In my previous article, I discussed extensively how to draw Fibonacci retracement correctly, today, am going to discuss Fibonacci extension levels mt4.

The Fibonacci tool is a critical tool for technical analysis trading; it should not be overlooked if you want to make substantial development as a technical analysis trader.

When used appropriately, the Fibonacci tool can assist you as a trader in identifying important Fibonacci extension and retracement levels.

For the record, the Fibonacci tool should not be used in isolation; it should be combined with other technical indicators like support and resistance, candlestick patterns, and so on to select the ideal trigger zone for market entry.

- TREND BASED FIB EXTENSION

- FIBONACCI EXTENSION LEVELS MT4

- HOW TO DRAW TREND BASED FIB EXTENSION

- FIBONACCI EXTENSION LEVELS CALCULATOR

- AUTO FIBONACCI EXTENSION INDICATOR MT4

- COMMON FIBONACCI EXTENSION LEVELS

- FIBONACCI EXTENSION LEVELS 127

- FIBONACCI EXTENSION INDICATOR MT4 DOWNLOAD

- HOW CAN FIBONACCI EXTENSION TAKE PROFIT?

- HOW DO YOU TRADE USING FIBONACCI RETRACEMENT AND EXTENSION LEVELS?

- HOW DO YOU USE FIBONACCI EXTENSION LEVELS?

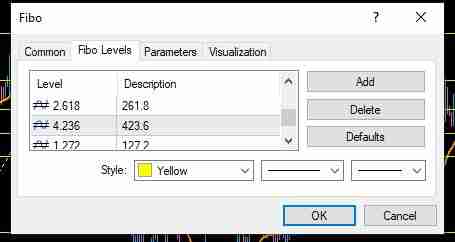

- HOW DO YOU USE FIBONACCI EXTENSION IN MT4?

- DOES MT4 HAVE FIBONACCI EXTENSIONS?

- WHAT ARE THE BEST FIBONACCI EXTENSION LEVELS?

- CONCLUSION

TREND BASED FIB EXTENSION

Trend based Fib extension is drawing your Fibonacci after a dominant trend is established.

Trend-based Fib extension can be used across multiple trading instruments such as currencies, stocks, crypto, synthetic trading, and more.

It is important you know that trend-based Fib extension are for mapping potential zone for profit targets.

Trend based Fib extension remains 127.2, 141.4, and 161.8. (These are the major levels).

RELATED: FIBONACCI RETRACEMENT LEVELS ABOVE 100

FIBONACCI EXTENSION LEVELS MT4

There are three significant Fibonacci extension levels for mt4, they are 127.2, 141.4, and 161.8.

The reason for this is that the vast majority of forex traders (professionals, market makers, and large institutions) are seeking to take profit levels at the Fib extension levels.

These Fibonacci extension levels can sometimes match with prior market highs and lows, or they might create new market highs and lows.

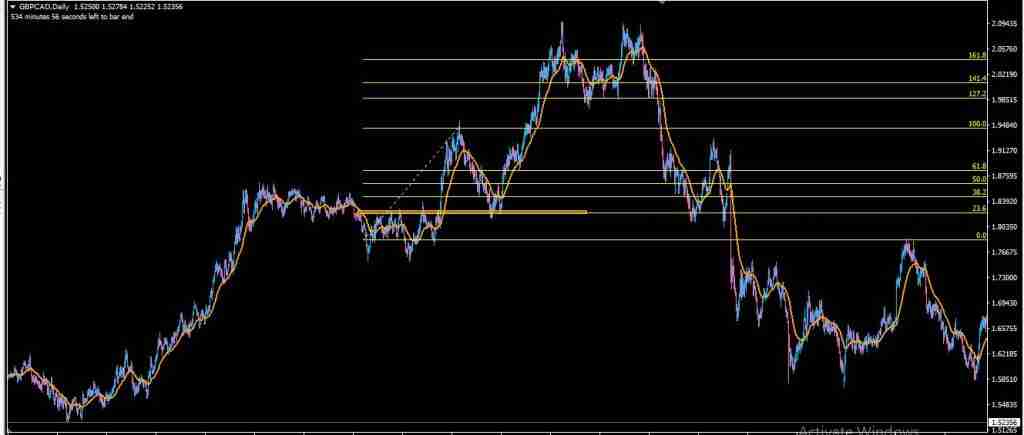

See the image illustration below:

HOW TO DRAW TREND BASED FIB EXTENSION

To draw trend based fib extension, a market-dominant trend will have been formed already, showing a clear direction of the market either in upward or downward momentum.

Based on the established trend, Fibonacci is drawn from point A (the peak of the market impulse) to point B the beginning of the market impulse.

Drawing this will pinpoint the Fib extension zones which is also the area of market reversal and take profit.

See the image illustration below:

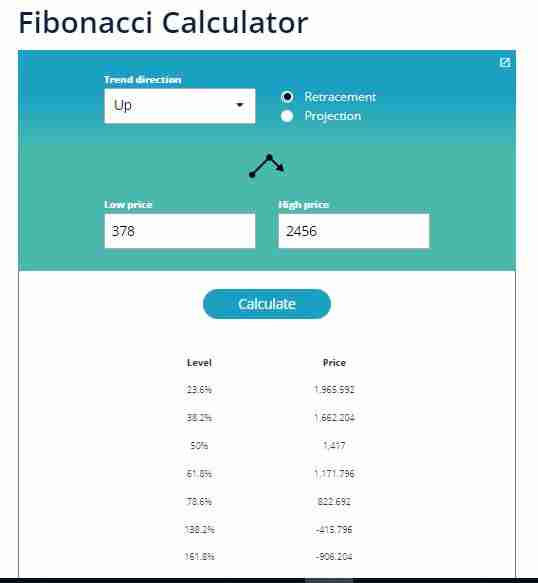

FIBONACCI EXTENSION LEVELS CALCULATOR

The Fibonacci extension levels calculator is a custom tool designed to aid traders in quickly identifying Fibonacci levels using the lows and highs of the market price.

These prices are imputed in the designed blank spaces to give fib levels.

You can see the Fibonacci tool calculator to use the custom-designed Fibonacci extension levels calculator.

AUTO FIBONACCI EXTENSION INDICATOR MT4

You would need a Fibonacci extension indicator for just one reason. This is a result of your lack of effort in learning how to manually draw your Fibonacci; in my experience, it is always preferable to keep things straightforward by comprehending how to use the Fibonacci tool and its relationship to support and resistance.

In light of this, I’ll give you the links to three websites where you can download a Fibonacci extension indicator automatically. You can verify:

In conclusion, you must read up on market structure support, and resistance as they play important roles when using the Fibonacci tool.

COMMON FIBONACCI EXTENSION LEVELS

Although the Fibonacci tool contains a large number of Fibonacci extension levels, traders frequently keep an eye out for certain Fibonacci extension levels.

The common levels of the Fibonacci extension are 127.2, 141.4, and 161.8.

Reversal levels are another name for these typical Fibonacci extension levels.

FIBONACCI EXTENSION LEVELS 127

The Fibonacci extension level 127 is the first extension level among the other two major levels (141.4 and 161.8).

In my experience, many traders take their profit on the first reversal zone (127.2), instead of waiting for the price to get to the other levels.

One key fact on Fibonacci extension level 127 is that it is a zone for exit and not entry.

Note that the Fibonacci tool is best for technical analysis.

FIBONACCI EXTENSION INDICATOR MT4 DOWNLOAD

Fibonacci extension indicator MT4 is designed to help technical analysis traders make a better decision on potential entry and exit zone.

You can have access to the Fibonacci extension indicator for download:

https://indicatorspot.com/indicator/auto-fibonacci-retracement-indicator

Below, you will find frequently asked questions regarding Fibonacci extension levels mt4:

HOW CAN FIBONACCI EXTENSION TAKE PROFIT?

Fibonacci extension take profit on an uptrend is drawn from the market impulse peak to the bottom of the impulse which pinpoints the zone for take profit.

HOW DO YOU TRADE USING FIBONACCI RETRACEMENT AND EXTENSION LEVELS?

Fibonacci retracement levels are drawn to join in on a recent dominant trend paying attention to previous support and resistance zones while Fibonacci extension levels are drawn to identify potential reversal zones for market exit.

HOW DO YOU USE FIBONACCI EXTENSION LEVELS?

Fibonacci extension levels are used to market exits in a market trend.

HOW DO YOU USE FIBONACCI EXTENSION IN MT4?

The Fibonacci extension is used to pinpoint potential profit target zones which are also known as reversal zones.

DOES MT4 HAVE FIBONACCI EXTENSIONS?

Yes, Mt4 has a Fibonacci extension tool at the top of the MT4 platform.

WHAT ARE THE BEST FIBONACCI EXTENSION LEVELS?

The best Fibonacci extension levels are 38.2, 50 and 61.8

CONCLUSION

Many traders pay attention to the Fibonacci tool because it is important in technical analysis trading, and you should too.

Trading with the Fibonacci is comparable to exploring a new location without a map.

A strong confluence zone for market entry will be created by the Fibonacci tool’s mapping of areas with high triggers that coincide with support and resistance zones.

When you take into account all aspects of technical trading, you will be learning market structure.