You’ve just spotted the perfect trade setup. The charts are screaming “buy,” your analysis is spot-on, and you’re ready to pull the trigger.

But there’s one crucial question that could make or break your trading account—what lot size should you use?

Getting your lot size wrong is like wearing a perfectly tailored suit that’s three sizes too big. It might look the part from a distance, but up close, it’s a disaster waiting to happen.

Your lot size isn’t just a number; it’s your lifeline in the volatile world of Forex trading.

- WHAT EXACTLY IS A LOT SIZE IN FOREX?

- RECOMMENDED LOT SIZE FOREX FOR DIFFERENT ACCOUNT SIZES

- HOW TO CALCULATE LOT SIZE IN FOREX: THE MATHEMATICAL APPROACH

- BEST LOT SIZE FOR SPECIFIC ACCOUNT AMOUNTS

- FOREX LOT SIZE AND LEVERAGE: THE DOUBLE-EDGED SWORD

- FOREX LOT SIZE CALCULATOR: YOUR BEST MATE

- ADVANCED LOT SIZING STRATEGIES

- COMMON LOT SIZING MISTAKES (AND HOW TO AVOID THEM)

- RISK MANAGEMENT: THE LOT SIZE CONNECTION

- PSYCHOLOGICAL ASPECTS OF LOT SIZING

- TECHNOLOGY AND LOT SIZE MANAGEMENT

- REGULATORY CONSIDERATIONS

- BUILDING YOUR PERSONAL LOT SIZING STRATEGY

- THE FUTURE OF LOT SIZING

- CONCLUSION: SIZE MATTERS IN FOREX

WHAT EXACTLY IS A LOT SIZE IN FOREX?

Before we dive into recommendations, let’s establish what we’re actually talking about. A lot size in Forex represents the unit of measurement for trading.

Think of it as the “serving size” of your trade—too small and you won’t see meaningful profits, too large and you could blow your account faster than you can say “margin call.”

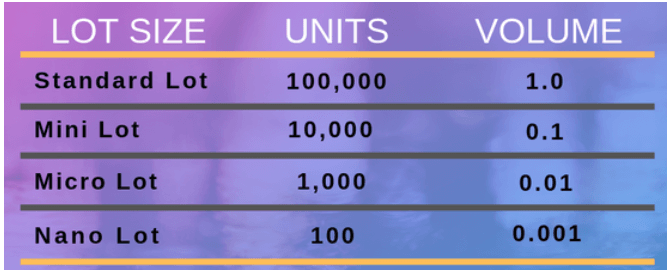

The four main types of lot sizes are:

Standard lot: 100,000 units (1.0 lot)

Nano lot: 100 units (0.001 lot)

Micro lot: 1,000 units (0.01 lot)

Mini lot: 10,000 units (0.1 lot)

RECOMMENDED LOT SIZE FOREX FOR DIFFERENT ACCOUNT SIZES

Here’s where the rubber meets the road. Your lot size should never be a wild guess it should be a calculated decision based on your account size, risk tolerance, and trading strategy.

Small Accounts ($100 – $500)

If you’re starting with a modest account, your lot size should reflect that reality. For accounts between $100-$500:

- Recommended lot size: 0.01 to 0.03

- Maximum risk per trade: 2-3% of account balance

- Pip value: $0.10 to $0.30 per pip (for major pairs)

Why this matters: With a $200 account using 0.02 lots, a 20-pip loss equals $4 manageable and within proper risk parameters.

Medium Accounts ($500 – $5,000)

This is where things get interesting. You have more breathing room, but discipline becomes even more critical:

- Account size $500: 0.03-0.05 lot size

- Account size $1,000: 0.05-0.10 lot size

- Account size $2,500: 0.10-0.25 lot size

- Account size $5,000: 0.20-0.50 lot size

For a beginner in the Forex market, sticking to the lower end of these ranges is crucial while you’re still learning the ropes.

Larger Accounts ($5,000+)

With substantial capital comes the temptation to go big. Resist it. Professional traders often use smaller position sizes relative to their account than beginners expect:

- $5,000 account: 0.30-0.40 lot maximum per trade

- $10,000 account: 0.50-1.00 lot maximum per trade

- $20,000+ accounts: 1.00-2.00 lots maximum per trade

HOW TO CALCULATE LOT SIZE IN FOREX: THE MATHEMATICAL APPROACH

Calculating your ideal lot size isn’t rocket science, but it does require some basic maths. Here’s the formula that professional traders swear by:

Lot Size = (Account Balance × Risk Percentage) ÷ (Stop Loss in Pips × Pip Value)

Let’s break this down with a real example:

- Account balance: $2,000

- Risk per trade: 2% ($40)

- Stop loss: 50 pips

- Trading EUR/USD (pip value for 0.01 lot = $0.10)

Calculation: ($40) ÷ (50 × $0.10) = $40 ÷ $5 = 0.08 lots

This mathematical approach removes emotion from the equation and keeps you trading within your means.

BEST LOT SIZE FOR SPECIFIC ACCOUNT AMOUNTS

Trading with a $10 Account

Let’s address the elephant in the room trading with a $10 account. While it’s technically possible, it’s like trying to drive a Ferrari with a lawnmower engine. Here’s the harsh reality:

- Maximum lot size: 0.001 (nano lot)

- Risk per trade: $0.20-$0.30 maximum

- Stop loss range: 20-30 pips maximum

- Realistic expectations: This is practice money, not profit money

Pro tip: Use these tiny accounts for learning, not earning. Focus on developing your skills rather than growing the balance.

Best Lot Size for $1,000

A $1,000 account gives you proper room to breathe:

- Conservative approach: 0.05-0.07 lots

- Moderate approach: 0.08-0.10 lots

- Aggressive approach: 0.12-0.15 lots (not recommended for beginners)

Best Lot Size for $5,000

This is where Forex trading starts to feel “real”:

- Multiple trade strategy: 0.20-0.30 lots per trade

- Single trade focus: 0.40-0.50 lots maximum

- Risk management: Never exceed 2% risk per trade

FOREX LOT SIZE AND LEVERAGE: THE DOUBLE-EDGED SWORD

Leverage amplifies both your profits and losses it’s the nitrous oxide of Forex trading. Understanding how lot size interacts with leverage is crucial:

High Leverage (1:500, 1:1000)

- Allows larger lot sizes with smaller deposits

- Increases risk exponentially

- Suitable only for experienced traders

Moderate Leverage (1:50, 1:100)

- Provides reasonable flexibility

- Manageable risk levels

- Ideal for most retail traders

Low Leverage (1:10, 1:30)

Maximum safety for capital preservation

Conservative approach

Reduced profit potential

FOREX LOT SIZE CALCULATOR: YOUR BEST MATE

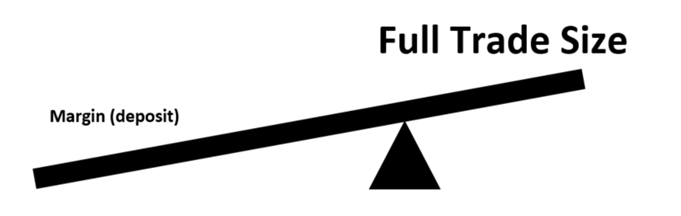

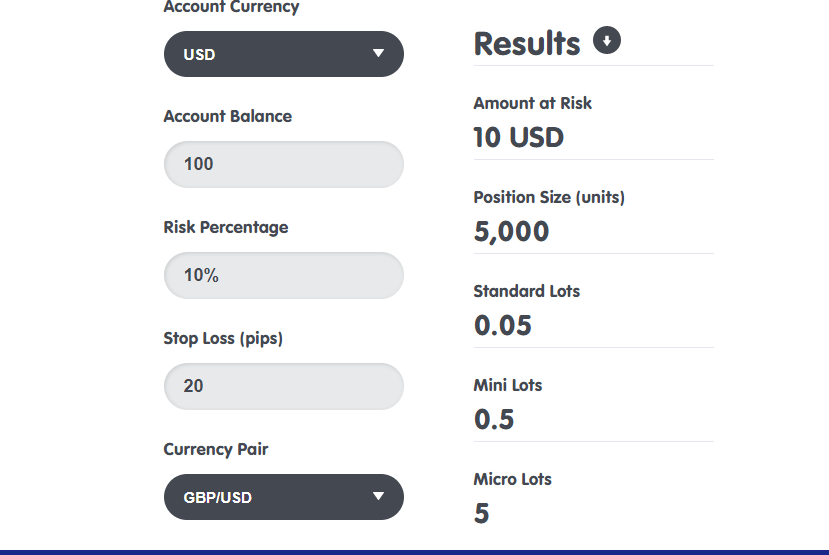

Manual calculations can be tedious and error-prone. Babypips.com offers an excellent lot size calculator that does the heavy lifting for you. Simply input:

- Account currency

- Account balance

- Risk percentage

- Stop loss in pips

- Currency pair

The calculator instantly provides your optimal lot size, removing guesswork from the equation.

ADVANCED LOT SIZING STRATEGIES

The Fixed Fractional Method

Risk a fixed percentage (typically 1-2%) of your account on each trade, adjusting lot size accordingly as your account grows or shrinks.

The Fixed Dollar Method

Risk the same dollar amount on each trade regardless of account size. Simple but less flexible than percentage-based methods.

The Volatility-Adjusted Method

Adjust lot sizes based on market volatility—smaller positions during high volatility periods, larger during calm markets.

COMMON LOT SIZING MISTAKES (AND HOW TO AVOID THEM)

Mistake #1: Using the same lot size regardless of account balance

- Solution: Always calculate position size relative to current account balance

Mistake #2: Ignoring correlation between pairs

- Solution: Reduce lot sizes when trading correlated pairs simultaneously

Mistake #3: Increasing lot sizes after losses

- Solution: Stick to your predetermined risk management rules

Mistake #4: Going “all in” on high-confidence trades

- Solution: No trade is 100% certain—maintain consistent position sizing

RISK MANAGEMENT: THE LOT SIZE CONNECTION

Your lot size is the cornerstone of risk management. Here’s how the pros approach it:

The 2% Rule: Never risk more than 2% of your account on a single trade.

The 6% Rule: Never have more than 6% of your account at risk across all open positions.

The Pyramid Rule: Reduce lot sizes as you add to winning positions.

PSYCHOLOGICAL ASPECTS OF LOT SIZING

Trading psychology and lot sizing are intimately connected. Using proper lot sizes helps you:

- Sleep better at night

- Make rational decisions under pressure

- Avoid revenge trading after losses

- Maintain consistent performance

The comfort test: If your lot size makes you nervous, it’s probably too large.

TECHNOLOGY AND LOT SIZE MANAGEMENT

Modern trading platforms offer sophisticated tools for lot size management:

- Position size calculators built into trading platforms

- Risk management EAs (Expert Advisors) for automated position sizing

- Mobile apps for quick lot size calculations on the go.

REGULATORY CONSIDERATIONS

Different jurisdictions have varying rules about leverage and position sizing:

EU regulations: Maximum leverage of 1:30 for major pairs (retail clients).

US regulations: Maximum leverage of 1:50.

Offshore brokers: Often offer higher leverage but with increased risks.

BUILDING YOUR PERSONAL LOT SIZING STRATEGY

Creating your lot sizing strategy involves several steps:

- Assess your risk tolerance honestly

- Determine your trading style (scalping, day trading, swing trading)

- Calculate your maximum comfortable loss per trade

- Test your strategy on a demo account first

- Refine and adjust based on real-world performance

THE FUTURE OF LOT SIZING

As technology evolves, lot sizing is becoming more sophisticated:

- AI-powered position sizing based on market conditions

- Dynamic lot sizing that adjusts to volatility in real-time

- Social trading platforms that copy professional lot sizing strategies

CONCLUSION: SIZE MATTERS IN FOREX

Your lot size isn’t just a technical detail it’s the foundation of your trading success.

Like a master tailor crafting the perfect suit, choosing the right lot size requires precision, patience, and a deep understanding of what fits your unique situation.

Remember, even the most brilliant trading strategy can be derailed by poor position sizing.

Start conservative, focus on preservation of capital, and let your account grow naturally through consistent, well-sized trades.

Ready to take your Forex trading to the next level? Start by recalculating your lot sizes using the methods outlined in this guide. Your future self (and your trading account) will thank you for the discipline you show today.