Ever wondered why some traders seem to profit consistently while others struggle with unpredictable market swings?

The secret might lie in a trading instrument that operates completely differently from traditional markets.

While most traders battle weekend gaps, news volatility, and market closures, there’s a select group capitalizing on a market that runs 24/7 with mathematically predictable patterns.

Synthetic indices have revolutionized trading for retail investors who’ve grown tired of waiting for the “perfect” market conditions.

Unlike traditional markets that close for weekends and holidays, synthetic indices like Boom 1000 operate 24/7, offering traders unlimited opportunities to capitalize on predictable price movements.

But here’s the kicker—not all brokers offer these synthetic gems, and finding the right Boom 1000 index brokers can make or break your trading career.

What if I told you there’s a specific pattern that occurs exactly once every 1000 ticks that smart traders are already exploiting?

- WHAT ARE BOOM 1000 INDEX BROKERS?

- WHAT BROKER OFFERS BOOM 1000 INDEX?

- IS BOOM 1000 INDEX PROFITABLE?

- HOW TO ANALYSE BOOM 1000 INDEX

- BOOM 1000 VS OTHER SYNTHETIC INDICES

- VOLATILITY INDICES TRADING STRATEGIES

- BEST PRACTICES FOR BOOM 1000 TRADING

- PLATFORM REQUIREMENTS AND SETUP

- GETTING STARTED WITH DERIV BROKER

- ADVANCED TRADING TECHNIQUES

- FUTURE OF SYNTHETIC INDICES TRADING

- CONCLUSION

WHAT ARE BOOM 1000 INDEX BROKERS?

Boom 1000 index brokers are financial service providers that offer access to synthetic indices, specifically the Boom 1000 index.

These aren’t your typical forex brokers they’re specialists in algorithmically-generated markets that simulate real trading conditions without the unpredictability of external economic factors.

The Boom 1000 index is a synthetic instrument designed to experience one significant price spike (boom) on average every 1000 ticks.

This predictable volatility pattern makes it attractive to traders who prefer technical analysis over fundamental analysis.

Key Characteristics of Boom 1000 Index:

Consistent Volatility: Maintains steady trading opportunities

24/7 Trading: Never closes, unlike traditional markets

Predictable Patterns: One bullish spike per 1000 ticks on average

Pure Technical Analysis: Unaffected by news or economic events

Low Capital Requirements: Suitable for small account holders.

WHAT BROKER OFFERS BOOM 1000 INDEX?

Currently, Deriv Broker stands as the primary and most established provider of Boom 1000 index trading.

As the creator and pioneer of synthetic indices, Deriv maintains exclusivity over these instruments, making them the only platform for traders worldwide.

Why Deriv Dominates the Synthetic Indices Market:

Experience and Reliability:

- Over 20 years in the trading industry

- Proven track record with synthetic instruments

- Robust platform infrastructure supporting 24/7 trading

Exclusive Synthetic Offerings:

- Complete range of volatility indices

- Deriv broker on Mt5 platform integration

- Advanced charting and analysis tools

Trading Advantages:

Options trading available on synthetic instruments

Tight spreads on synthetic indices

No overnight fees or weekend gaps.

IS BOOM 1000 INDEX PROFITABLE?

The profitability of Boom 1000 index trading depends largely on your approach, risk management, and understanding of synthetic market dynamics. Here’s what determines success:

Profit Potential Factors:

Pattern Recognition: Understanding that Boom 1000 experiences predictable spikes allows traders to position themselves strategically.

The algorithmic Pattern analysis becomes crucial for timing entries and exits

Risk-to-Reward Ratios:

- Small account growth potential: 5-20% monthly returns possible

- Conservative approach: 2-5% monthly targets

- Aggressive strategies: Higher returns with increased risk

Time Frame Considerations: The best time to trade synthetic indices isn’t tied to market sessions but rather to technical setups and Dominant trend identification.

Success Statistics:

Risk management: Essential for long-term profitability

Profitable traders: Typically those who master technical analysis

Average win rate: 60-70% for experienced synthetic traders.

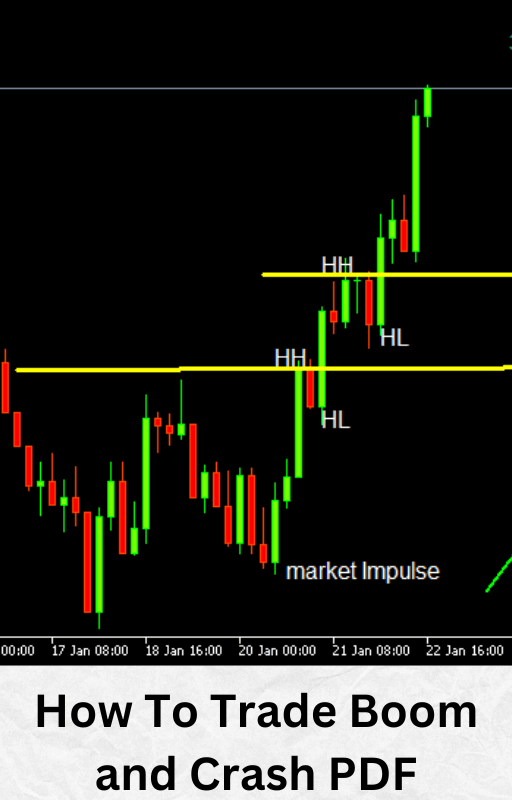

HOW TO ANALYSE BOOM 1000 INDEX

Is like Analyzing the Forex Market, these principles can be applied to Boom 1000, but with synthetic-specific considerations:

Technical Analysis Approach:

Higher Timeframe Analysis (H1-H4):

- Identify major support and resistance levels

- Determine the Dominant trend direction

- Mark significant supply and demand zones

Lower Timeframe Execution (M15-M30):

- Look for Chart Pattern formations

- Time entries based on retracements

- Use price action signals for confirmation

Essential MT5 Tools:

- Built-in indicators for synthetic analysis

- Custom timeframes for detailed study

- Advanced order management systems.

BOOM 1000 VS OTHER SYNTHETIC INDICES

Understanding the differences between synthetic indices helps you choose the right instrument for your trading style:

Boom Family Comparison:

Boom 1000:

- Spike frequency: 1 per 1000 ticks (average)

- Movement: Bullish spikes, bearish ticks

- Volatility: Moderate to high

- Best for: Swing trading, position trading

Boom 500:

- Spike frequency: 1 per 500 ticks (average)

- Movement: Bullish spikes, bearish ticks

- Volatility: Higher than Boom 1000

- Best for: Scalping, day trading

Crash 1000 index Comparison:

Key Differences:

- Boom 1000: Bullish spikes, bearish ticks

- Crash 1000: Bearish spikes, bullish ticks

- Both operate on 1000-tick cycles

- Mirror opposite of each other’s behaviour

VOLATILITY INDICES TRADING STRATEGIES

Scalping Strategy:

Setup Requirements:

- Identify Dominant trend on H1-H4

- Switch to M15 timeframe for entries

- Wait for retracements to key levels

- Look for Chart Pattern confirmations

Execution Steps:

- Enter on trend continuation signals

- Set tight stop losses (10-20 pips)

- Target quick profits (15-30 pips)

- Never risk more than 2% per trade

Swing Trading Approach:

Higher Timeframe Focus:

- Use H4 and daily charts for bias

- Identify major swing points

- Enter on smaller timeframe confirmations

- Hold positions for multiple days

BEST PRACTICES FOR BOOM 1000 TRADING

Risk Management Essentials:

Position Sizing:

- Never risk more than 2-3% per trade

- Use consistent lot sizes based on account balance

- Scale up gradually as account grows

Stop Loss Placement:

- Always use stop losses

- Place beyond recent swing highs/lows

- Adjust based on volatility conditions

Profit Taking:

- Set realistic profit targets

- Use trailing stops on winning positions

- Take partial profits at key resistance levels

Trading Psychology:

Discipline Requirements:

- Stick to your trading plan

- Avoid revenge trading after losses

- Keep detailed trading journals

- Regular strategy review and adjustment

Common Mistakes to Avoid:

- Overtrading during low-volatility periods

- Ignoring higher timeframe bias

- Risking too much per trade

- Trading without proper analysis

PLATFORM REQUIREMENTS AND SETUP

MT5 Platform Advantages:

Advanced Features:

- Multiple timeframe analysis

- Custom indicator installation

- Automated trading capabilities

- Professional charting tools

Setup Recommendations:

- Use clean charts with essential indicators only

- Set up multiple timeframe layouts

- Configure alerts for key price levels

- Organise workspace for efficient analysis

Mobile Trading Considerations:

Deriv Mobile App:

Account funding options

Full synthetic indices access

Real-time price updates

Order management capabilities.

GETTING STARTED WITH DERIV BROKER

Account Opening Process:

- Registration:

- Complete online application

- Verify email address

- Submit required documents

- Account Verification:

- Identity verification (passport/ID)

- Address proof (utility bill/bank statement)

- Processing time: 1-3 business days

- Platform Setup:

- Download MT5 platform

- Connect to Deriv servers

- Fund your account (minimum $10)

Funding Options:

Popular Methods:

- Credit/debit cards (instant)

- Bank wire transfers (1-3 days)

- E-wallets (Neteller, Skrill)

- Cryptocurrency deposits

Minimum Deposits:

- Standard account: $10

- No maximum deposit limits

- Multiple currency options available

ADVANCED TRADING TECHNIQUES

Pattern Recognition Mastery:

Learning the top secret on how to trade Boom and crash involves understanding these advanced concepts:

Spike Prediction Methods:

- Volume analysis before spikes

- Price compression patterns

- Time-based spike probability

- Multiple timeframe confluences

Professional Strategies:

- Grid trading modifications for synthetics

- Martingale variations with strict rules

- Correlation trading between Boom and Crash

- News-free technical setups

FUTURE OF SYNTHETIC INDICES TRADING

Market Evolution:

Expanding Offerings: The synthetic indices market continues growing, with brokers exploring new volatility patterns and synthetic instruments. Volatility indices represent just the beginning of algorithmic trading evolution.

Technology Integration:

- AI-powered analysis tools

- Enhanced mobile trading platforms

- Social trading integration

- Automated strategy deployment

Regulatory Developments:

- Increased oversight and regulation

- Enhanced trader protection measures

- Standardised synthetic instrument classifications

- Global market accessibility improvements

CONCLUSION

Boom 1000 index brokers, led by Deriv’s pioneering platform, offer traders unprecedented access to consistent, predictable market volatility.

Unlike traditional markets plagued by unpredictable news events and limited trading hours, synthetic indices provide a pure technical analysis environment where skilled traders can thrive.

The key to success lies not just in finding the right broker, but in mastering the unique characteristics of synthetic trading.

From understanding the 1000-tick spike patterns to implementing proper risk management, every aspect requires dedication and continuous learning.

Remember, Deriv broker currently stands as the primary gateway to this exciting market, offering the tools, reliability, and expertise needed for synthetic indices success.

Whether you’re a small account holder looking to grow your capital or an experienced trader seeking new opportunities, Boom 1000 index trading offers a compelling alternative to traditional markets.

Ready to start your synthetic trading journey? Open your Deriv account today and discover why thousands of traders have made the switch to 24/7 synthetic indices trading. The market never sleeps, and neither should your profit potential.

Disclaimer: Trading synthetic indices involves substantial risk and may not be suitable for all investors. Past performance does not guarantee future results. Always conduct thorough research and consider seeking professional financial advice before trading.