You’re scrolling through your phone after a long day, perhaps nursing a cuppa, when you stumble across stories of traders turning pocket change into substantial profits.

It sounds like modern-day alchemy, doesn’t it? The notion of transforming a tenner barely enough for a decent meal into something meaningful in the forex market seems almost fantastical.

Yet here’s the thing: How to trade Forex with $10 isn’t just a pipe dream reserved for financial wizards or lucky punters.

It’s entirely possible, though it requires the precision of a Swiss watchmaker and the patience of a seasoned chess grandmaster.

While your local bookmaker might scoff at a $10 flutter, the forex market welcomes even the most modest investments with open arms.

But here’s where it gets interesting and slightly dangerous…

- THE REALITY CHECK: WHAT $10 CAN ACTUALLY DO IN FOREX

- CAN I TRADE FOREX WITH $10 AND BE PROFITABLE?

- CHOOSING YOUR WEAPON: BROKER SELECTION FOR SMALL ACCOUNTS

- THE ART OF LEVERAGE: YOUR DOUBLE-EDGED SWORD

- STRATEGIC PAIR SELECTION: QUALITY OVER QUANTITY

- THE $10 TRADING STRATEGY: A STEP-BY-STEP BLUEPRINT

- ADVANCED TECHNIQUES FOR SMALL CAPITAL TRADING

- RISK MANAGEMENT: YOUR TRADING LIFELINE

- COMMON PITFALLS AND HOW TO AVOID THEM

- THE LONG GAME: GROWING YOUR $10 ACCOUNT

- TECHNOLOGY AND TOOLS FOR SMALL CAPITAL TRADING

- ADVANCED RISK MANAGEMENT TECHNIQUES

- TAX IMPLICATIONS AND RECORD KEEPING

- BUILDING TOWARDS LARGER CAPITAL

- CONCLUSION: YOUR $10 TRADING JOURNEY STARTS NOW

THE REALITY CHECK: WHAT $10 CAN ACTUALLY DO IN FOREX

Let’s be brutally honest about what you’re working with. Trading forex with little capital isn’t like stepping into Harrods with unlimited credit; it’s more akin to shopping at a charity shop with loose change in your pocket.

You need to be incredibly selective, strategic, and—dare we say—clever about every move you make.

The Mathematics of Small Capital Trading

When you’re operating with $10, every pip matters. Here’s a breakdown of what your capital can realistically achieve:

Account Size: $10

- Micro Position (0.01 lots): Risk per trade $0.20, potential daily return $0.50 – $1.00

- Small Position (0.02 lots): Risk per trade $0.20, potential daily return $1.00 – $2.00

- Aggressive Position (0.05 lots): Risk per trade $0.20, potential daily return $2.50 – $5.00

These numbers might seem paltry compared to the Instagram-worthy screenshots of massive profits you’ve probably seen. But remember, Rome wasn’t built in a day, and neither are successful trading accounts.

CAN I TRADE FOREX WITH $10 AND BE PROFITABLE?

This is the million-dollar question—or in our case, the ten-dollar question. The short answer is yes, but it comes with more conditions than a premium insurance policy.

Profitability with $10 depends on several critical factors:

- Broker selection (ultra-low spreads are non-negotiable)

- Leverage management (your best friend and worst enemy)

- Currency pair selection (stick to the majors, darling)

- Risk management (tighter than a Victorian corset)

- Realistic expectations (we’re not turning $10 into $10,000 overnight)

The harsh truth? Most beginner traders who attempt this strategy fail not because it’s impossible, but because they approach it with the wrong mindset.

They treat it like a lottery ticket rather than a business venture requiring meticulous planning and execution.

CHOOSING YOUR WEAPON: BROKER SELECTION FOR SMALL ACCOUNTS

Not all brokers are created equal, especially when you’re working with limited capital. Your broker choice can make or break your $10 trading venture.

Essential Broker Criteria:

Ultra-Low Spreads: With $10, you can’t afford to pay highway robbery spreads. Look for brokers offering spreads as low as 0.1 pips on major pairs.

Minimum Deposit Requirements: Ensure your chosen broker accepts $10 deposits without imposing ridiculous restrictions.

Micro Lot Trading: You need access to 0.01 lot sizes (1,000 units) to manage risk properly.

Reliable Execution: Slippage can devastate a small account faster than you can say “margin call.”

Recommended Broker Features:

- ECN or STP execution

- Regulation by FCA or equivalent

- No commission on standard accounts

- Negative balance protection

- Educational resources

THE ART OF LEVERAGE: YOUR DOUBLE-EDGED SWORD

Leverage in forex trading with small capital is like handling a vintage sports car thrilling when mastered, potentially catastrophic when mishandled.

Leverage Options for $10 Accounts:

Conservative Approach (5:1 to 10:1): This gives you $50-$100 buying power. It’s the equivalent of wearing a seatbelt while driving—sensible, if somewhat limiting.

Moderate Approach (20:1 to 30:1): Provides $200-$300 buying power. Think of it as the middle lane on the motorway reasonable speed without excessive risk.

Aggressive Approach (50:1+): Offers $500+ buying power. This is the fast lane, where fortunes are made and lost in the blink of an eye.

The Golden Rule: Never use more leverage than you can mentally and financially handle losing.

STRATEGIC PAIR SELECTION: QUALITY OVER QUANTITY

When trading with $10, you can’t afford to scatter your attention like confetti at a wedding. Focus is your superpower.

The Holy Trinity of Currency Pairs:

GBP/USD (The Cable): High liquidity, predictable patterns, and enough volatility to generate meaningful profits.

EUR/USD (The Fiber): The world’s most traded pair, offering tight spreads and abundant trading opportunities.

USD/JPY: Excellent for trend-following strategies, with clear technical levels.

Why These Pairs Matter:

- Liquidity: Easy entry and exit

- Spread efficiency: Lower transaction costs

- Predictable patterns: Technical analysis works better

- News impact: Clear fundamental drivers

THE $10 TRADING STRATEGY: A STEP-BY-STEP BLUEPRINT

Here’s where theory meets practice. This isn’t just another generic strategy it’s specifically crafted for small-capital constraints.

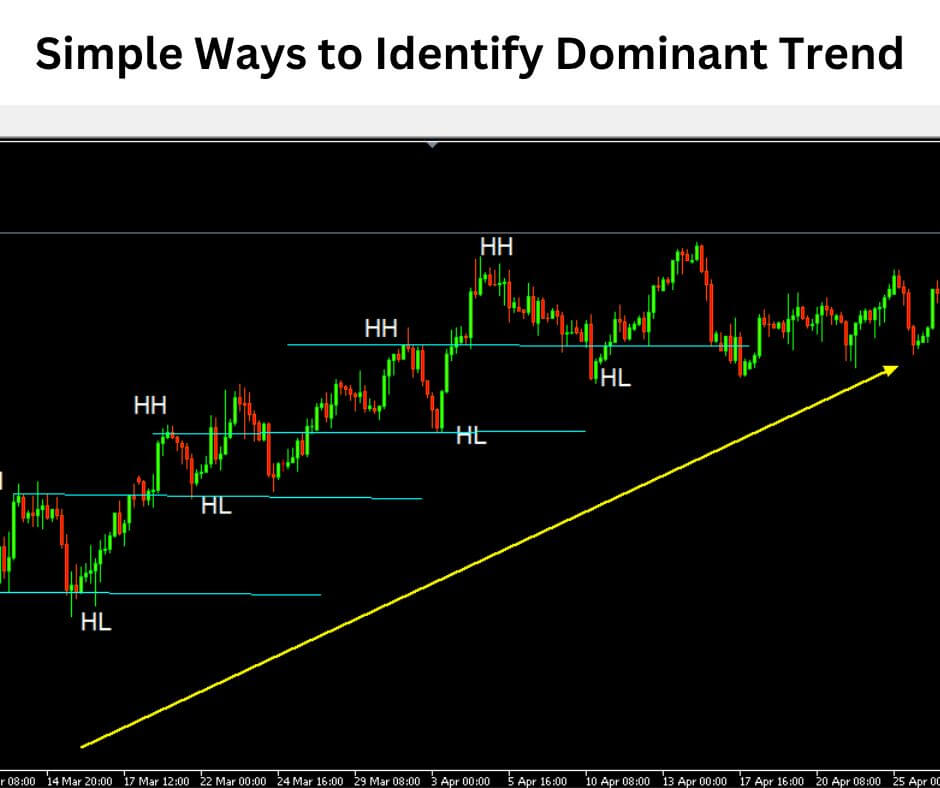

Phase 1: Market Analysis

Step 1: Understand the Market structure using higher timeframes (Daily and 4-hour charts). Look for dominant trends and key support/resistance levels.

Step 2: Identify market impulses and retracements. You’re hunting for high-probability setups, not random entries.

Step 3: Employ top-down analysis—start with the weekly view, then narrow down to daily, then hourly for entry timing.

Phase 2: Entry Execution

Risk Management Protocol:

- Risk maximum 2% per trade ($0.20)

- Position size: 0.01-0.02 lots maximum

- Stop loss: 10-20 pips

- Take profit: 20-40 pips (minimum 2:1 risk-reward ratio)

Entry Criteria:

- Confluence of technical indicators

- Clear market structure break

- Favourable risk-reward ratio

- Proper timing on lower timeframes

Phase 3: Trade Management

Monitor your position like a hawk watching prey. With $10, you can’t afford to be casual about trade management.

Key Management Rules:

- Move stop loss to breakeven after 1:1 risk-reward

- Consider partial profit-taking at 2:1

- Never let a winning trade turn into a loser

- Keep detailed trading records

ADVANCED TECHNIQUES FOR SMALL CAPITAL TRADING

The Compound Growth Strategy

Rather than withdrawing profits, reinvest them to accelerate account growth. Here’s a realistic progression:

Monthly Growth Projection (10% target):

- Month 1: Starting with $10.00, target return $1.00, ending with $11.00

- Month 2: Starting with $11.00, target return $1.10, ending with $12.10

- Month 3: Starting with $12.10, target return $1.21, ending with $13.31

- Month 6: Starting with $17.72, target return $1.77, ending with $19.49

- Month 12: Starting with $31.38, target return $3.14, ending with $34.52

The Psychological Game

Trading with $10 requires a unique psychological approach. You’re not trying to get rich quick; you’re building skills and confidence.

Mental Framework:

- Treat each trade as a learning experience

- Focus on percentage returns, not absolute amounts

- Celebrate small wins consistently

- Learn from every loss without emotional attachment

RISK MANAGEMENT: YOUR TRADING LIFELINE

With such limited capital, risk management isn’t just important—it’s survival. One catastrophic trade can wipe out your entire account faster than you can order a takeaway.

The 2% Rule in Practice

Never risk more than $0.20 per trade. This might seem restrictive, but it ensures survival through inevitable losing streaks.

Position Sizing Calculator

Use this formula: Position Size = (Account Balance × Risk %) ÷ (Stop Loss in Pips × Pip Value)

For a $10 account risking 2% with a 20-pip stop: Position Size = ($10 × 0.02) ÷ (20 × $0.10) = 0.01 lots.

COMMON PITFALLS AND HOW TO AVOID THEM

The Overtrading Trap

With $10, every trade feels significant. Resist the urge to trade constantly. Quality over quantity is your mantra.

The Leverage Temptation

High leverage might seem attractive for quick gains, but it’s often the fastest route to account annihilation.

Unrealistic Expectations

You’re not going to turn $10 into $1,000 in a week. Set realistic monthly targets of 5-10% growth.

Building Your Trading Foundation

Essential Education Resources

- Economic Calendar: Stay informed about major news events

- Technical Analysis Courses: Master chart reading and pattern recognition

- Risk Management Principles: Understand position sizing and portfolio theory

- Trading Psychology Books: Develop the mental edge

Practice Makes Perfect

Before risking real money, spend considerable time on demo accounts. Paper trading with virtual $10 helps you understand the unique challenges of small-capital trading.

THE LONG GAME: GROWING YOUR $10 ACCOUNT

Milestone Targets

$10 to $25: Focus on consistency and skill development

$25 to $50: Introduce slightly larger position sizes

$50 to $100: Begin diversifying trading strategies

$100+: Consider adding new currency pairs

Reinvestment Strategy

Once you’ve doubled your account, consider withdrawing your initial $10 investment. This removes emotional pressure and allows for more aggressive growth strategies with “house money.”

TECHNOLOGY AND TOOLS FOR SMALL CAPITAL TRADING

Essential Trading Tools

Mobile Trading Apps: Perfect for monitoring positions on the go.

Economic Calendars: Stay ahead of market-moving events.

Position Size Calculators: Ensure proper risk management.

Trading Journals: Track performance and identify improvement areas

Automation Considerations

While expert advisors (EAs) might seem appealing, manual trading often works better for small accounts. You maintain complete control and can adapt quickly to changing market conditions.

The Realistic Timeline

Let’s set proper expectations about growth timelines:

Months 1-3: Focus on learning and avoiding major losses.

Months 4-6: Achieve consistent small profits.

Months 7-12: Compound growth begins to accelerate.

Year 2+: Consider increasing capital or withdrawing profits.

ADVANCED RISK MANAGEMENT TECHNIQUES

The Martingale Trap

Never double down after losses with such limited capital. One bad streak will obliterate your account.

Correlation Risk

If trading multiple pairs, ensure they’re not highly correlated. Don’t put all eggs in one currency basket.

News Trading Considerations

Major economic announcements can create volatile conditions unsuitable for small accounts. Consider staying flat during high-impact news events.

TAX IMPLICATIONS AND RECORD KEEPING

Even with a $10 account, maintain proper records for tax purposes. In the US, forex trading profits may be subject to capital gains tax depending on your circumstances.

Essential Records

- Trade entry and exit times

- Profit and loss statements

- Currency pairs traded

- Risk management decisions

BUILDING TOWARDS LARGER CAPITAL

The Graduation Strategy

Once you’ve consistently grown your $10 to $100, consider adding fresh capital. Your proven skills justify increased investment.

Scaling Considerations

As your account grows, you can:

- Trade additional currency pairs

- Increase position sizes proportionally

- Implement more sophisticated strategies

- Consider swing trading alongside scalping

CONCLUSION: YOUR $10 TRADING JOURNEY STARTS NOW

Trading forex with $10 isn’t about getting rich quickly it’s about proving you can be profitable with any amount of capital. It’s the ultimate test of skill, discipline, and patience.

Every successful trader started somewhere, and that somewhere doesn’t need to be thousands of dollars.

The beauty of starting with $10 lies not in the potential profits, but in the invaluable experience gained.

You’ll learn to squeeze every ounce of value from your trades, develop unshakeable discipline, and master the psychological aspects of trading under pressure.

Remember, the forex market doesn’t care whether you’re trading with $10 or $10,000—the same principles of technical analysis, risk management, and emotional control apply.

Master these with your ten-dollar bill, and you’ll be well-equipped to handle larger amounts when the time comes.

Your journey begins with that first $10 deposit. Will you treat it as a lottery ticket or the foundation of your trading education? The choice and the opportunity is entirely yours.

Ready to start your $10 trading journey? Open a demo account today, practice these strategies, and when you’re consistently profitable in simulation, take the leap with real money. Your future trading success might just begin with the money currently sitting in your pocket.

The forex market is waiting. Your $10 adventure starts now.

Disclaimer: Forex trading involves substantial risk and is not suitable for all investors. Past performance does not guarantee future results. Only trade with capital you can afford to lose.