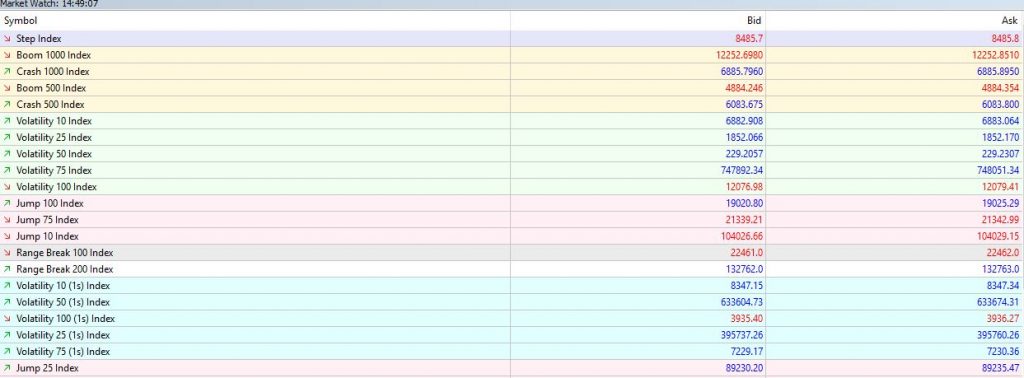

HOW TO TRADE VOLATILITY 100 INDEX

Just like every other trading instrument, to know how to trade Volatility 100 index you must understand how it moves across all the timeframes paying attention to high trigger zones especially swing highs and lows. The Volatility 100 Index is a captivating arena in the ever-evolving financial markets, offering traders high-octane opportunities that demand specialized … Read more