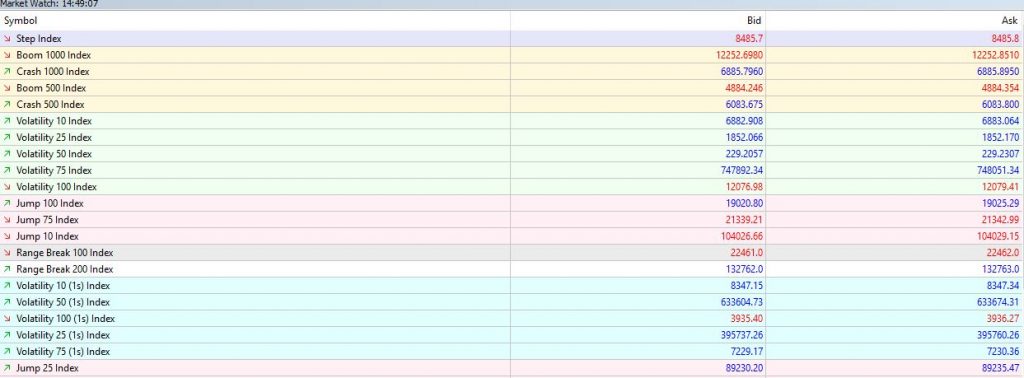

VOLATILITY 25 INDEX STRATEGY

When I began trading Deriv synthetic indices, I was eager to find the perfect volatility 25 index strategy. I kept searching for a magical approach, only to realize that true and consistent profitability requires understanding market psychology and acquiring the essential trading knowledge used by professional traders. In this article, I assure you that if … Read more