When EUR/USD rallies 50 pips, GBP/USD often follows with a similar move. When AUD/USD drops during risk-off sentiment, NZD/USD typically mirrors the decline.

These aren’t random coincidences they’re examples of currency pair correlation, one of forex trading’s most powerful yet overlooked concepts.

Understanding the currency pairs that move together gives you a significant edge in the markets. It’s the difference between blindly placing trades and making informed decisions backed by statistical relationships.

Smart traders use correlation to manage risk better, avoid overexposure, and identify high-probability setups that others miss.

Most traders focus solely on individual pair analysis, completely ignoring the interconnected web of currency relationships.

This oversight costs them money and missed opportunities every single trading day.

- WHAT ARE CURRENCY PAIRS THAT MOVE TOGETHER?

- HOW CURRENCY CORRELATION WORKS IN PRACTICE

- MAJOR CURRENCY PAIRS THAT MOVE TOGETHER

- CURRENCY PAIRS THAT MOVE IN OPPOSITE DIRECTIONS

- CURRENCY CORRELATION STRATEGY: HOW TO TRADE CORRELATED PAIRS

- MOST VOLATILE CURRENCY PAIRS AND CORRELATION

- READING CURRENCY CORRELATION TABLES

- FACTORS THAT INFLUENCE CURRENCY CORRELATION

- ADVANCED CORRELATION TRADING TECHNIQUES

- RISK MANAGEMENT WITH CORRELATED PAIRS

- TOOLS FOR MONITORING CURRENCY CORRELATION

- SEASONAL CORRELATION PATTERNS

- FUTURE OF CURRENCY CORRELATION

- COMMON CORRELATION TRADING MISTAKES

- CONCLUSION: MASTERING CURRENCY CORRELATION FOR TRADING SUCCESS

WHAT ARE CURRENCY PAIRS THAT MOVE TOGETHER?

Currency pairs that move together, known as correlated pairs, are forex pairs that exhibit similar price movements due to shared economic factors, geographical proximity, or trading relationships.

When one pair rises, its correlated counterpart typically follows suit, and vice versa.

Currency pair correlation measures the statistical relationship between two currency pairs over a specific period. This relationship is expressed as a correlation coefficient ranging from -1 to +1:

- +1: Perfect positive correlation (pairs move identically)

- 0: No correlation (pairs move independently)

- -1: Perfect negative correlation (pairs move in opposite directions)

HOW CURRENCY CORRELATION WORKS IN PRACTICE

Think of correlation like a dance partnership. Some currency pairs are perfectly synchronized dancers, moving in harmony.

Others are rebellious dancers, deliberately moving in opposite directions. Understanding these relationships helps you predict market movements more accurately.

The Science Behind Correlation

Currency correlation occurs due to several factors:

Economic Interdependence: Countries with strong trade relationships often see their currencies move together. For instance, Australia and New Zealand’s close economic ties create strong correlation between AUD/USD and NZD/USD.

Commodity Influences: Commodity-driven economies like Australia (gold, iron ore) and Canada (oil) often see their currencies correlate with commodity prices and each other.

Risk Sentiment: During market uncertainty, traders flock to safe-haven currencies like USD, JPY, and CHF, creating correlation patterns across multiple pairs.

MAJOR CURRENCY PAIRS THAT MOVE TOGETHER

Here are the most significant currency pairs that move together:

Strongest Positive Correlations (0.70 and above)

EUR/USD and GBP/USD (Correlation: 0.77)

- Both represent major European economies against the dollar

- Brexit developments affect both pairs similarly

- European Central Bank policies influence both currencies

EUR/USD and AUD/USD (Correlation: 0.75)

- Risk-on sentiment drives both pairs higher

- Both suffer during US dollar strength periods

- Commodity prices indirectly affect both relationships

AUD/USD and NZD/USD (Correlation: 0.85)

- Geographical neighbors with intertwined economies

- Both are commodity currencies

- Similar interest rate environments

GBP/USD and GBP/JPY (Correlation: 0.88)

- Sterling strength/weakness affects both pairs

- UK economic data impacts both simultaneously

- Bank of England policies drive both directions

Moderate Positive Correlations (0.50 to 0.69)

USD/CHF and USD/JPY (Correlation: 0.57)

- Both feature safe-haven currencies

- Similar central bank intervention patterns

- Flight-to-quality flows affect both pairs

EUR/JPY and GBP/JPY (Correlation: 0.54)

- Cross-pairs sharing the Japanese yen

- European economic sentiment drives both

- Risk appetite changes impact both similarly

CURRENCY PAIRS THAT MOVE IN OPPOSITE DIRECTIONS

Understanding negative correlations is equally crucial for risk management:

Strong Negative Correlations

EUR/USD and USD/CHF (Correlation: -0.77)

- Swiss franc often strengthens when euro weakens

- Safe-haven flows create opposite movements

- European uncertainty benefits CHF over EUR

GBP/USD and USD/JPY (Correlation: -0.56)

- Sterling weakness often coincides with yen strength

- Risk-off sentiment favors’ JPY over GBP

- Different monetary policy cycles create divergence

USD/CAD and AUD/USD (Correlation: -0.68)

- Oil price changes affect these pairs oppositely

- Commodity currency vs. commodity currency pair dynamics

- North American vs. Asia-Pacific economic cycles

CURRENCY CORRELATION STRATEGY: HOW TO TRADE CORRELATED PAIRS

The Confirmation Strategy

When trading correlated currency pairs, use one pair to confirm signals from another:

- Identify Your Primary Trade: Choose your main currency pair based on technical analysis

- Check Correlated Pairs: Verify that correlated pairs show similar signals

- Execute with Confidence: Trade when multiple correlated pairs align

Example: If EUR/USD shows bullish signals, check GBP/USD and AUD/USD for confirmation. When all three align bullishly, your confidence level increases significantly.

The Hedging Strategy

Use negatively correlated pairs to hedge your positions:

- Open Primary Position: Enter your main trade

- Identify Hedge Pair: Find a negatively correlated pair

- Adjust Position Sizes: Use appropriate lot sizes to balance risk

For traders wondering what is the recommended lot size for Forex, correlation analysis helps determine optimal position sizing across multiple pairs.

The Diversification Strategy

Avoid overexposure by understanding correlations:

- Don’t trade multiple highly correlated pairs simultaneously

- Spread risk across uncorrelated or negatively correlated pairs

- Monitor correlation changes during different market conditions

Understanding what is order block Forex can enhance your correlation-based strategies by providing better entry points across related pairs.

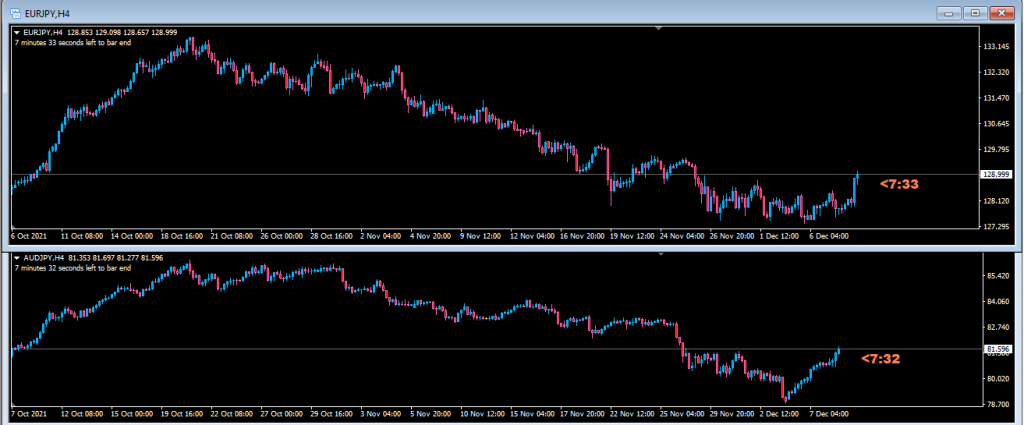

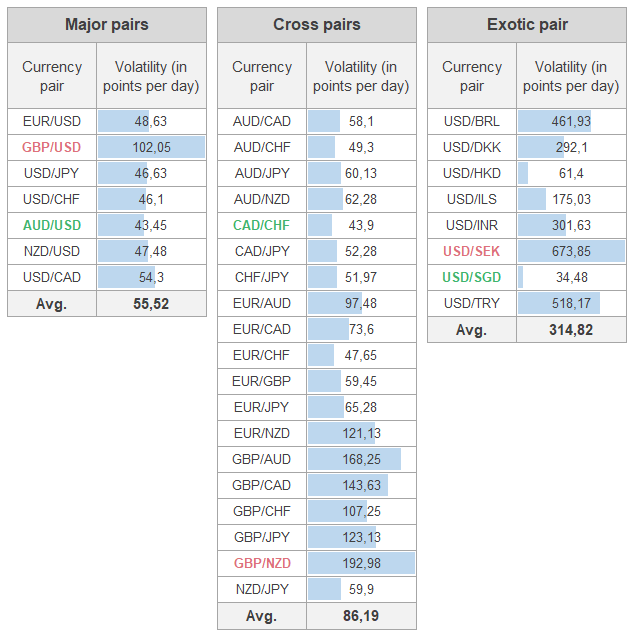

MOST VOLATILE CURRENCY PAIRS AND CORRELATION

Exotic currency pairs often show unique correlation patterns due to their volatility:

High-Volatility Exotic Pairs:

- USD/ZAR (South African Rand)

- USD/TRY (Turkish Lira)

- USD/BRL (Brazilian Real)

- USD/MXN (Mexican Peso)

- GBP/JPY (Major cross pair)

These pairs can offer substantial profit opportunities, making them attractive for traders curious about how much can I make trading Forex.

However, their correlation patterns can shift rapidly during economic uncertainty.

READING CURRENCY CORRELATION TABLES

Here’s how to interpret correlation data effectively:

EUR/USD Correlations:

- GBP/USD: +0.77 (Strong positive)

- AUD/USD: +0.75 (Strong positive)

- USD/CHF: -0.77 (Strong negative)

- USD/JPY: -0.46 (Moderate negative)

GBP/USD Correlations:

- EUR/USD: +0.77 (Strong positive)

- AUD/USD: +0.70 (Strong positive)

- USD/CHF: -0.57 (Moderate negative)

- USD/CAD: -0.85 (Very strong negative)

Key Correlation Insights:

- Correlations above 0.70 indicate strong relationships

- Correlations below -0.70 suggest strong inverse relationships

- Correlations between -0.30 and +0.30 show weak relationships

FACTORS THAT INFLUENCE CURRENCY CORRELATION

Understanding what drives correlation helps predict changes:

Economic Factors:

- Interest Rate Differentials: Central bank policies affect correlation strength

- GDP Growth Rates: Economic performance similarities create correlation

- Inflation Levels: Price stability comparisons influence relationships

Geopolitical Factors:

- Trade Agreements: NAFTA, Brexit affect specific currency relationships

- Political Stability: Uncertainty changes traditional correlation patterns

- Regional Conflicts: Geopolitical tensions alter safe-haven flows

Market Sentiment Factors:

- Risk Appetite: Risk-on/risk-off sentiment affects correlation strength

- Commodity Prices: Oil, gold prices influence commodity currency correlations

- Global Economic Outlook: Recession fears alter traditional relationships

ADVANCED CORRELATION TRADING TECHNIQUES

The Correlation Divergence Strategy

When traditionally correlated pairs diverge, opportunities arise:

- Identify Divergence: Spot when correlated pairs move differently

- Analyze Reasons: Determine if divergence is temporary or fundamental

- Trade the Convergence: Position for pairs to return to normal correlation

The Correlation Coefficient Formula

For mathematical traders, the correlation coefficient formula is:

r = Σ[(Xi – X̄)(Yi – Ȳ)] / √[Σ(Xi – X̄)²Σ(Yi – Ȳ)²]

Where:

- r = correlation coefficient

- Xi, Yi = individual data points

- X̄, Ȳ = means of datasets.

RISK MANAGEMENT WITH CORRELATED PAIRS

Position Sizing Considerations

When trading correlated pairs:

- Reduce Individual Position Sizes: Highly correlated pairs amplify risk

- Calculate Combined Exposure: Consider total risk across correlated positions

- Use Portfolio Heat: Limit total portfolio risk percentage

For beginners learning how to trade Forex with $10, understanding correlation prevents overexposure with limited capital.

Correlation Risk Warnings

Overconfidence: Strong correlation doesn’t guarantee future movements

Correlation Changes: Market conditions alter correlation strength

False Signals: Temporary correlations can mislead traders.

TOOLS FOR MONITORING CURRENCY CORRELATION

Professional Platforms:

- MetaTrader 4/5: Built-in correlation indicators

- TradingView: Real-time correlation matrices

- Bloomberg Terminal: Professional correlation analysis

Free Resources:

- Forex Factory: Daily correlation updates

- Investing.com: Currency correlation tools

- Central Bank Websites: Economic data for correlation analysis.

SEASONAL CORRELATION PATTERNS

Currency correlations often follow seasonal patterns:

Year-End Patterns:

- December: Reduced liquidity affects correlations

- January: New year positioning changes relationships

- Summer: Holiday trading alters normal patterns

Economic Calendar Impact:

- NFP Release: USD pairs show temporary correlation changes

- Central Bank Meetings: Policy decisions affect related currencies

- GDP Announcements: Economic surprises alter correlation strength

FUTURE OF CURRENCY CORRELATION

Technological Impact:

- Algorithmic Trading: High-frequency trading affects short-term correlations

- Artificial Intelligence: Machine learning identifies new correlation patterns

- Digital Currencies: Cryptocurrency adoption may alter traditional relationships

Global Economic Changes:

- Emerging Market Growth: New economic powers create different correlations

- Climate Change: Environmental policies affect commodity currency relationships

- Technological Disruption: Innovation changes traditional economic relationships

COMMON CORRELATION TRADING MISTAKES

Mistake 1: Assuming Correlation is Permanent

Correlations change based on market conditions. Always verify current relationships before trading.

Mistake 2: Ignoring Fundamental Changes

Economic policy shifts can break long-standing correlations. Stay informed about central bank policies.

Mistake 3: Over-Diversifying with Correlated Pairs

Trading multiple highly correlated pairs doesn’t provide true diversification.

Mistake 4: Misunderstanding Timeframes

Correlation strength varies across different timeframes. Daily correlations differ from hourly ones.

CONCLUSION: MASTERING CURRENCY CORRELATION FOR TRADING SUCCESS

Understanding currency pairs that move together transforms your approach to forex trading.

From better risk management to enhanced profit opportunities, correlation analysis provides the edge serious traders need in today’s competitive markets.

Remember these key takeaways:

- Monitor correlation coefficients regularly as they change with market conditions

- Use correlation for confirmation, not as your sole trading signal

- Balance correlated and uncorrelated pairs in your portfolio

- Stay informed about economic factors driving correlation changes

Whether you’re managing substantial capital or starting small, currency correlation knowledge elevates your trading game.

The forex market rewards prepared traders, and understanding these relationships puts you firmly in that category.

Ready to implement correlation strategies in your trading?

Start by monitoring a few highly correlated pairs, practice with demo accounts, and gradually incorporate correlation analysis into your existing trading system.

Your future trading self will thank you for mastering this powerful concept today.