes on the Boom and Crash index.

It’s a widely recognized truth among Deriv traders that being able to predict when a spike is imminent on the Boom index or a drop on the Crash index could significantly transform their trading experience.

Traders must keep in mind that, while there’s no Holy Grail strategy applicable to trading any financial instrument, there exists a potential, to some extent, to forecast boom and crash spikes.

However, achieving this requires a solid understanding of rally base rally and drop base drop patterns.

CATCHING SPIKES ON BOOM AND CRASH

Many Deriv synthetic traders want to be able to catch spikes on Boom and Crash, but they refuse to pay attention to what matters in trading.

If you want to succeed in catching spikes on Boom and Crash then, here is a list of things you should understand.

- Market Bias (dominant trend from higher timeframe)

- rally base rally and drop base drop

- Top down analysis

- Structural formation and breakout.

A proper combination of the above will help you predict with high accuracy when a spike or drop is about to happen on Boom and Crash respectively.

RELATED: HOW TO FIND BOOM AND CRASH ON TRADINGVIEW

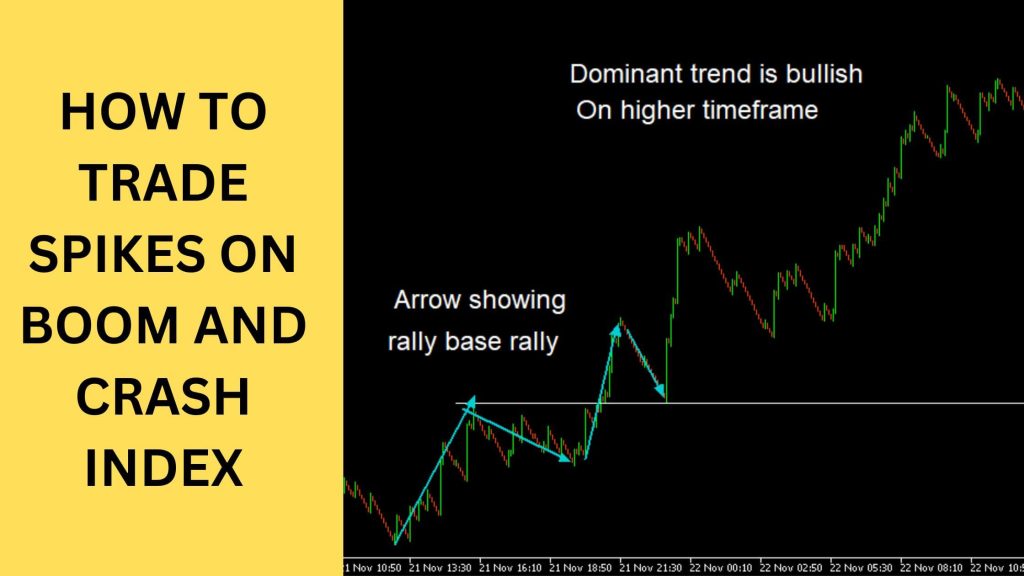

HOW TO TRADE SPIKES ON BOOM AND CRASH INDEX

If you want to know how to trade spikes on Boom and Crash index, you need a good understanding of rally base rally and drop base drop.

I have traded the Boom and crash market for years and I see that it follows the same pattern as when trading currencies.

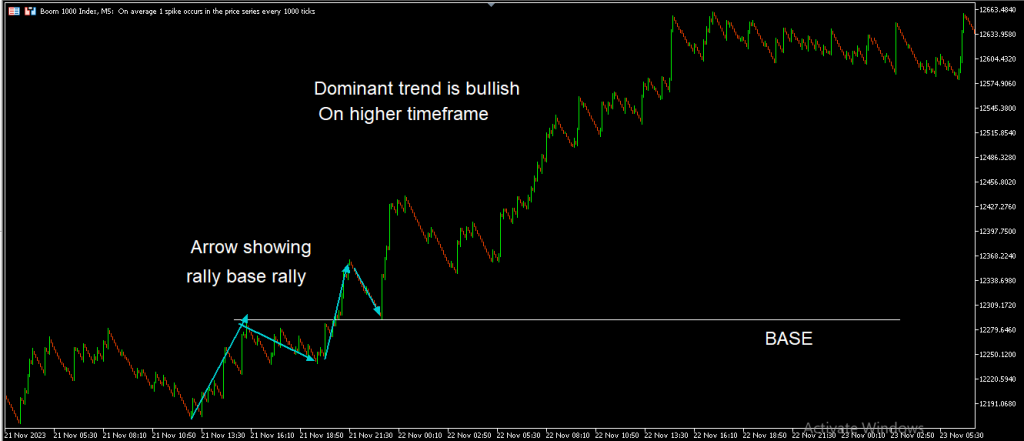

See the live Image example below of what I mean by using rally base rally, drop base drop.

HOW DO YOU CATCH SPIKES ON BOOM AND CRASH INDEX

One common mistake I see many Boom and Crash traders make is looking at lower timeframes alone. When they should be looking at more than one time frame, this is called multiple timeframe analysis.

Multiple time frame analysis on boom and crash trading allows the trader to see the market from a larger perspective, which means a trader, can see the highs and lows of the market which will lead to better decision making.

To put it in simple terms, understand the fundamentals of rally base rally and drop base drop and let it align with the market dominant trend.

See the image live example above.

BOOM AND CRASH SPIKE DETECTOR

I’ve emphasized to fellow traders that if there truly existed a reliable boom and crash spike detector, everyone would be profiting.

The reality is the search for an effective boom and crash spike detector should center on market structure patterns, such as the rally base rally.

As a trader, delving into an understanding of these patterns allows you to recognize the repetitive nature of these structures over time, thereby allowing you to be your boom spike detector without the use of any custom indicator.

In conclusion, go learn the secret to boom and crash trading on my YouTube channel.

CAN YOU TRADE BOOM AND CRASH WITH $1?

No, you cannot trade boom and crash with $1, you cannot trade any financial instrument with $1.

To successfully trade any financial instrument, you need a substantial amount of trading capital to easily apply any trading strategy.

In my trading experience, I would recommend that you have a minimum of $100 as a startup capital for your trading or begin with $10 as a beginner, especially with boom and crash.

BOOM AND CRASH SPIKE STRATEGY

Many Deriv synthetic traders are looking for that one Boom and crash spike strategy that works every time.

To effectively have a boom and spike strategy, you cannot ignore the understanding of rally base rally, and drop base drop as it is an essential part of trading boom and crash.

This concept cuts across all time frames and trading instruments. With this concept, you will find repeated patterns.

Note that this rally base rally, drop base drop should align with the dominant trend.

See the live Image example above.

WHAT IS THE BEST STRATEGY FOR CATCHING SPIKES ON BOOM AND CRASH

In reality, there are no best strategies for catching spikes on Boom and crash, if you want to catch spikes on Boom and crash, you must pay attention to the fundamentals of trading.

These fundamentals are:

- Identifying the dominant trend (market Bias)

- Rally base rally and drop base drop

- Supply and demand

In this article above you will find information that expands on catching spikes on Boom indices and drops on crash indices.

Leave a Reply