If you’ve been introduced to Deriv synthetic indices and are considering giving them a try, you’ve landed in the right spot.

This article will provide you with essential information on trading Deriv synthetic indices, including details on the minimum lot size for volatility index.

As you delve into the world of Deriv synthetic indices, you’ll discover that some indices like Boom and Crash exhibit distinctive price movements compared to traditional currency trading.

Nevertheless, a crucial element in trading any financial instrument involves understanding fundamental price movements, such as rally base rally, drop base drop, market structure, buying low, and selling high.

- MINIMUM LOT SIZE FOR VOLATILITY 75 INDEX

- MINIMUM LOT SIZE FOR VOLATILITY INDEX 10

- MINIMUM LOT SIZE FOR VOLATILITY INDEX

- SYNTHETIC INDICES LOT SIZES CHART

- SYNTHETIC INDICES LOT SIZES CALCULATOR

- WHAT IS THE LOWEST AMOUNT TO TRADE SYNTHETIC INDICES

- WHAT IS THE BEST LOT SIZE FOR VOLATILITY 75 INDEX

- DOES MT5 HAVE VOLATILITY 75 INDEX

- WHEN IT’S THE BEST TIME TO EXIT A TRADE ON VOLATILITY 75 INDEX

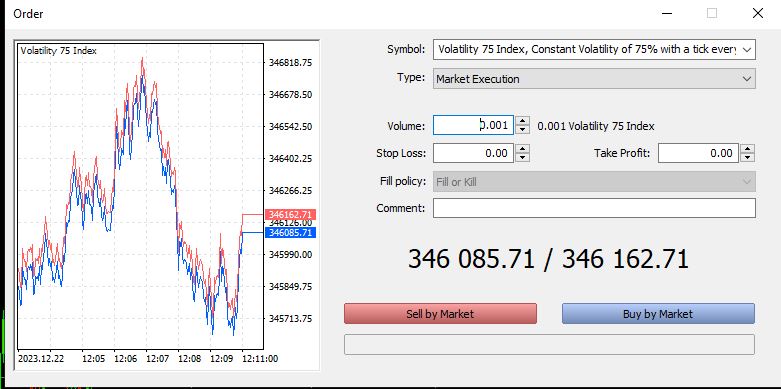

MINIMUM LOT SIZE FOR VOLATILITY 75 INDEX

Volatility 75 index is one of the most traded Deriv synthetic instruments, it is designed to move at a constant volatility of 75% with a tick every two seconds and has a minimum lot size of 0.001.

Because of the volatility of this pair, it is advisable to have a substantial account size for a smooth trading experience.

RELATED: STEP INDEX MINIMUM LOT SIZE

MINIMUM LOT SIZE FOR VOLATILITY INDEX 10

The minimum lot size for volatility index 10 is 0.50, it is another exclusive index of Deriv, and it moves at a volatility of 10% every 2 seconds.

Traders can access the V10 index on MT5 and make use of all the default tools that come with trading on MT5.

MINIMUM LOT SIZE FOR VOLATILITY INDEX

Deriv broker provides a range of Volatility indices, each with its specific minimum lot sizes.

See a few examples below:

Volatility 75 – minimum lot size is 0.001

Volatility 10- minimum lot size is 0.50

Volatility 50(1s) – minimum lot size is 0.005

Volatility 50 minimum lot size is 4

SYNTHETIC INDICES LOT SIZES CHART

See below the list of various synthetic indices lot sizes in chart or tabular form;

| LIST OF SYNTHETIC INDICES | Drift Swift Index 20 |

| Volatility 25 index | 0.50 |

| Volatility 50 index | 4.0 |

| Volatility 75 index | 0.001 |

| Volatility 100 index | 0.50 |

| Volatility 10 (1s) index | 0.50 |

| Volatility 25 (1s) index | 0.005 |

| Volatility 10 index | 0.50 |

| Volatility 50 (1s) index | 0.005 |

| Volatility 250 (1s) index | 0.005 |

| Volatility 75 (1s) index | 0.050 |

| Volatility 100 (1s) index | 0.20 |

| Volatility 200 (1s) index | 0.02 |

| Volatility 300 (1s) index | 1.00 |

| Volatility 150 (1s) index | 0.010 |

| Boom 1000 index | 0.2 |

| Crash 500 index | 0.2 |

| Crash 1000 index | 0.2 |

| Boom 500 index | 0.2 |

| Boom 300 index | 1.00 |

| Crash 300 index | 0.50 |

| Step index | 0.1 |

| Range Break 100 index | 0.01 |

| Range Break 200 index | 0.01 |

| Jump 25 index | 0.01 |

| Jump 10 index | 0.01 |

| Jump 50 index | 0.01 |

| Jump 100 index | 0.01 |

| Jump 75 index | 0.01 |

| Drift swift index 30 | 0.01 |

| Drift Swift Index 10 | 0.01 |

| DEX 1500 Up Index | 0.01 |

| DEX 900 up index | 0.01 |

| DEX 600 up index | 0.01 |

| DEX 900 down index | 0.01 |

| DEX 600 down index | 0.01 |

| DEX 1500 down index | 0.01 |

| DEX 1500 Up index | 0.01 |

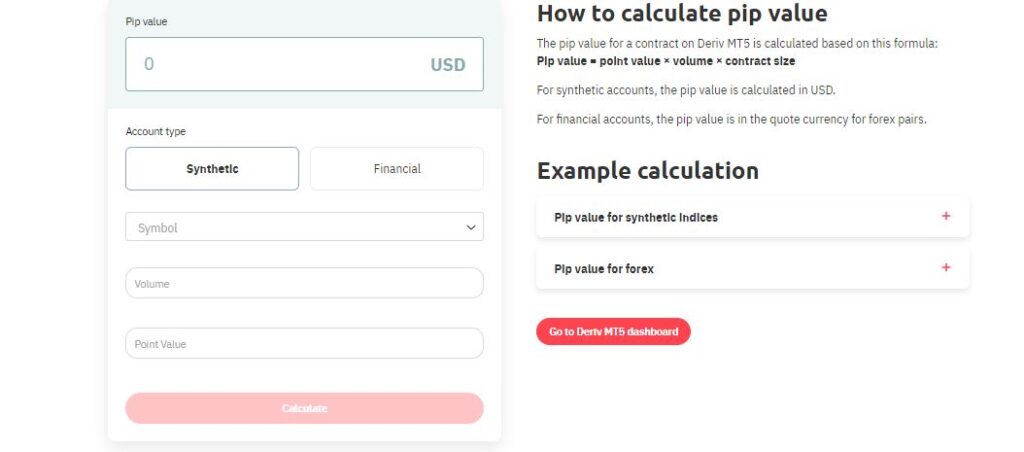

SYNTHETIC INDICES LOT SIZES CALCULATOR

Deriv broker has provided a reliable synthetic indices lot size calculator to help traders estimate the pip value in their trade so they can better manage risk.

To easily access it, visit their webpage: Deriv Trader Tools Pip Calculator

WHAT IS THE LOWEST AMOUNT TO TRADE SYNTHETIC INDICES

The minimum trading amount for synthetic indices varies depending on the specific index pair you wish to trade, as each has its unique minimum requirement.

Nevertheless, it is recommended to maintain a substantial trading capital for a seamless trading experience across all indices.

WHAT IS THE BEST LOT SIZE FOR VOLATILITY 75 INDEX

Determining the best lot size for trading the Volatility 75 index is subjective, and it hinges on the level of risk you are comfortable assuming, in essence, the greater the risk, the higher the potential reward.

To provide a practical viewpoint based on trading Deriv synthetic indices, it is advisable not to exceed a lot size of 0.001 for a $100 account.

This recommendation aims to ensure a more seamless and manageable trading experience.

DOES MT5 HAVE VOLATILITY 75 INDEX

Certainly, MT5 includes the Volatility 75 index, making it a robust platform for both forex and exchange markets.

Within MT5, you have access to a diverse array of trading instruments, including forex, stocks, futures, commodities, indices, and more.

To acquire MT5, you can download it directly from the Meta Trader website or through the broker with which you are registered.

WHEN IT’S THE BEST TIME TO EXIT A TRADE ON VOLATILITY 75 INDEX

To know the best time to exit a trade on volatility 75 index, you must have a good trading experience in market structure such as rally base rally, drop base drop based on my experience trading V75 indices, I have to see that both entry and exit occurs around a base zone.