The question “What is pin bar?” is frequently asked by newcomers to the forex market. This should be super easy to identify on the forex chart because it is the simplest candlestick pattern to recognize.

It can be found on all time frames; but, in my experience, it works best on higher time frames.

The Japanese candlestick best illustrates this visualization on the chart compared to the other two price visualizations; line chart and bar chart.

They can form in both bullish and bearish markets, and when they do, they should not be traded in isolation; instead, search for other market structures or candle stick pattern confirmations that support the pin bar before entering a trade.

The steps outlined above will assist you in filtering out fake pin bars.

HOW DO I FIND A HAMMER?

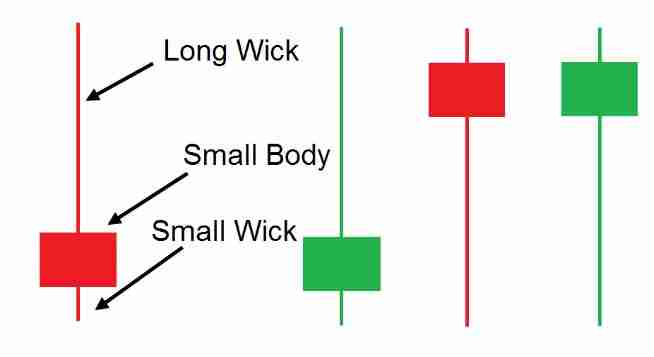

Simply look out for a candlestick pattern with a long wick and a small body. In my experience it is much more effective when pin bars are found at the end of a trend; they can be found at the end of a trend indicating a reversal, and they can also be found at a continuation trend after a retracement.

If you know how to use the Fibonacci tool, they can also be found at key Fibonacci retracement and reversal levels.

WHAT IS PIN BAR

A pin bar is made up of one price bar, generally a candlestick price bar that signals a strong price reversal and rejection.

The area between the pin bar’s open and close positions is referred to as its “real body,” and pin bars often have smaller real bodies about their long tails.

They are the simplest candlestick patterns to recognize.

RELATED: PIN BAR REVERSAL

HOW DO YOU TRADE WITH HAMMERS?

It is no doubt that pin bars are powerful candlestick patterns, however, they should not be traded in isolation because there are many cases of failed pin bars in the forex market.

That being said, this is how to trade pin bars.

- Look out for pin bars that appear in support and resistant zones

- Over-bought and over-sold zones

- An engulfing or bullish/bearish candle that supports the pin bar.

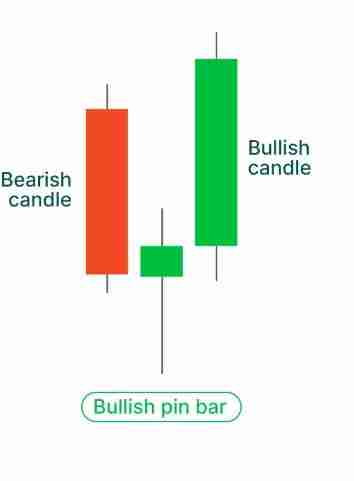

See the image below;

HOW IS A HAMMER FORMED?

It is formed when there is a price rejection possibly at key resistant and support zones; this price rejection indicates a large volume of buyers or sellers in the market possibly pending orders.

To put it in simple terms, when there is a large volume of (pending) orders in a key support or resistant zone and price reaches that zone; and the pending order is triggered across all brokers and traders, then it can be formed.

WHAT DOES A BULLISH MEAN?

A bullish Pinbar means that lower prices are being rejected. The lower wick of the candle indicates that the bears were dominant earlier but were eventually overpowered by the bulls.

This bullish pin bar is common in the forex market at oversold and support levels and they are seen across all timeframes, however, it is more effective on higher timeframes.

HAMMER IN FOREX

This is the easiest candlestick pattern to identify because of its unique long wick and small body. Because it is a power reversal candle, this does not mean that all pin bars are tradable as there a many failed analyses after a pin bar formation.

This is why pin bars in forex are not traded in isolation.

Here are tools and confirmations to use when trading.

- Fibonacci tools

- Support and resistant levels

- Oversold and overbought

- Demand and supply levels

- Bullish/bearish candle engulfing

- Multiple timeframe analysis

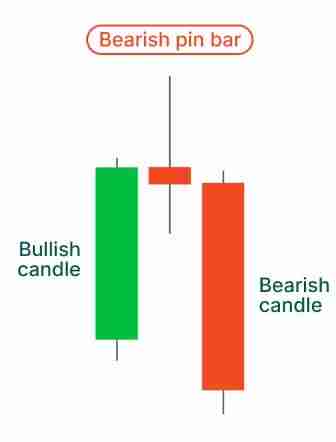

BEARISH

A bearish Pinbar means that higher prices are being rejected. The higher wick of the pin bar candle indicates that the bulls were in dominance earlier but were eventually overpowered by the bears.

This bearish pin bar is common in the forex market at overbought and resistant levels and they are seen across all timeframes, however, it is more effective on higher timeframes.

PIN BAR VS HAMMER

The argument of pin bar vs hammer has lingered for a long time among forex traders, In this article you are going to know in layman’s terms the difference between these two terms

The pin bar is a more generic term to use for any candle with a long wick and a small body while the hammer is a bullish candlestick pattern that implies a trend reversal.

A Bullish Pin Bar is the version of this.

In theory, they are the same thing; in my years of trading, I have noticed that older traders refer to it as a hammer, whereas newer traders refer to it as pin bars.

HAMMER TRADING STRATEGY

When used correctly, the pin bar trading approach can be extremely effective.

In the forex market, not every pin bar should be traded because there are many failed setups due to incorrect applications.

You will know the best setups to take at the end of the post since they will align with the market structure at the moment of entry.

To have an effective trading strategy, here are key points to look out for;

- Pin bars are much better on key support and resistant levels

- Fibonacci retracement and reversal levels

- Better pin bars on higher timeframes

- Overbought and oversold levels

HAMMER PATTERN FORMATION

A pin bar pattern is a Japanese candlestick that indicates a quick price rejection at a lower price; this pattern is one of the most effective reversal candlestick patterns every trader should know.

This pattern can be recognized with its long wick and small body. It can be formed both in down and up trend.

After this pattern formation, you will need an extra confirmation before entry.

TYPES OF HAMMER CANDLESTICK

There are two types of pin bar candlesticks;

BULLISH: it has a lower long wick and a small candle body.

BEARISH: it has an upper long wick and a small candle body.

CONCLUSION

As a trader, make sure your strategy is in line with the real-time market structure before you trade it. Through my years of trading I have seen that when pin bars are implemented correctly, the returns are fantastic.