The Pin Bar candlestick pattern is a widely recognized and powerful tool in technical analysis, providing valuable insights into market sentiment and potential price reversals.

Traders and investors often turn to this distinctive formation to gain a deeper understanding of market dynamics.

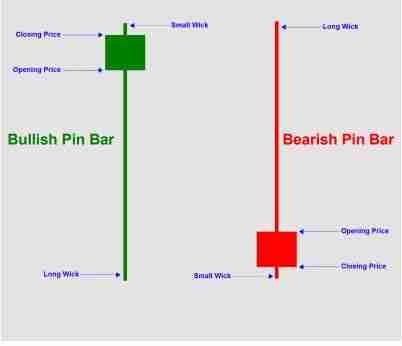

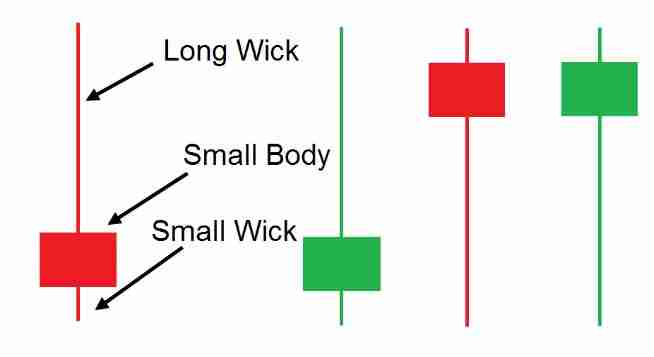

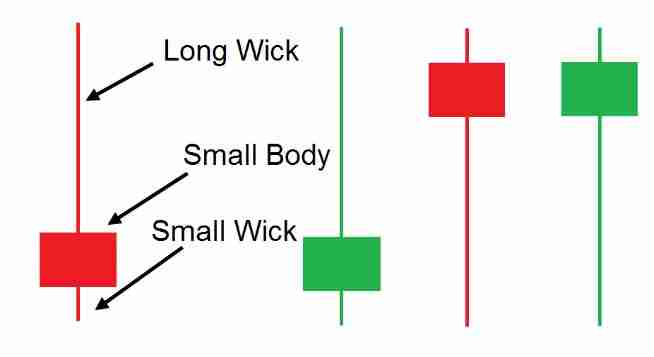

Characterized by its distinct shape— a single candle with a small body and a long tail or wick on one side—the Pin Bar signifies potential shifts in price direction.

Its formation at key support or resistance levels can indicate impending market reversals, making it a crucial tool for decision-making.

By understanding the nuances of the Pin Bar candle pattern, traders can enhance their ability to identify favorable entry and exit points, contributing to more informed and profitable trading strategies.

IS A PIN BAR BULLISH OR BEARISH?

In either a bullish or bearish market, a pin bar might form. The bottom of a sustained bearish trend is typically where the bullish pin bar forms.

These bearish pin bars typically appear at levels of support. When this occurs, the market’s primary trend shifts from bearish to bullish.

And it is quite the opposite for pin bar formation at a resistance level.

RELATED: PIN BAR REVERSAL

RELATED: PIN BAR TRADING STRATEGY

PIN BAR CANDLESTICK

Pin bar candlestick has a long tail, and a short body, it is easy to spot and it is best employed at the peak of a trending market since it signals a sharp reversal in the main trend because the price has been rejected at a given point.

WHAT DOES A BULLISH MEAN?

A bullish Pin bar indicates that lower prices have been rejected.

The lower wick of the pin bar candle indicates that the bears were in charge earlier but were eventually defeated by the bulls. The best bullish pin bar formations occur at support levels.

PIN BAR PATTERN

Of all the candle stick patterns, the pin bar is easily identified. The pin bar candle can be seen across timeframes and it can be formed in a bearish or bullish market.

It is formed in a single candle. When formed it indicates a string rejection in price at that level, lower or higher.

THE BEST TIME TO TRADE PIN BAR

Pin bars are powerful market setups, but not all pin bars are profitable. For this reason, the optimum time to trade pin bar candles is at significant support and resistance levels in higher timeframes.

By doing this, you can narrow your attention to setups with a high chance and moderately frequent occurrences.

IS PIN BAR A GOOD STRATEGY?

This is a critical question that forex traders frequently ask.

For the record, there are no perfect strategies for trading the forex market because market behavior changes due to trader sentiments and worldwide activity; yet, price action and market structure remain consistent.

To address your question, using a pin bar in conjunction with market structure and price action concepts is a good strategy. For instance, where or when is the ideal time to trade a pin bar?

Another idea would be to consider whether a pin would work better at a lower or higher timeframe. You can trade the best of pin bar setups by answering these questions.

In conclusion, any trading strategy including a pin bar would work well when you understand price action and market structure. Keep reading below you will find the best time to trade pin bar when they are formed.

HAMMER PIN BAR

The hammer pin bar is a unique candlestick pattern that indicates a price rejection; it can be bullish or bearish. It is known for its long tail and small real body.

PIN BAR VS HAMMER

There is no difference between a pin bar and a hammer. However, the Hammer pattern is a bullish candlestick pattern that signals a trend reversal.

TYPES OF CANDLESTICK

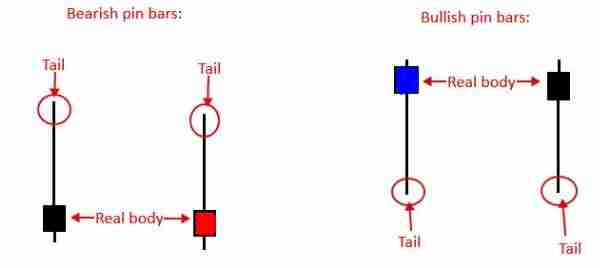

There are two types of pin bar candlestick. The bullish and Bearish pin bar

- BULLISH PIN BAR

It has a long lower wick, a small candle body, and a little higher wick.

- BEARISH PIN BAR

It has a long upper wick, a small candle body, and a short lower wick.

BEARISH CANDLESTICK

A bearish pin bar candlestick signal has a lengthy upper tail, indicating a quick rejection of higher prices with the implication that prices will drop shortly.

In simple terms, a bearish pin bar is formed when buyers start the session and are in control, but the price reaches a level that is quickly rejected, and sellers take over and dominate the rest of the session, closing out at a lower price.

FAKE CANDLESTICK

Fake pin bar candlesticks are failed patterns since they do not form at multiple levels of support and resistance and should be avoided.

Many failed pin bar setups may be found on the Forex chart. Having stated that your best pin bars will be found in concentrated locations of multiple support and resistance.

CONCLUSION

One thing to remember is that pin bars are not traded in isolation; for a successful outcome, a good pin bar setup must correlate with other technical trading techniques.

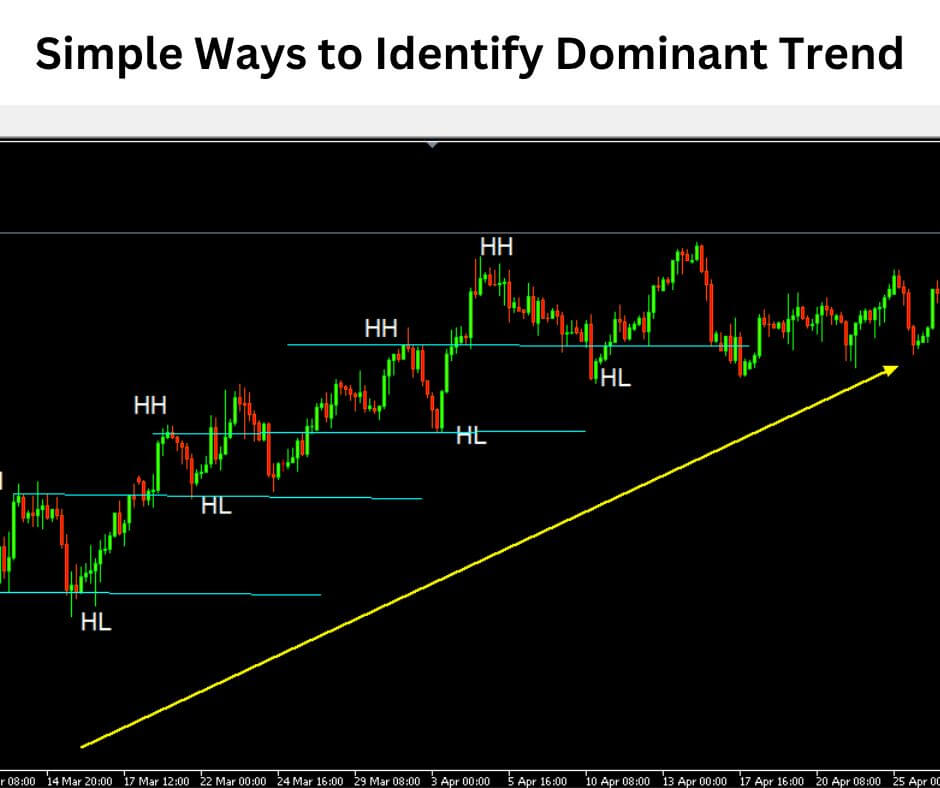

At the end of the day, in all you get, get an understanding of market structure.

Leave a Reply