With so many synthetic indices brokers available, it’s easy to become overwhelmed; this article will help you choose the best brokers offering synthetic indices while taking their benefits and drawbacks into account.

Over time, the financial market has expanded to include new trading instruments for traders to choose from.

Some brokers are taking advantage of this expansion to ensure that they can meet the needs of their clients while also attracting new traders.

Let’s dive in to learn more!

VOLATILITY INDICES BROKERS

Volatility indices brokers are brokers that offer volatility indices brokers to traders, these indices can be traded both on MT4 and MT5.

In my previous articles, you will find extensive content on brokers that offer volatility indices.

SYNTHETIC INDICES BROKERS

Below is the full guide to synthetic indices brokers and their offerings;

| SYNTHETIC INDICES BROKERS | ACCOUNT TYPE | INDICES |

| FXTM | Pro account CFDs | 11 indices |

| IG | Investment, spread betting, pro account, index CFDs | 34 indices |

| XTB | CFDs pro account | 25 inches |

| Markets.com | Index CFDs, spread betting, pro account | 10 inches |

| Saxo Market | Pro account, futures and options, investment | 21 Indices |

| Pepperstone | Index CFDs, spread betting, Pro account | 28 indices |

| CMC markets | Index CFDs, spread betting, pro account, direct market access | 82 inches |

BOOM 1000 INDEX BROKERS

This is a synthetic indices offered exclusively by Deriv broker.

It is specially designed for bullish spikes and bearish ticks, if you want to trade Boom 1000 index, you will only find it on Deriv.

You can read more on boom 1000 index in my previous article.

READ ALSO: CRASH 1000 INDEX BROKER

WHICH BROKER HAS VOLATILITY 75 INDEX

Every time volatility 75 index is mentioned, know that there are two types. The first one is the exclusive MT5-only V75 synthetic indices on Deriv and the second is the Vix 75 which can be traded both on MT4 and MT5.

Below is a list of brokers that have volatility 75 index:

- Deriv- exclusive V75 different from the rest

- Etoro

- IC market

- Pepperstone

- Plus500

- IG

WHICH BROKER HAS BOOM AND CRASH INDEX

Boom and crash index can only be traded on Deriv platform.

Deriv offers other trading instruments from currencies to CFDs.

SYNTHETIC INDICES BROKERS WITH BONUS

Brokers give bonuses as a way to attract new clients and keep existing clients. These bonuses sometimes come with conditions.

In this article, I will list two synthetic indices brokers with bonuses:

- IC MARKETS

- HOTFOREX

SYNTHETIC INDICES BROKERS IN NIGERIA

Many brokers in Nigeria offer synthetic indices however none of them are homegrown, they all have their parent company outside Nigeria and have offices in Nigeria.

Here are a few recommended trusted synthetic indices brokers in Nigeria.

- FXTM

- DERIV

- OCTAFX

- HOTFOREX

- AVATRADE

- PEPPERSTONE

FXTM

FXTM broker provides a wide range of spot indices such as:

- GDAX (DAX 30)

- AUS 200 (Australia 200)

- ND100m (US Tech 100 mini)

- UK100 (UK100)

- SP500m (US SPX 500 Mini)

Indices can be traded with leverage to suit your trading style and investment objectives. This can strengthen your positions and potentially maximize profits, but keep in mind that leverage can also magnify your losses.

DERIV

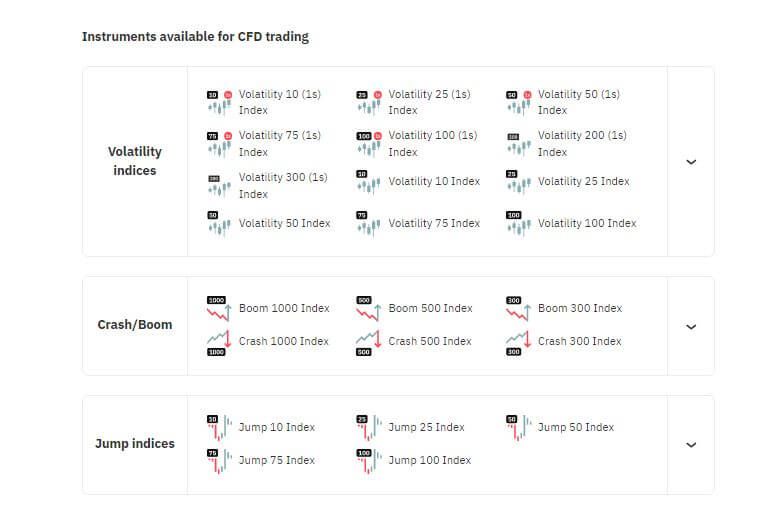

Deriv indices are unique and different from other indices; Derivative indices mimic real-world market movements.

These indices, which are supported by a cryptographically secure random number generator, are available for trading 24 hours a day, seven days a week, and are unaffected by regular market hours, global events, or market and liquidity risks.

Deriv synthetic indices can only be traded on MT5, unlike other brokers that offer indices both on MT5 and MT4.

You can read more in my previous article on Synthetic indices.

OctaFX

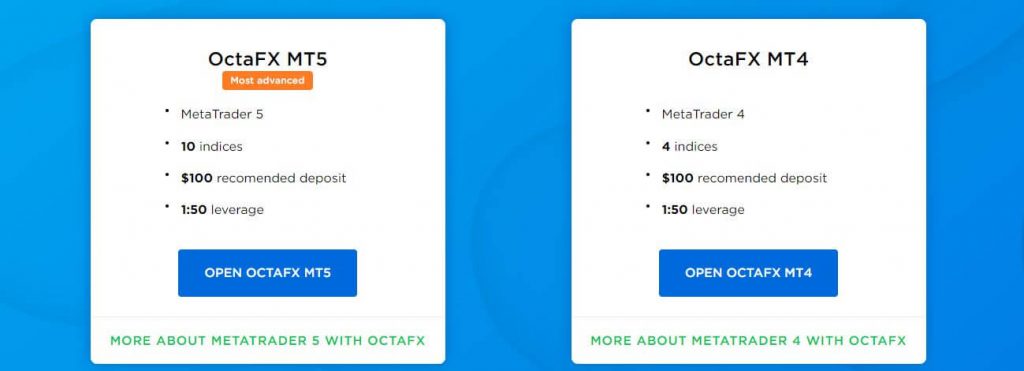

OctaFX provides CFDs on ten popular indices, including the Dow Jones, NASDAQ, Nikkei, and EuroStoxx.

You can trade indices on MT4 and MT5; they provide powerful trading tools, such as automated trades, technical indicators, and advanced live charts, in addition to a wide range of features.

There are no swaps or commissions. With no commissions or swap fees, you can enjoy the best trading conditions in the industry. To provide you with cost-effective trading conditions, OctaFX does not charge any volume-based commissions.

Spreads are small. You can reduce your portfolio expenses by opening deals on index CFDs with the industry’s lowest spreads.

1:50 leverage. One of the most powerful tools in CFD trading is leverage. Increase the potential of your portfolio by investing only a fraction of the value of a CFD.

OctaFX offers 10 indices on MT5 and 4 indices on MT4.

HOTFOREX

With HotForex, you can trade the leading spot and futures contracts on indices.

HotForex provides ten different Index CFDs via the MT4 trading platform, which are as follows:

- AUS200

- FRA40

- SHCOMP

- GER30

- SPA35

- UK100

- USA100

- USA30

- USA500

- USD Index

Margins: 0.5% margin and 1:200 leverage on all spot contracts

Contract size: Minimum contracts of 0.1 lots

There are no trading restrictions for trading Index CFDs on HotForex MT4, and hedging, scalping, and many other trading methods are permitted, besides arbitrage.

AVATRADE

Globally recognized broker with a proven track record dating back to 2006.

Up to a 20:1 leverage.

From a single screen, you can trade stocks, indices, and commodities on all major exchanges, including the NYSE and FTSE.

Live multilingual customer service

World-class educational resources and tools

Platforms include desktop, web, and mobile.

Avatrade also provides weekly webinars led by top industry professionals and investors, as well as real-time stock market indices in-chart technical analysis updates provided by Trading Central! AvaTrade has everything you need to trade indices CFDs more accurately.

Avatrade on indices offers a minimum deposit of $100 and leverage up 400:1

You will find indices such as:

- Dollar index

- Dow Jones index

- Dax 30 index

- US Tech 100 index

- China A50 index

- AEX index

- HSI index

- SPI 200 index and more.

PEPPERSTONE

With Pepperstone you can Profit from 22 diverse instruments that reflect changes in the overall value of the world’s largest stock markets, including those in the United States, Europe, Australia, and Asia.

Benefits of trading Index CFDs with Pepperstone.

Price cuts from multiple Tier 1 banks and liquidity providers, with competitive fixed spreads as low as 1 point on the AUS200, 0.9 on the GER30, and 2.4 on the US30, and no “commissions.”

All of your Indices trades will be filled in full, with no partial execution or requotes on market orders.

From Monday to Friday, trade all opportunities with 24-hour pricing on major indices such as the US30, UK100, and GER30.

With an ASIC-regulated broker, you can trade with confidence and security.

Fill rate of 99.95% and quick execution.

Award-winning customer service is available 24 hours a day, five days a week, and 18 hours on weekends.

ARE SYNTHETIC INDICES LEGIT?

Yes, synthetic indices are legit.

I have traded both currencies and synthetic indices (on Deriv).

And found that synthetic indices are more stable than conventional trading instruments.