You’re scrolling through Instagram, and there’s another flashy post about someone making $10,000 in a day trading forex from their laptop on a beach in Bali.

Your mate from university just quit his banking job to become a “full-time trader,” and suddenly everyone’s talking about currency markets like they’re the next Bitcoin gold rush.

But here’s the million-dollar question (quite literally): How much can I make trading Forex?

The short answer? It’s complicated. The long answer? Well, that’s exactly what we’re about to dive into.

Because whilst social media might paint forex trading as a shortcut to financial freedom, the reality is far more nuanced, far more challenging, and frankly, far more interesting than those get-rich-quick posts would have you believe.

Ready to separate the wheat from the chaff?

- THE REALITY CHECK: WHAT FOREX TRADING ACTUALLY PAYS

- UNDERSTANDING THE STRUCTURE OF PROFESSIONAL TRADING

- CAN I BUILD A CAREER TRADING FOREX?

- IS FOREX A RELIABLE SKILL FOR MAKING MONEY?

- BREAKING DOWN MONTHLY EARNINGS BY EXPERIENCE LEVEL

- ESSENTIAL TOOLS AND STRATEGIES FOR MAXIMISING EARNINGS

- ALTERNATIVE WAYS TO PROFIT FROM FOREX MARKETS

- THE PSYCHOLOGY OF FOREX EARNINGS

- BUILDING YOUR FOREX TRADING FOUNDATION

- THE TRUTH ABOUT DAILY TRADING PROFITS

- GLOBAL MARKET DYNAMICS AND OPPORTUNITY

- CONCLUSION: THE REALISTIC PATH TO FOREX PROFITS

THE REALITY CHECK: WHAT FOREX TRADING ACTUALLY PAYS

Let’s cut through the noise straight away. The question isn’t really how much you can make trading forex—technically, there’s no upper limit.

The real question is how much you’re likely to make, and more importantly, how much you’re prepared to lose in the process.

Professional forex traders, who represent less than 1% of all market participants, typically achieve monthly returns of 5-15%.

Notice I said monthly, not daily. These aren’t the flashy figures you see plastered across social media, but they’re sustainable, realistic, and most crucially, they’re backed by years of experience and rigorous risk management.

Here’s what the numbers actually look like for different trading capital levels:

- $500 Account: Conservative monthly profit of $25-$75

- $1,000 Account: Conservative monthly profit of $50-$150

- $5,000 Account: Conservative monthly profit of $250-$750

- $10,000 Account: Conservative monthly profit of $500-$1,500

These figures assume you’re following proper risk management protocols, risking no more than 1-3% of your account per trade.

Yes, it’s possible to make more—much more—but it comes with exponentially higher risk.

UNDERSTANDING THE STRUCTURE OF PROFESSIONAL TRADING

Before we dive deeper into earnings potential, it’s crucial to understand how successful traders actually operate.

The structure of the Forex Market isn’t just about currency pairs and pip movements—it’s about understanding market dynamics, economic indicators, and global financial flows.

Most successful traders don’t trade daily. Despite what you might see on social media, scalping (trading multiple times per day) isn’t the most reliable path to consistent profits.

Instead, professional forex traders focus on quality over quantity, often holding positions for days or weeks rather than hours.

The key differentiator? They’ve mastered their emotions and developed systematic approaches to market analysis.

They understand that forex isn’t a casino—it’s a skill-based endeavour that rewards patience, discipline, and continuous learning.

CAN I BUILD A CAREER TRADING FOREX?

This is perhaps the most important question for anyone serious about forex trading. Can I build a career trading Forex?

The honest answer is yes, but with significant caveats.

Building a sustainable trading career requires several elements:

Capital Requirements

You’ll need substantial trading capital not just for trading, but for living expenses during the inevitable learning curve.

Most successful traders recommend having at least 6-12 months of living expenses saved before attempting to trade full-time.

Skill Development Timeline

Becoming consistently profitable typically takes 2-3 years of dedicated learning and practice. This includes mastering technical analysis, understanding fundamental factors, and developing robust risk management strategies.

Income Consistency Challenges

Unlike traditional employment, trading income is irregular. You might have excellent months followed by break-even or losing periods.

This unpredictability makes career planning challenging and requires exceptional financial discipline.

Psychological Demands

Trading full-time is mentally demanding. The isolation, pressure, and constant decision-making can be overwhelming. Many successful traders actually prefer part-time trading alongside other income sources.

IS FOREX A RELIABLE SKILL FOR MAKING MONEY?

The question of reliability is complex. Forex trading is indeed a skill—one that can be learned, refined, and monetised.

However, it’s not reliable in the traditional sense of a steady paycheque.

Statistical Reality: Studies consistently show that 70-80% of retail forex traders lose money. This isn’t because forex is a scam, but because most people approach it with unrealistic expectations and inadequate preparation.

The Learning Curve: Those who do succeed typically follow a structured learning path.

They learn how to trade Forex systematically, starting with demo accounts, studying market analysis, and gradually developing their own trading style.

Risk vs. Reward: Successful traders understand that reliability comes from consistent application of proven strategies, not from hitting home runs. They focus on protecting capital first and growing it second.

BREAKING DOWN MONTHLY EARNINGS BY EXPERIENCE LEVEL

Beginner Traders (0-1 Years)

Realistically, beginners should expect to lose money whilst learning. This isn’t pessimism—it’s preparation. The focus should be on education and skill development rather than profits.

Typical Monthly Performance: -5% to +2% Primary Goal: Capital preservation and skill acquisition

Intermediate Traders (1-3 Years)

With consistent practice and proper education, intermediate traders can begin seeing modest, consistent profits.

Typical Monthly Performance: 2% to 5% Primary Goal: Consistency and risk management refinement

Advanced Traders (3+ Years)

Experienced traders with proven track records can achieve higher returns whilst maintaining acceptable risk levels.

Typical Monthly Performance: 5% to 15%. Primary Goal: Scaling strategies and optimising performance.

ESSENTIAL TOOLS AND STRATEGIES FOR MAXIMISING EARNINGS

Success in forex trading isn’t just about market knowledge it’s about having the right tools and strategies. Modern traders rely on sophisticated platforms and proven methodologies.

Platform Selection

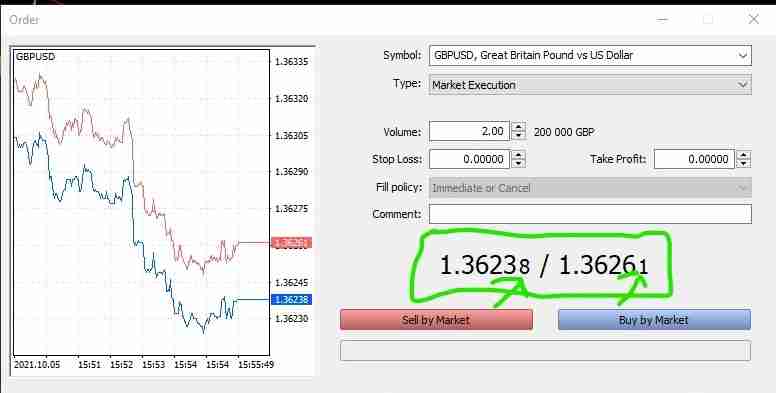

Most successful traders use either MetaTrader 4 or MetaTrader 5. If you’re wondering Mt4 or Mt5 for Beginners, both platforms offer excellent functionality, with MT5 providing more advanced features for experienced traders.

Strategy Development

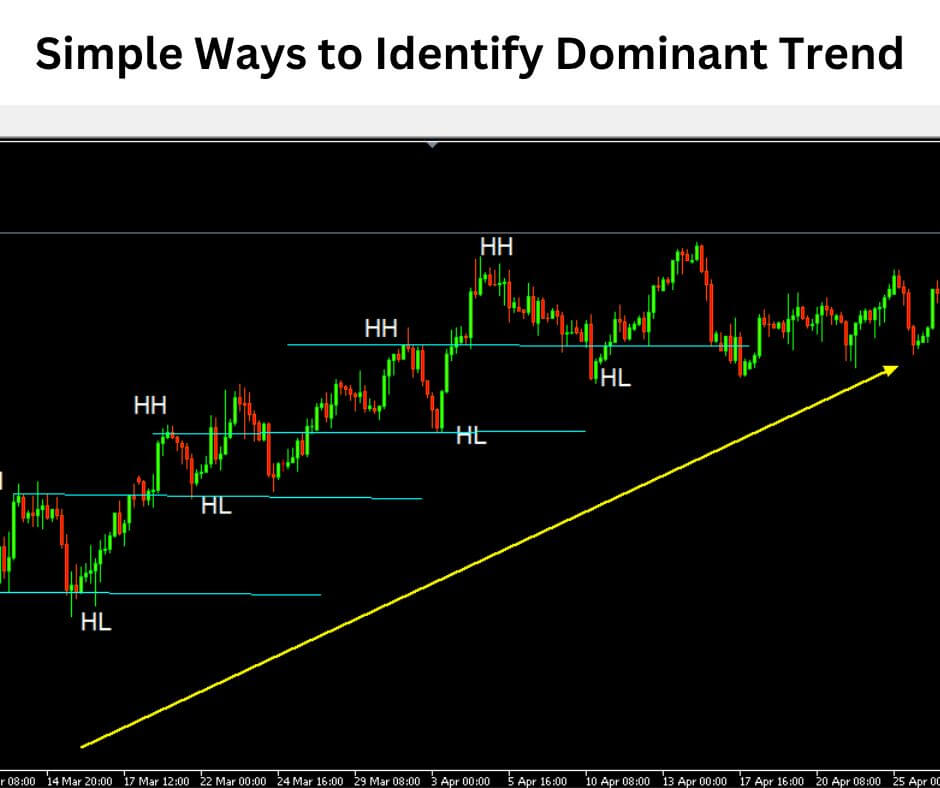

Profitable trading requires systematic approaches. Many traders find success with trend-following strategies, though some prefer Very easy and profitable strategy MT4 approaches that focus on simplicity and consistency.

Risk Management Fundamentals

This cannot be overstated: proper risk management is the difference between sustainable profits and account destruction. Key principles include:

- Never risk more than 1-3% of your account on a single trade

- Always use stop losses

- Understanding How to set stop loss and take profit in MT4 is crucial for protecting capital

- Learning How to know when a trend is ending helps with exit timing

ALTERNATIVE WAYS TO PROFIT FROM FOREX MARKETS

Not everyone is suited to active trading, but that doesn’t mean you can’t profit from forex markets. Several alternatives exist:

Copy Trading

This involves automatically copying the trades of successful traders. Platforms like eToro and ZuluTrade offer these services, though they come with fees and require careful selection of traders to follow.

Forex Education and Coaching

If you develop expertise, teaching others can be lucrative. Many successful traders supplement their income through courses, coaching, or educational content creation.

Affiliate Marketing

Forex brokers offer affiliate programmes that pay commissions for referring new clients. This can provide passive income streams for those with relevant audiences.

Signal Services

Experienced traders can monetise their analysis by providing trading signals to subscribers, creating recurring revenue streams.

THE PSYCHOLOGY OF FOREX EARNINGS

Perhaps the most overlooked aspect of forex profitability is psychology. The mental game often determines success more than technical knowledge.

Managing Expectations

Unrealistic profit expectations lead to excessive risk-taking and inevitable losses. Successful traders focus on process over profits, understanding that consistency compounds over time.

Dealing with Losses

Every trader experiences losses even the most successful ones. The difference lies in how they respond. Professional traders view losses as business expenses and learning opportunities rather than personal failures.

Maintaining Discipline

The freedom of forex trading can be its downfall. Without the structure of traditional employment, maintaining discipline becomes crucial.

Successful traders develop routines and stick to predetermined rules regardless of emotions.

BUILDING YOUR FOREX TRADING FOUNDATION

If you’re serious about forex trading, start with proper foundations:

Education First

Begin with comprehensive education about markets, analysis methods, and trading psychology. Understanding market fundamentals is crucial before attempting to profit from price movements.

Demo Trading

Practice extensively on demo accounts before risking real money. This allows you to test strategies and build confidence without financial pressure.

Start Small

When you do begin live trading, start with amounts you can afford to lose completely. This removes emotional pressure and allows for clearer decision-making.

Continuous Learning

Markets evolve, and successful traders adapt. Continuous education and strategy refinement are essential for long-term success.

THE TRUTH ABOUT DAILY TRADING PROFITS

Social media is full of screenshots showing massive daily profits, but these represent survivorship bias—you only see the winners, not the countless losers.

Reality Check: Most professional traders aim for monthly rather than daily profit targets. Daily trading (scalping) requires significant time investment and often produces inconsistent results.

Sustainable Approach: Focus on weekly or monthly performance rather than daily profits. This perspective encourages better decision-making and reduces emotional trading.

GLOBAL MARKET DYNAMICS AND OPPORTUNITY

The forex market trades approximately $6.6 trillion daily, making it the world’s largest financial market. This massive liquidity creates opportunities but also highlights the sophistication of participants.

Understanding that you’re competing against banks, hedge funds, and algorithmic trading systems provides important context for setting realistic expectations.

Technology and Modern Trading

Today’s forex traders have access to sophisticated tools that were once exclusive to institutional traders:

- Advanced charting software

- Algorithmic trading capabilities

- Real-time economic calendars

- Risk management tools

- Mobile trading platforms

However, technology is just a tool success still depends on knowledge, discipline, and proper risk management.

CONCLUSION: THE REALISTIC PATH TO FOREX PROFITS

So, how much can you make trading forex? The answer depends entirely on your approach, capital, risk tolerance, and commitment to learning.

If you’re looking for quick riches, forex isn’t for you. If you’re prepared for a challenging but potentially rewarding journey that requires years of dedicated learning, substantial capital, and exceptional discipline, then forex trading could offer genuine opportunities.

Remember: successful forex trading isn’t about hitting home runs, it’s about consistent base hits. The traders who build sustainable careers focus on preserving capital, managing risk, and gradually building their skills and account size over time.

Ready to start your forex journey properly? Begin with education, practice on demo accounts, and never risk more than you can afford to lose completely.

The market will be here tomorrow, next year, and decades from now. There’s no rush except the rush to learn properly.

The forex market rewards patience, discipline, and continuous learning. Are you prepared for that challenge?