Trading gold (XAUUSD) requires precision, and understanding pip calculations is your gateway to profitable trades.

Unlike traditional currency pairs, gold behaves differently in the forex market, with unique pip values that can make or break your trading account.

Many traders struggle with accurate pip calculations for XAUUSD, leading to poor risk management and unexpected losses.

The difference between a successful gold trader and a losing one often comes down to mastering these fundamental calculations.

What if you could eliminate the guesswork and trade with mathematical precision? Let’s explore how proper pip calculation can transform your gold trading strategy.

- UNDERSTANDING XAUUSD PIP VALUES

- HOW TO CALCULATE PIP VALUE FOR XAUUSD

- ESSENTIAL XAUUSD PIP CALCULATOR TOOLS

- ADVANCED PIP CALCULATION STRATEGIES

- POPULAR PIP VALUE SCENARIOS

- COMPARING XAUUSD TO OTHER INSTRUMENTS

- PROFESSIONAL TRADING SETUP

- COMMON PIP CALCULATION MISTAKES

- ADVANCED PIP CALCULATION TECHNIQUES

- TECHNOLOGY INTEGRATION

- MARKET CONDITIONS AND PIP VALUES

- BUILDING YOUR PIP STRATEGY

- CONCLUSION

UNDERSTANDING XAUUSD PIP VALUES

What Makes Gold Different

XAUUSD operates differently from standard currency pairs. While most forex pairs move in increments of 0.0001 (1 pip), gold typically moves in increments of 0.1 for most MT4 and MT5 brokers.

Key Differences:

- Currency pairs: 1 pip = 0.0001

- XAUUSD: 1 pip = 0.1

- Base pip value for XAUUSD: $0.01

XAUUSD Pip Value Breakdown

The fundamental pip value for XAUUSD is $0.01 per pip. However, this changes dramatically based on your lot size:

Standard Lot (1.0):

- 1 pip = $10

- 10 pips = $100

- 100 pips = $1,000

Mini Lot (0.1):

- 1 pip = $1

- 10 pips = $10

- 100 pips = $100

Micro Lot (0.01):

- 1 pip = $0.10

- 10 pips = $1

- 100 pips = $10

HOW TO CALCULATE PIP VALUE FOR XAUUSD

Manual Calculation Method

The formula for calculating XAUUSD pip value is straightforward:

Pip Value = (Pip Size × Lot Size) × Account Currency Conversion Rate

For XAUUSD in USD accounts:

- Pip Value = 0.1 × Lot Size × 1 (no conversion needed)

Practical Examples

Example 1: Trading 0.5 Lots

- Lot Size: 0.5

- Pip Value: 0.1 × 0.5 = $5 per pip

- 20 pip move = $100 profit/loss

Example 2: Trading 2 Standard Lots

- Lot Size: 2.0

- Pip Value: 0.1 × 2.0 = $20 per pip

15 pip move = $300 profit/loss.

ESSENTIAL XAUUSD PIP CALCULATOR TOOLS

Professional Trading Platforms

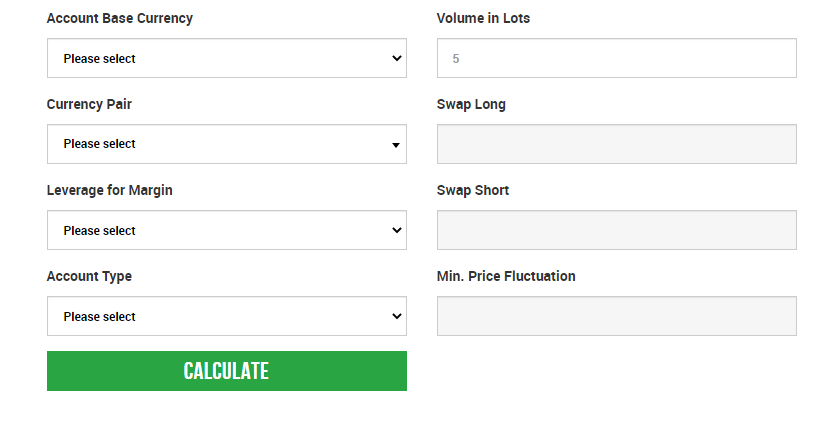

XM Pip Calculator XM offers one of the most comprehensive pip calculators available. Their tool includes:

- Live market quotes

- Multiple lot size options

- Real-time pip value calculations

- Profit and loss projections

MT4/MT5 Integration While MT4 doesn’t include a default pip calculator, several third-party applications are available for download that integrate seamlessly with the platform.

Forex Pip Calculator Features to Look For

When selecting a pip calculator, prioritise these features:

- Real-time market data

- Multiple currency pair support

- Lot size flexibility

- Mobile compatibility

- Historical data access

ADVANCED PIP CALCULATION STRATEGIES

Risk Management Integration

Understanding pip values is crucial for effective risk management. Use a stoploss calculator to determine optimal exit points based on your risk tolerance.

Risk Calculation Formula:

- Risk per Trade = (Stop Loss in Pips × Pip Value) × Lot Size

- Maximum recommended risk: 1-2% of account balance

Position Sizing Techniques

Fixed Fractional Method:

- Determine risk percentage (e.g., 1% of account)

- Calculate pip value for intended lot size

- Adjust lot size based on stop loss distance

Kelly Criterion Application:

- f = (bp – q) / b

- Where: f = fraction of capital to wager, b = odds, p = probability of win, q = probability of loss.

POPULAR PIP VALUE SCENARIOS

50 Pips Profit Calculations

Micro Lot (0.01): 50 pips = $5 Mini Lot (0.1): 50 pips = $50 Standard Lot (1.0): 50 pips = $500

100 Pips Profit Calculations

Micro Lot (0.01): 100 pips = $10 Mini Lot (0.1): 100 pips = $100 Standard Lot (1.0): 100 pips = $1,000

200 Pips Profit Calculations

Micro Lot (0.01): 200 pips = $20 Mini Lot (0.1): 200 pips = $200 Standard Lot (1.0): 200 pips = $2,000.

COMPARING XAUUSD TO OTHER INSTRUMENTS

Gold Pip Calculator vs Currency Pairs

XAUUSD Characteristics:

- Higher volatility

- Larger pip movements

- Greater profit potential

- Increased risk exposure

Currency Pairs (EUR/USD, GBP/USD):

- More predictable movements

- Smaller pip sizes

- Lower volatility

- Steadier trends

Alternative Instruments

GER30 Pip Calculations For traders interested in German index trading, cashbackforex.com for Ger30 provides specialized calculation tools similar to XAUUSD calculators.

US30 Considerations US30 pip calculations follow different rules, typically using point values rather than traditional pip structures.

PROFESSIONAL TRADING SETUP

Essential Tools for Gold Trading

Primary Requirements:

- Reliable pip calculator

- Real-time market data

- Professional charting software

- Risk management tools

- Economic calendar

Recommended Platforms:

- MetaTrader 4/5

- TradingView

- cTrader

- NinjaTrader

Forex Trading Best Practices

Pre-Trade Checklist:

- Calculate pip value for intended lot size

- Set stop loss and take profit levels

- Determine position size based on risk tolerance

- Verify market conditions

- Check economic news schedule.

COMMON PIP CALCULATION MISTAKES

Overlooking Lot Size Impact

Many traders underestimate how lot size affects pip values. A seemingly small increase in lot size can dramatically amplify both profits and losses.

Ignoring Spread Costs

The bid-ask spread in XAUUSD can be significant, especially during volatile market conditions. Factor spread costs into your pip calculations.

Misunderstanding Broker Specifications

Different brokers may have varying pip structures for XAUUSD. Always verify your broker’s specific pip value calculations.

ADVANCED PIP CALCULATION TECHNIQUES

Compound Interest Applications

Scenario: Starting with $1,000, targeting 10 pips daily

- Month 1: Consistent 10-pip gains with proper position sizing

- Month 2: Increased lot size based on account growth

- Month 3: Compounded returns accelerate account growth

Correlation Analysis

Understanding how XAUUSD correlates with other instruments helps optimize pip calculations across multiple positions:

Positive Correlations:

- Silver (XAGUSD)

- Oil prices

- Inflation rates

Negative Correlations:

Risk-on market sentiment

US Dollar strength

Interest rate increases.

TECHNOLOGY INTEGRATION

Automated Pip Calculation

Modern trading platforms offer automated pip calculation features:

- Real-time position monitoring

- Automatic profit/loss updates

- Risk percentage calculations

- Portfolio-wide pip tracking

Mobile Trading Considerations

Mobile pip calculators ensure you can make informed decisions anywhere:

- Offline calculation capabilities

- Cloud synchronization

- Push notifications for pip milestones

- Integration with mobile trading apps

MARKET CONDITIONS AND PIP VALUES

Volatility Impact

High volatility periods can affect pip calculations:

- Wider spreads increase trading costs

- Slippage may impact actual pip values

- Market gaps can create unexpected pip movements

News Events

Major economic announcements can dramatically impact XAUUSD pip movements:

- Federal Reserve decisions

- Inflation reports

- Geopolitical events

- Central bank interventions

BUILDING YOUR PIP STRATEGY

Beginner Framework

Phase 1: Foundation (Weeks 1-4)

- Master basic pip calculations

- Practice with micro lots

- Use demo accounts exclusively

- Track all pip movements

Phase 2: Development (Weeks 5-12)

- Increase lot sizes gradually

- Implement risk management rules

- Analyze pip patterns

- Develop personal trading style

Phase 3: Optimization (Months 4-6)

- Refine pip-based strategies

- Optimize position sizing

- Advanced risk management

- Consistent profitability focus

Advanced Techniques

Scalping Strategies:

- Target 5-10 pips per trade

- High-frequency trading approach

- Tight stop losses

- Quick decision making

Swing Trading Applications:

- Target 50-200 pips per trade

- Longer holding periods

- Fundamental analysis integration

- Patience-based approach

CONCLUSION

Mastering XAUUSD pip calculations is fundamental to successful gold trading. The unique characteristics of gold as a trading instrument require specific knowledge and tools to calculate pip values accurately.

Remember that pip values change significantly with lot size, and proper risk management depends on understanding these calculations.

Whether you’re targeting 10 pips or 100 pips, knowing the exact monetary value helps you make informed decisions.

Use professional pip calculators, practice with different lot sizes, and always factor in your risk tolerance.

The difference between successful and unsuccessful traders often comes down to precision in these fundamental calculations.

Ready to elevate your gold trading game? Start by implementing proper pip calculations in your next XAUUSD trade, and watch how mathematical precision transforms your trading results.

This guide provides educational information for forex trading. Always consult with qualified financial advisors and practice proper risk management when trading XAUUSD or any financial instruments.