In this article, I am going to show you how to trade synthetic indices so that you can avoid the basic mistakes that beginners make. Stay with me and get this information for free.

Synthetic indices are uniquely designed to simulate real-world market movements without being affected by global events, because of their unique design, they can be traded 24/7 and fit well into technical analysis trading.

One thing technical analysis traders will love about Deriv synthetic indices is its constant liquidity and no sudden surprise of high-impact fundamental news.

- BEST TIME TO TRADE SYNTHETIC INDICES

- HOW TO TRADE SYNTHETIC INDICES

- ARE SYNTHETIC INDICES MANIPULATED?

- WHAT MOVES SYNTHETIC INDICES

- HOW TO TRADE SYNTHETIC INDICES ON MT5

- BEST INDICATOR FOR SYNTHETIC INDICES

- LIST OF SYNTHETIC INDICES

- CAN YOU TRADE SYNTHETIC INDICES?

- HOW DO I START TRADING SYNTHETIC INDICES?

- IS TRADING SYNTHETIC INDICES PROFITABLE?

- WHICH BROKER IS THE BEST TO TRADE SYNTHETIC INDICES?

- CONCLUSION

BEST TIME TO TRADE SYNTHETIC INDICES

If you recall from the beginning of this post and in previous articles about synthetic trading, I stated that Deriv synthetic indices are unaffected by global events or market hours.

As a result, the ideal time to trade synthetic indices is not a matter of time or day.

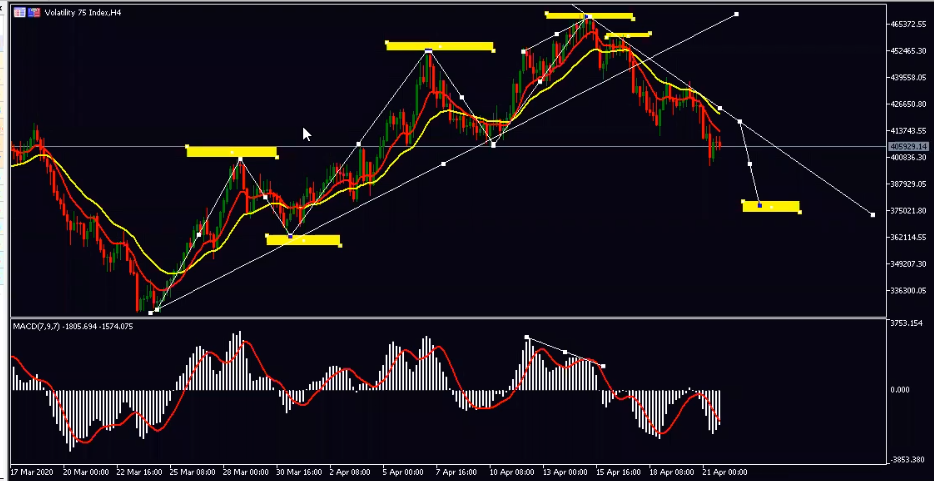

Rather the best time to trade synthetic indices is at the break of the market structure after a market technical analysis is done.

This analysis has to do with a breakout of support and resistance levels and other trading tools that are required based on market conditions.

Below is a visual example of the step index market structure being broken.

HOW TO TRADE SYNTHETIC INDICES

To trade synthetic indices successfully, an understanding of market structure is essential, and because synthetic indices are unaffected by global events.

Learning this will assist you in accurately applying support and resistance, the Fibonacci tool, trend lines, and the other default trading tools.

ARE SYNTHETIC INDICES MANIPULATED?

It is challenging to determine whether synthetic indices are manipulated or not.

According to Deriv Broker, the indices are based on a cryptographically secure random number generator that has been certified by an independent third party to ensure that they cannot be manipulated or altered.

For the record, there are fundamental principles that govern the market when trading financial instruments, and if you can grasp how they operate, you will come out on top.

WHAT MOVES SYNTHETIC INDICES

Unlike the FX market, which is impacted by major central banks and the world’s events? With the exclusion of fundamental news, synthetic indices are specially created to replicate the real-world market.

Synthetic indices are moved by secure random number generators which are confirmed by an external independent trusted third party according to Deriv.

HOW TO TRADE SYNTHETIC INDICES ON MT5

Synthetic indices on MT5 can be traded easily just like trading the forex market as they share similarities. Because synthetic indices mirror real-world market movements, the same forex trading tools, and strategies can be applied.

To trade synthetic indices, you will need to open a Deriv account using the Meta Trader 5 to access synthetic indices. In my previous post, I discussed extensively how to trade synthetic indices on MT5 and I exposed trading secrets on Volatility 75, step index with boom and crash.

Feel free to read up on the above topics.

BEST INDICATOR FOR SYNTHETIC INDICES

The belief that there is a best indicator for synthetic indices persists among many traders.

For this reason, they never stop looking for the perfect indicator. In actuality, there are no best indications for synthetic indices; if there were, then most traders would be profitable.

The best indicator for synthetic indices will always be having a solid understanding of trading fundamentals, which all come together in market structure trading.

LIST OF SYNTHETIC INDICES

Here are the lists of Synthetic indices on Deriv:

| Volatility Indices | Volatility 10 (1s) Index Volatility 25 (1s) Index Volatility 50 (1s) Index Volatility 75 (1s) Index Volatility 100 (1s) Index Volatility 200 (1s) Index Volatility 300 (1s) Index Volatility 10 Index Volatility 25 Index Volatility 50 Index Volatility 75 Index Volatility 100 Index | These indices correspond to simulated markets with 10%, 25%, 50%, 75%, 100%, 200%, and 300% constant volatility. For volatility indices 10, 25, 50, 75, and 100, one tick is generated every two seconds. For volatility indices 10 (1s), 25 (1s), 50 (1s), 75 (1s), 100 (1s), 200 (1s), and 300, one tick is generated per second (1s). |

| Boom/Crash | Boom 1000 Index Boom 500 Index Boom 300 Index Crash 1000 Index Crash 500 Index Crash 300 Index | There is an average of one drop (crash) or one spike (boom) in prices that occur in a series of 1000, 500, or 300 ticks with these indices. |

| Jump Indices | Jump 10 Index Jump 25 Index Jump 50 Index Jump 75 Index Jump 100 Index | These indices correspond to simulated markets with 10%, 25%, 50%, 75%, and 100% constant volatility. Every 20 minutes, there is an equal chance of an up or down jump. On average, the size of the jump is roughly 30 times that of normal price movement. |

| Step Indices | Step index | In a price series with a fixed step size of 0.1, these indices have an equal likelihood of moving up or down. |

| Range Break indices | Range Break 100 Index Range Break 200 Index | These indices fluctuate between two price points (borders), occasionally breaking through to form a new range once every 100 or 200 times they hit the borders. |

Below are frequently asked questions on how to trade synthetic indices:

CAN YOU TRADE SYNTHETIC INDICES?

Yes, you can trade synthetic indices on Deriv.

HOW DO I START TRADING SYNTHETIC INDICES?

You can start trading synthetic indices by opening a demo account on Deriv.

IS TRADING SYNTHETIC INDICES PROFITABLE?

Yes, trading synthetic indices are profitable because of their constant liquidity and volatility.

WHICH BROKER IS THE BEST TO TRADE SYNTHETIC INDICES?

Deriv is the only broker that offers Synthetic indices to traders.

CONCLUSION

If you want to be successful in trading financial instruments, you have to start seeing the market from higher time frames; there you can easily spot the dominant trend and spot market patterns.

This is not a way but a way to go.

Love the content , really helpful

Am glad you found it helpful. Kindly share with friends and family.